Once I had determined that long-term investing made the most sense – where I could not only get the kind of returns I wanted over time, but also could enjoy the lifestyle that my success in the markets would deliver – I set out to build a model.

Today, I call that model my Trendsetter Strategy.

My goal was to build a system that could account for a stock’s near-term growth, but make sure that it has underlying characteristics of a great long-term growth company.

That meant I needed to fuse technical analysis, fundamental analysis, and sentiment analysis to deliver the best all around companies I could find.

Here are some of the key indicators I use for my analysis:

- Turnover – A positive development is a plus.

- EBITDA, or Earnings Before Interest, Taxes, Depreciation and Amortization – A strong record of growth is key.

- Stock Yield – A stable, growing, and consistent dividend is favored.

- Positive Working Capital – Whether a company has enough cash on hand to manage its debt obligations; the more the better.

- MACD, or Moving Average Convergence/Divergence – A trend-following momentum indicator that shows the relationship between two moving averages of prices. Positive momentum is key.

- MOM – A momentum indicator that measures the velocity of price change instead of looking only at the price levels. A reading above 0 is crucial.

- RSI, or Relative Strength Index – Compares the magnitude of recent gains and losses over a given time period to measure speed and change of price movements of a stock. It’s used to identify overbought or oversold conditions in a stock.

- Williams %R – The current closing price of a stock in relation to the high and low of the past x number of days.

After I built my Trendsetter Strategy, I had to put it to work to hone its effectiveness.

What I found was that this strategy gave me the ability to reap superior market performance without using a lot of stocks or a lot of turnover.

Birth of MegaTrends

I also discovered that the stocks that were serving me best, had some key things in common.

Namely, they were all what I call “MegaTrend” stocks. These are stocks that have dominant positions in key sectors where long-term growth is assured. Today, that means companies that are not only embracing technology to establish or expand key strategic market sectors, but are outpacing the competition.

Today, these are stocks like NVIDIA (NASDAQ: NVDA), Eli Lilly (NYSE: LLY), Intuitive Surgical (NASDAQ: ISRG), and others.

These stocks will, by their very nature, provide diversification, as well as outsized growth without the risk of using smaller, more volatile proxies for the key sectors.

For the past few decades, it has been working as hoped. Of course, as the markets and economy change, I constantly tweak the model, but the fundamental goals remain the same.

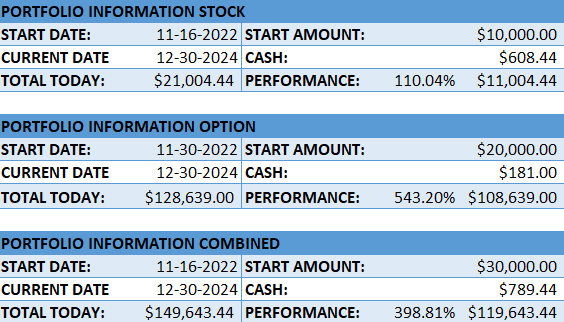

Here are the most recent results from Proffe’s Trend Portfolio 2.0. Judge for yourself.