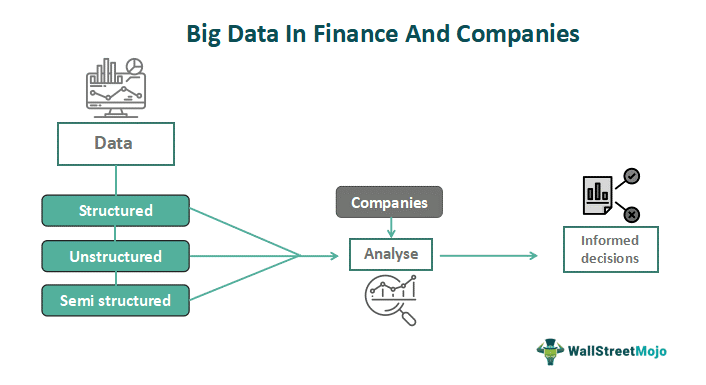

The financial industry depends on data in many different areas. Industry experts, such as Gartner, predict that Big Data will play a major role in making the financial industry more efficient, while also allowing for opportunities to grow revenue:

The use cases for Big Data in the financial world include, for example, the process of determining the creditworthiness of a potential customer seeking a mortgage or other loan.

The bank will use a range of data points, such as the customer’s credit score, in order to gauge the risk of default when offering a loan — which, in turn, impacts the interest rate for the customer. The more data points a bank has access to, and the more advanced the algorithms the bank uses, the better the credit default risk predictions will be.

Advanced data analysis, such as the approaches that are made possible by Big Data, allows for better predictions and thus lower credit risk.

Likewise, financial institutions can use Big Data approaches to detect cases of fraud, which is especially interesting for credit card players and other payment technology companies, such as PayPal (NASDAQ: PYPL).

Not surprisingly, major players in this space, such as American Express (NYSE: AXP), utilize Big Data for fraud detection. The company itself explains the process in this video:

Credit card companies can also use big data to better match specific offers to the interests and needs of individual customers.

Analyzing vast data sets also helps improve performance in other areas of the financial industry, such as trading. In fact, one of the best-performing hedge funds in history, Renaissance Technologies’ Medaillon Fund, uses a very data and algorithm-heavy trading approach. Better customer targeting, better risk analysis, and so on are other advantages of using Big Data in the financial industry.

Profiting From The Big Data MegaTrend In Finance

Investors have several ways of participating in the advancement of Big Data in the financial world. Of course, major banks will benefit from stronger credit loss prevention measures, which will be an advantage for the likes of Citigroup (NYSE: C), Bank of America (NYSE: BAC), and JPMorgan Chase (NYSE: JPM) — all of which invest heavily in their technologies. Credit card players such as AXP will benefit as well.

Investors can also use a “picks and shovels” approach, however. Not only will the major financial institutions benefit from increased Big Data usage in the financial world, but the suppliers of the needed hardware and the providers of software and services are positioned to benefit as well. This includes not only top AI/Big Data hardware companies, such as NVIDIA (NASDAQ: NVDA) and chip manufacturing equipment leader ASML (NASDAQ: ASML), but also Oracle (NASDAQ: ORCL) or Hewlett Packard Enterprise (NYSE: HPE).

Last but not least, VMware (NYSE: VMW), which is currently in the process of being acquired by Broadcom (NASDAQ: AVGO), is a significant Big Data player that should benefit from industry growth, including due to increased Big Data usage in the financial industry.

Take Advantage of Proffe’s Options Strategy by Never Missing an Options Package!

Are you seeking a secure, uncomplicated, and highly profitable options strategy?

If that’s the case, our Options Package is exactly what you need! With Proffe’s Options Packages, you don’t need to struggle with intricate strategies – we provide you with handpicked contracts for buying and selling over a 24-month timeframe. You’ll buy when we do, and we’ll alert you when it’s time to sell. It’s truly that simple.

Interested in knowing when our next package launches? Click the button below to sign up for our mailing list!