A hundred years ago this year, the American Electric Car Company began selling its electric car. That adds some perspective to the recent craze that has hit over EVs in recent years.

Also, around 100 years ago, there were dozens of carmakers in the US alone. It was an exciting time in the auto industry, but after WWII, the US eventually ended up with the Big Three that had gobbled up most of the surviving brands into their own bellies.

The recent revival in the EV sector has brought with it new technology and new opportunities to explore, given the massive advancements in embedded computing, mobile networks’ speed, and computer-aided design.

Visualizing the Future

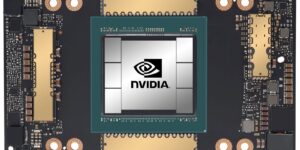

Perhaps the best example of how computing has become a game-changer in the evolution of AVs is NVIDIA (NASDAQ: NVDA).

It started as an upscale graphics processing unit (GPU) maker. Basically, it takes digital information and creates images from it. If you pull up a photo online, it has been coded in 0s and 1s. GPUs convert that to the image. It also means GPUs can help visualize data so it’s easier to understand, like the GPS directions to your intended location.

As the digital revolution began, NVDA started expanding into more markets, and when mobility increased opportunities for smart devices like the Internet of Things (IoT) and smart vehicles, NVDA became a dominant force.

It’s now the go-to player when it comes to gaming, crypto mining, smart vehicles, data visualization of Big Data, and server farm management. NVDA has been a favorite MegaTrend stock for years now and this is a great opportunity to begin a decade-long, mega-growth path for the stock.

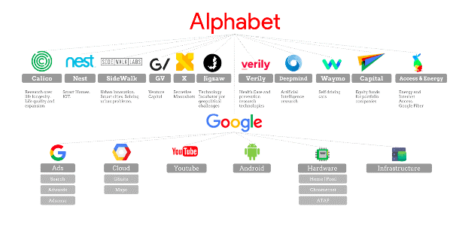

Way More Than Search

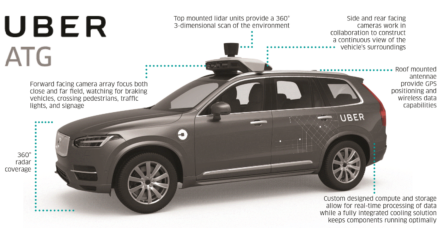

Alphabet (NASDAQ: GOOGL) isn’t just a search company. It has Google (the most popular search engine in the world), YouTube (the most watched video site in the world), Android (the most popular mobile OS in the world), as well as scores of other businesses.

One of those divisions is Waymo, an AV company.

It already has cars on the street in Chandler, Arizona picking up fares and is looking to now expand into other cities soon. There’s even talk that it may buy Lyft (NASDAQ: LYFT) and transition its fleet into the car service in strategic locations.

Given the commitment in time and money that GOOGL has put in at this point, it’s certain Waymo is going to get a lot bigger in coming years, adding to GOOGL’s massive bottom line.

Don’t Stop Thinking About Tomorrow

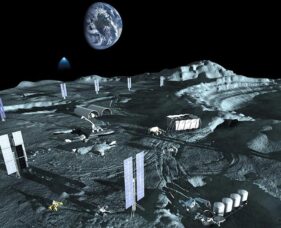

When you think of cutting-edge companies that are on the vanguard of AV tech, you likely don’t think of heavy equipment maker Caterpillar (NYSE: CAT).

Don’t let the size of the vehicles fool you. AVs would be a major part of CAT’s business since most of their work is dirty, dangerous, and exacting. Its massive dump trucks for mining operations are already automated.

CAT has been working with NASA for nearly a decade, developing AVs to help colonize the moon and beyond. The current Artemis program includes CAT in its long-term plans for a moon base and building out extra-planetary infrastructure.

These companies have long-term, innovative visions that they’re committed to bringing to reality, and they’re doing it while growing their businesses and taking advantage of current opportunities to build great devices and equipment that people continue to rely upon now and for decades to come.

Introducing Proffe’s Trend Portfolio 2.0!

A new market deserves a fresh start…

In November 2021, Proffe’s Trend Portfolio officially crossed the $1,600,000 target. I reached this milestone with a portfolio of just a dozen stocks and a unique options strategy I perfected in Europe and brought to the US.

Having hit that benchmark, after starting with $30,000 about a decade before, I started to wonder how I could best help new subscribers that are coming on board now at this particular time.

Given the current economic conditions and the massive pullback across all three major indexes, I have decided to relaunch my flagship newsletter: Proffe’s Trend Portfolio.

Join Us!

Your nest egg – and grandchildren – will thank you!

Now and for a limited time, you can experience the market beating returns of Proffe’s Trend Portfolio for only $1 for a full 14 days! During your risk-free trial, you’ll get a firsthand look at how my strategy works and the MegaTrend stocks in the portfolio.

The new portfolio will follow the same criteria and investing philosophy that’s the bedrock of my (and my subscribers’) success, and that means a small portfolio of MegaTrend stocks that tick all the boxes in my Trendsetter Strategy and long-term, in-the-money call options that leverage the same MegaTrend themes as the stocks in the portfolio.

If you’re looking for a new way to invest that will provide great profits with far less work – and worry – than typical investment services, then sign up for a 14-day free trial to Proffe’s Trend Portfolio 2.0 for only $1 and join us for the next million dollar portfolio!