One of the biggest players in the game is SoFi Technologies (NASDAQ: SOFI). It started refinancing student loans and when interest rates were staggeringly low pre-pandemic, it was gaining significant market share with graduates looking to refinance loan debt, especially from big banks and others that were charging premium rates.

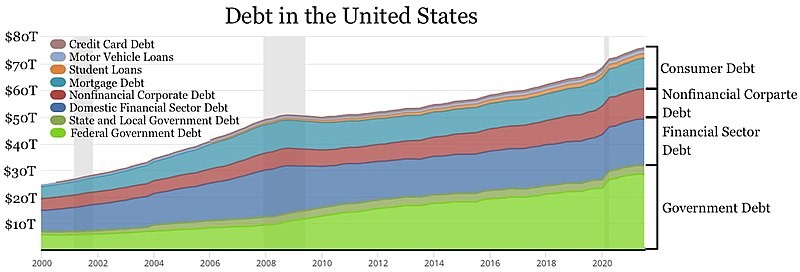

As you can see from the chart above, student loan debt continues to climb, and as more undergrads are pressured by their career choices to go to grad school, that debt is growing even faster.

Many grad schools are significantly more expensive than just an undergrad degree, and this is one of the challenges of pushing everyone to go to college – the bar gets continually raised to the point where some people will never find jobs that will afford them all the school they have.

SOFI’s first win was helping refinance high interest debt college grads incurred.

The biggest problem hit when the pandemic did. Mandatory student loan payments were halted for an indefinite period, and SOFI took a big hit.

It pivoted, expanded its offerings, and in 2022 became a full-fledged bank. Since then, it’s been off to the races.

Beyond SOFI

This isn’t a story about this company. It’s an example of how innovating within financial services using the new technologies available can be a game-changer.

Now that the pandemic is over, rates have soared, which makes this sector prime for new disruptors or even big banks, like JPMorgan (NYSE: JPM) or Bank of America (NYSE: BOA), to use their in-house tech departments to innovate.

Then there’s the companies that are supporting this new financing and refinancing opportunity – cloud providers like Alphabet (NASDAQ: GOOG), Microsoft (NASDAQ: MSFT), and Amazon (NASDAQ: AMZN).

There are also the chipmakers that are building blazing fast chips to help power AI, which will certainly find an important home in the student loan marketplace. This is why NVIDIA (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD) are going gangbusters.

This is a great example of how MegaTrends encompass more than just a couple direct players. How you choose to play these MegaTrends is the difference between growing your wealth or just keeping your head above water.