So, what is digital visualization? Well, the chart below does a good job of staking out its borders, but when you look at it, think about how pervasive its applications are in today’s and tomorrow’s world.

The companies that have really changed the game in this sector are workhorses that build the GPUs that have expanded this world far beyond what anyone in the early 21st Century could have imagined.

I’m talking about the GPU makers, and the one that stands out most is NVIDIA (NASDAQ: NVDA).

It started as a niche player, making high-end GPUs mostly for R&D shops and university research labs, but as the consumer-driven digital world expanded, its uses for gaming made NVDA chips the choice of serious gamers.

Plenty of other people were making GPUs, but most were simply functional to help consumers better navigate the software they were using.

Data visualization was the underlying force that revolutionized the functionality of computers for the consumer world, and now, all the big chip companies are in the sector at one level or another, from Intel (NASDAQ: INTC) to Advanced Micro Devices (NASDAQ: AMD) to Qualcomm (NASDAQ: QCOM). Of course, Alphabet (NASDAQ: GOOG) and Apple (NASDAQ: AAPL) have joined, as they begin to design and build their own chipsets.

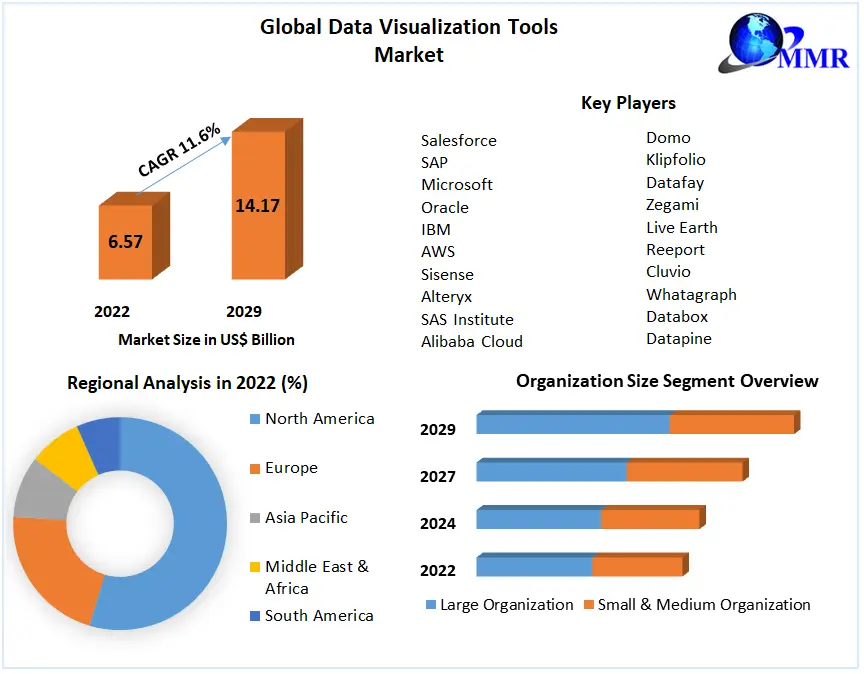

Below, you get a good idea of where we stand now, and where we’re headed by the end of the decade. As you can see, the “Key Players” in the chart are the software powerhouses that build the programs to power the GPUs’ efforts on particular tasks.

Also, remember that while the specific market size looks relatively small, the underlying reality is that data visualization is the tip of the spear when it comes to the digital experience.

It’s like looking at the market for exterior doors rather than understanding their importance to the housing market. Another exciting piece of data from the above chart is the fact that up to now the US has been driving this sector, and there’s no doubt it will continue.

As has happened throughout the world’s “digital awakening” so far, what the US has begun spreads across the globe, and that means expanding markets for all these companies as new markets open.

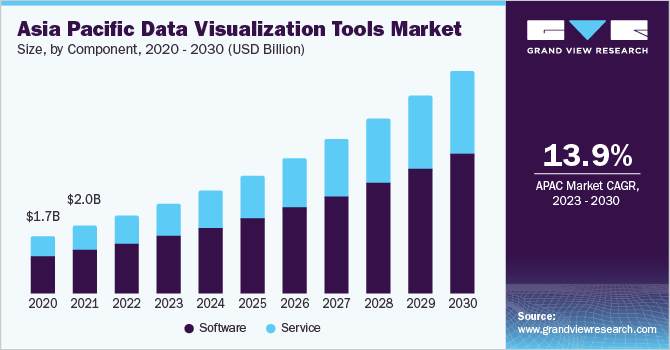

For example, Asia is on track for even faster growth in this sector, which will drive the growth of the foundational companies that drive the GPU sector.

Also, remember that GPUs are the driving force behind sectors, such as artificial intelligence, machine learning, autonomous vehicles, virtual reality, cryptocurrencies and the blockchain, and so much more.

While long-term growth stocks may sound a bit tame, it’s fair to say that this kind of long-term growth can be the difference between growing your wealth and building generational wealth.

Take Advantage of Proffe’s Options Strategy by Never Missing an Options Package!

Are you seeking a secure, uncomplicated, and highly profitable options strategy?

If that’s the case, our Options Package is exactly what you need! With Proffe’s Options Packages, you don’t need to struggle with intricate strategies – we provide you with handpicked contracts for buying and selling over a 24-month timeframe. You’ll buy when we do, and we’ll alert you when it’s time to sell. It’s truly that simple.

Interested in knowing when our next package launches? Click the button below to sign up for our mailing list!