Just a decade ago, renewables seemed a bit futuristic and out of reach for most people. Coal, while not still king, was still royalty in the energy sector, and nukes were about as unpopular as an energy resource could be – expensive, complicated, and potentially catastrophic.

But much of that has changed now.

Solar, while still not super-efficient, is cheaper than coal now. Wind is going up onshore and offshore all around the world, and nukes, thanks to second generation small modular reactors (SMRs) and molten salt reactors, as well as new fuels and more standardized reactor vessels, are starting to make a significant comeback.

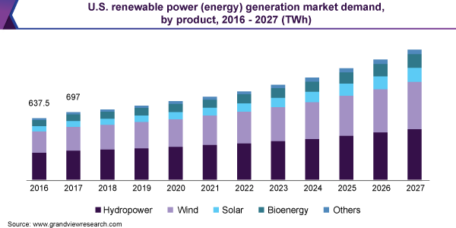

That’s why renewables ex-nukes are expected to have a compounded annual growth rate (CAGR) of nearly 17% between now and 2030. It will double the current $1.1 trillion industry into a $2 trillion industry in just seven years.

As for the nuclear energy people, like Bill Gates, Warren Buffett, and Jeff Bezos, they are investing in new technologies, and some of those companies are already setting up SMRs.

What’s more, major utilities, like Dominion Energy (NYSE:D) and Duke Energy (NYSE: DUK), are committed to building SMRs in their service territories to supply commercial and residential power.

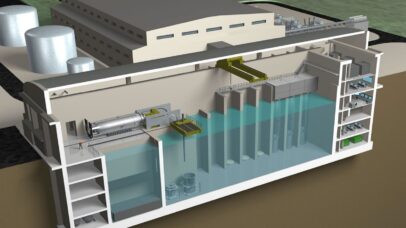

The great thing about the new generation of SMRs is that they’re modular, so municipalities or utilities can add modules as populations or energy use increases without having to build a huge first-gen nuke and hope it can accurately project demand decades into the future.

One of the companies on the cutting edge is Gates-backed NuScale Power (NYSE: SMR).

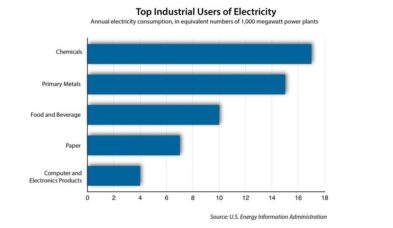

It has signed a deal to put one of its SMRs (below) in South Korea. US steelmaker Nucor (NYSE: NUE) is planning on putting reactors at its arc furnace steel mills (massively energy intensive and polluting). It also has a pilot facility going up in Idaho where 50 Western state municipal utilities are contributing funds to see how well the building, siting, and functioning goes. The company got approval from the Nuclear Regulatory Commission just this past January!

What’s more, these new reactors are also a potentially great source of green hydrogen, which then becomes another revenue source.

While wind is the oldest of these three renewables, going back to windmills from centuries ago that milled flour and ground seeds for oils, it has also become a new growth sector in renewables as advanced technologies help make turbines and blades more efficient.

While not general knowledge, the fact is that wind is most efficient when there’s a consistent breeze. The turbines operate at an optimal speed, so high winds are just as unhelpful as no wind at all. That makes siting a crucial aspect of a productive wind farm.

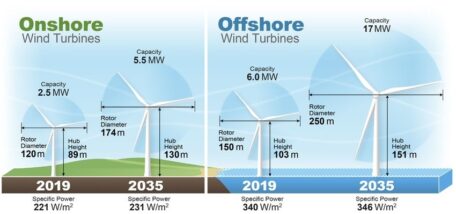

What you see above is how wind power generation is improving – bigger towers with larger blades.

The two biggest players in this game are Vestas (OTC: VWDRY) from Denmark and General Electric (NYSE: GE). Siemens is another big player, but it doesn’t trade in the US any longer.

As for solar, its growth is visible in virtually any landscape these days. From shopping malls to single family homes to utility scale solar farms, every community has its share of solar panels dotting (or dominating) the landscape.

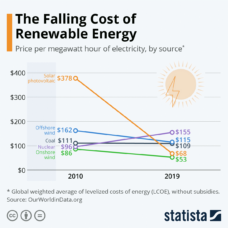

Why? Look at this chart

Solar has gone from one of costliest renewable energy resources to one of the cheapest in less than a decade, and prices continue to come down as efficiency increases.

Plus, new technologies are being introduced that make photovoltaic cells cheaper and greener to make. Higher efficiencies also mean that fewer cells will be needed to generate similar amounts of power. That means it may soon be possible to have a couple solar panels run an entire house’s electricity rather than a roof full of panels. Those higher efficiencies equate to more uses for solar, including powering EVs in real time.

First Solar (NASDAQ: FSLR), JinkoSolar (NYSE: JKS), and Canadian Solar (NASDAQ: CSIQ) are three top firms. There’s also the inverter companies that turn the DC electricity generated from wind and solar to AC power. Enphase (NASDAQ: ENPH) is one of the top players.

Underlying this massive collective MegaTrend is the fact that while these companies are ground floor picks, there are also huge companies and utilities that are well positioned to take advantage of these new technologies and partnerships with these leaders that will take their businesses to the next level.

We’re also following those and continue to hold them in our portfolios.

AVAILABLE NOW : US OPTIONS PACKAGE MAY 2023

This unique window of opportunity for huge profits is closing fast. Don’t delay your purchase of our latest options package!

- ⏰ Time Sensitive: Due to current market conditions, the deadline to purchase the May 2023 Options Package is Friday, May 26, at 4:00 pm EDT.

- 📚 Clear Trade Instructions: Receive a PDF with the 5 carefully hand-selected options and their expiration dates. We recommend allocating a total capital of $15,000 across all 5 positions.

- 🔔 Stay Informed: The options will remain active for 20-30 months, considering market conditions, volatility, and performance. I will update you on when to sell once the package meets my expectations.

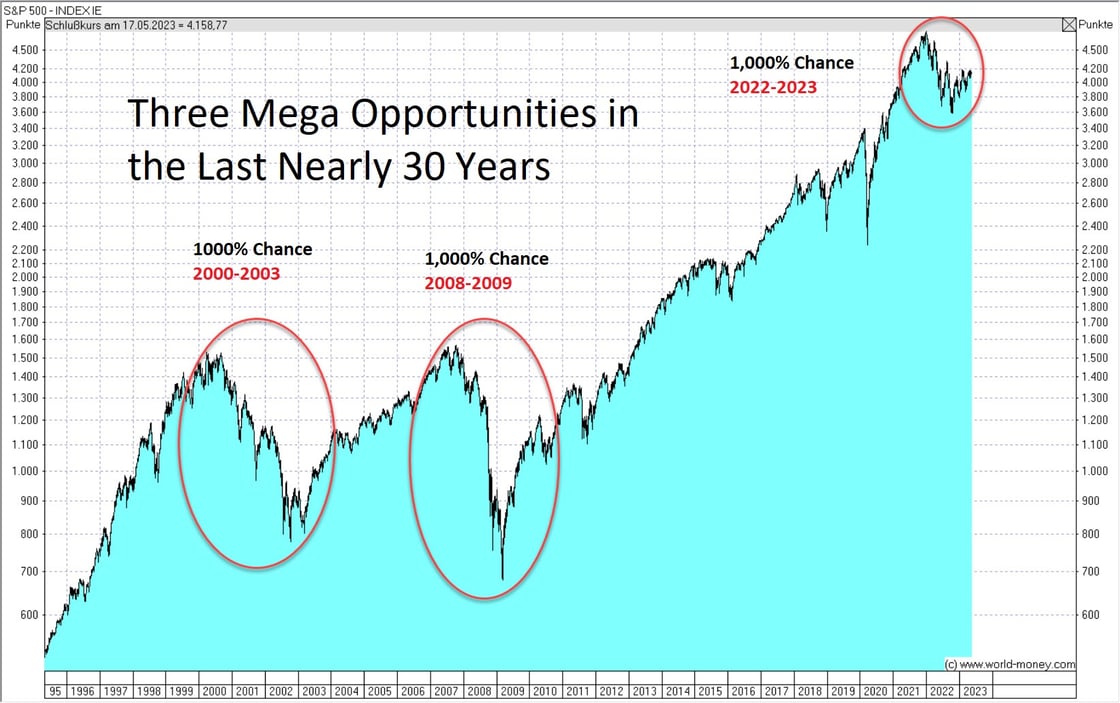

Over the past three decades, only three opportunities like this have arisen. That’s how rare they are…

While my stock market services have consistently delivered substantial profits, there are moments that demand your immediate attention. Timing is everything. This is a limited time offer…so, don’t delay!