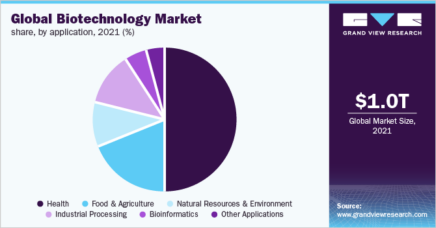

BioSpace is a biotech research firm. It projects that the biotech sector will see a compounded annual growth rate (CAGR) of nearly 18% between now and 2030. That means investments in this sector will more than double by the time the next decade rolls around.

During the pandemic, I found a couple strong biotech candidates that were undervalued and under the radar, and they paid off handsomely.

However, given my MegaTrend approach to Healthcare, direct investment in specific biotech companies can be tricky. You see, it’s not as simple an industry as it seems.

Here’s what I’m talking about:

Biotech is more than just cutting edge drugs that cure cancer. It’s a multi-sector, multi-layered industry unto itself.

Given all the regulatory issues involved, as well as the long journey any drug or technology has “from lab to fab” (from testing to production for the marketplace), finding the right ones always has a bit more of an element of chance than I’m comfortable taking for my long-term growth portfolios.

A Challenge – Not a Barrier

The sheer fact I’m writing about this industry and the inherent opportunity it provides for investors means I have found a way to take advantage of the opportunity without getting caught up in the volatility and risks associated with biotech.

One way I chose in my publication, Proffe’s Trend Portfolio 1.0 (now closed to subscribers after an 11-year run from $30,000 to $1.5 million), was to find a less complicated sector to find biotech stocks. In that case, it was animal health. My chosen stock was IDEXX Laboratories (NASDAQ: IDXX).

It continues to do well, but for my recent launch of Proffe’s Trend Portfolio 2.0 and my Proffe’s Growth Stocks, I have taken a different track.

As they say, during the Gold Rush, mining wasn’t the road to riches. Selling the miners equipment, food, and clothing was the sure path. That’s why I own two of the best diagnostic and health sciences companies in the business, Danaher (NYSE: DHR) and Thermo Fisher (NYSE: TMO).

They sell the picks and shovels not only to biotech firms, but virtually every sector in the healthcare industry.

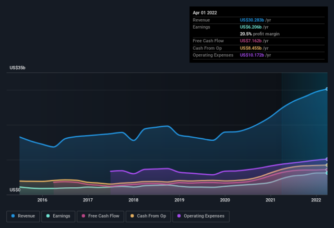

This is a chart of DHR’s earnings growth over the past 7 years or so. You can see that it’s not a wild ride, but a steady, strong climb.

That’s what I like to see in my long-term growth stocks. I generally expect my stocks to return on average 20% annually. Sometimes that can get a bit sticky due to unforeseen market conditions – pandemics, Russia’s invasion of Ukraine, supply chain issues, etc.

That’s why I have my Trendsetter Strategy. It helps keep me focused on the long-term value of the positions I hold, even in the most unpredictable times.

That’s really the most important issue for individual investors. To remain calm and confident in down markets is crucial to gaining wealth in the markets. Knowing you have great, long-term growth companies that are shelters in any storm, as well as the first stocks investors flock to in good times, means you can sit back and enjoy your holidays – whenever they may come – in peace and comfort.

Introducing Proffe’s Trend Portfolio 2.0!

A new market deserves a fresh start…

In November 2021, Proffe’s Trend Portfolio officially crossed the $1,600,000 target. I reached this milestone with a portfolio of just a dozen stocks and a unique options strategy I perfected in Europe and brought to the US.

Having hit that benchmark, after starting with $30,000 about a decade before, I started to wonder how I could best help new subscribers that are coming on board now at this particular time.

Given the current economic conditions and the massive pullback across all three major indexes, I have decided to relaunch my flagship newsletter: Proffe’s Trend Portfolio.

Join Us!

Your nest egg – and grandchildren – will thank you!

Now and for a limited time, you can experience the market beating returns of Proffe’s Trend Portfolio for only $1 for a full 14 days! During your risk-free trial, you’ll get a firsthand look at how my strategy works and the MegaTrend stocks in the portfolio.

The new portfolio will follow the same criteria and investing philosophy that’s the bedrock of my (and my subscribers’) success, and that means a small portfolio of MegaTrend stocks that tick all the boxes in my Trendsetter Strategy and long-term, in-the-money call options that leverage the same MegaTrend themes as the stocks in the portfolio.

If you’re looking for a new way to invest that will provide great profits with far less work – and worry – than typical investment services, then sign up for a 14-day free trial to Proffe’s Trend Portfolio 2.0 for only $1 and join us for the next million dollar portfolio!