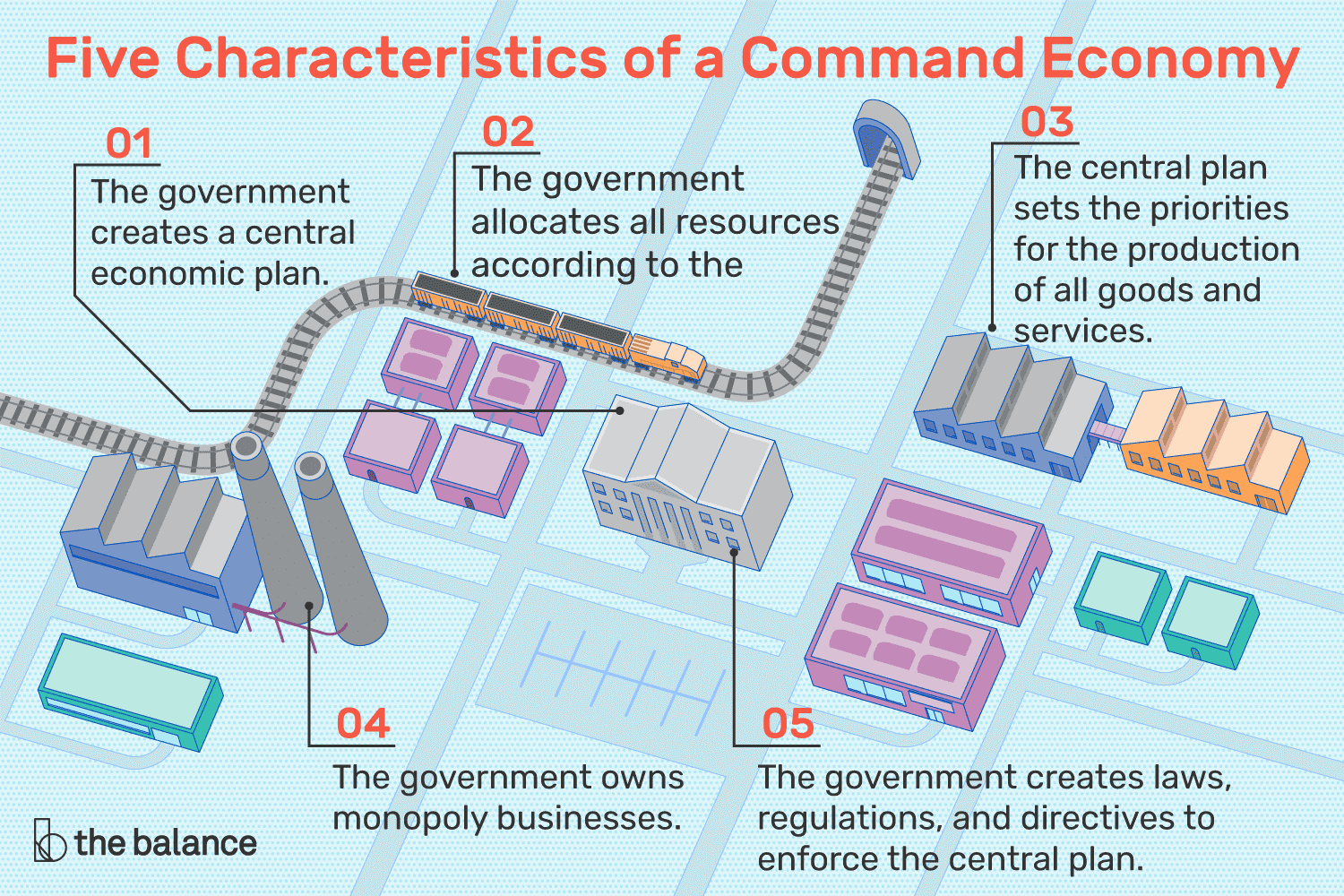

Other countries, like China and Russia, have command economies. That basically means the government decides what is best for the economy and then funds those sectors it wants to succeed.

Source: The Balance

While the concept seems a lot cleaner than letting millions of people determine what is going to work to drive the national economy forward, it doesn’t have the kind of flexibility and dynamism that a market economy has.

This is why the US stock market is so unique in the world, and it’s why many of the most powerful companies in the world are from or are involved in the US market.

In the 21st century, you see that most of the MegaTrends that we’ve experienced in the world have roots in the American market because it’s the most fertile place for opportunities to become successful companies.

Classic examples are the search sector and the rise of Alphabet (NASDAQ: GOOG), or digital retail and the rise of Amazon (NASDAQ: AMZN). These companies seem like they’ve been around forever, but neither has celebrated its 31st anniversary yet.

They dominate the internet because they follow the consumer.

Both, as well as Microsoft (NASDAQ: MSFT) and Apple (NASDAQ: AAPL), have created empires from the MegaTrends that they worked within.

New leaders are already emerging as artificial intelligence (AI) drives new players to change the landscape and create the products that will drive sales.

That’s why we focus on the US markets when we look for the MegaTrend winners for now and in the future.

It’s not just those companies driving sales, but driving the technology that supports those sales, like NVIDIA (NASDAQ: NVDA), ASML (NASDAQ: ASML), or Arm Holdings (NASDAQ: ARM).

Individual investors are best served when they focus on long-term growth investing, and that’s what MegaTrend stocks are all about.