Start Big

When it comes to teasing out the winners in the drug industry, your best bet is to start with the big companies first. Most are well seasoned competitors with massive R&D programs and decades of experience getting drugs “from lab to fab”.

Often that is the biggest problem for big organizations. They may have great research, but getting that into the commercial side through development and approval, then marketed, can be a challenge.

Big pharma also knows when to add gas and step on the brake. Plus, the best companies have diversified their drug pipelines to take advantage of new opportunities in strategic sectors.

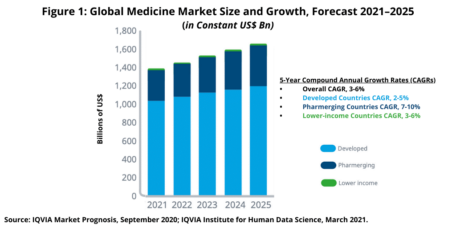

There’s also the fact that different markets are growing at different speeds. China has been a very attractive market and will remain one for at least another decade.

For example, as we have seen with the country’s zero-Covid policy, it has been hurt economically because it continually has to shut down major cities due to outbreaks. Much of this can be blamed on the fact that the Chinese vaccines aren’t as effective as those derived in the US and Europe.

In most cases, China is very interested in creating a pharmaceutical industry that can both help Chinese citizens improve their health outcomes and also compete with Western drug companies on a global scale.

The Best of the Best

First, the country needs to learn from big companies like Eli Lilly (NYSE: LLY), one of my favorite, big drug companies.

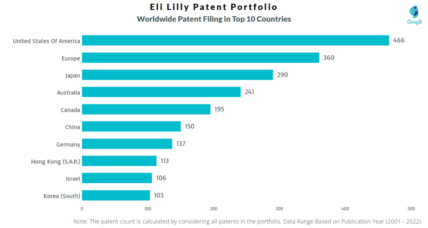

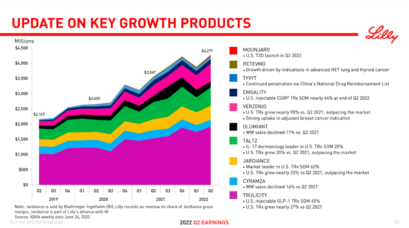

This is one of the great advantages of a company like LLY – a massive patent portfolio, and this is what it means to sales when you’re involved with not one, but several blockbuster drugs.

LLY was founded in 1876 and has remained one of the leading drug companies in the world for more than a century, selling its products in more than 125 countries.

It was the first company to mass produce Jonas Salk’s polio vaccine, and it also pioneered the mass production of insulin. That kind of vanguard work continues today.

LLY is a MegaTrend company inside a MegaTrend sector, and like many MegaTrend stocks, it may not be the sexiest company that comes to mind for big, long-term growth prospects. The fact is, it’s certainly in the club.

The stock has gained 33% this year, and it has gained 220% in the past three years. That’s very impressive during a time when most big, non-tech growth stocks were not grabbing the headlines or investors’ money.

Introducing Proffe’s Trend Portfolio 2.0!

A new market deserves a fresh start…

In November 2021, Proffe’s Trend Portfolio officially crossed the $1,600,000 target. I reached this milestone with a portfolio of just a dozen stocks and a unique options strategy I perfected in Europe and brought to the US.

Having hit that benchmark, after starting with $30,000 about a decade before, I started to wonder how I could best help new subscribers that are coming on board now at this particular time.

Given the current economic conditions and the massive pullback across all three major indexes, I have decided to relaunch my flagship newsletter: Proffe’s Trend Portfolio.

Join Us!

Your nest egg – and grandchildren – will thank you!

Now and for a limited time, you can experience the market beating returns of Proffe’s Trend Portfolio for only $1 for a full 14 days! During your risk-free trial, you’ll get a firsthand look at how my strategy works and the MegaTrend stocks in the portfolio.

The new portfolio will follow the same criteria and investing philosophy that’s the bedrock of my (and my subscribers’) success, and that means a small portfolio of MegaTrend stocks that tick all the boxes in my Trendsetter Strategy and long-term, in-the-money call options that leverage the same MegaTrend themes as the stocks in the portfolio.

If you’re looking for a new way to invest that will provide great profits with far less work – and worry – than typical investment services, then sign up for a 14-day free trial to Proffe’s Trend Portfolio 2.0 for only $1 and join us for the next million dollar portfolio!