The Fourth Revolution is far more complex than the previous paradigm shifts. It involves ever more sophisticated and capable manufacturing robots.

The space economy is supposed to top $1 trillion by 2040, and much of that will come from the militarization of space.

Let’s face it, robotics is no longer a novel concept in most of the industrialized world. In fact, for those of us lucky enough to live where robots thrive, they’re downright ubiquitous.

Now that Space Race 2.0 is underway, advanced technology is now available to many more countries than ever, and that means SIGINT is becoming very big business, not just limited to the traditional big players.

Within this article, I mention a fair number of companies that will be involved with colonizing the Moon and supporting ongoing missions to Mars.

Satellite communication is becoming very lucrative. SpaceX isn’t the only one launching satellites to build a global communications network.

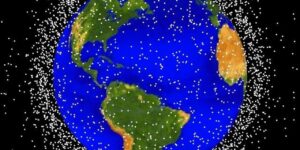

There’s big business involved with launching satellites into Earth’s orbit. Learn more about it and NASA’s new rocket propulsion technology.

Not only are billionaires investing their fortunes into this market, governments from around the world are moving into space too.

The rise of the metaverse and augmented reality (AR) promise to make lifelong learning impossible to avoid.

Understanding the shift in education and student debt is important to seeing the risks and opportunities that occur with this topic.

The rise of the metaverse will offer new opportunities for distance learning, but with many of the advantages of in-person learning.

We’re just starting to see where the MegaTrend in education is leading us, and this is a great time to start looking for some winners.