Just as Wall Street is always looking at tomorrow, the next quarter, and the next year, so investors have to look at the EV/AV sector.

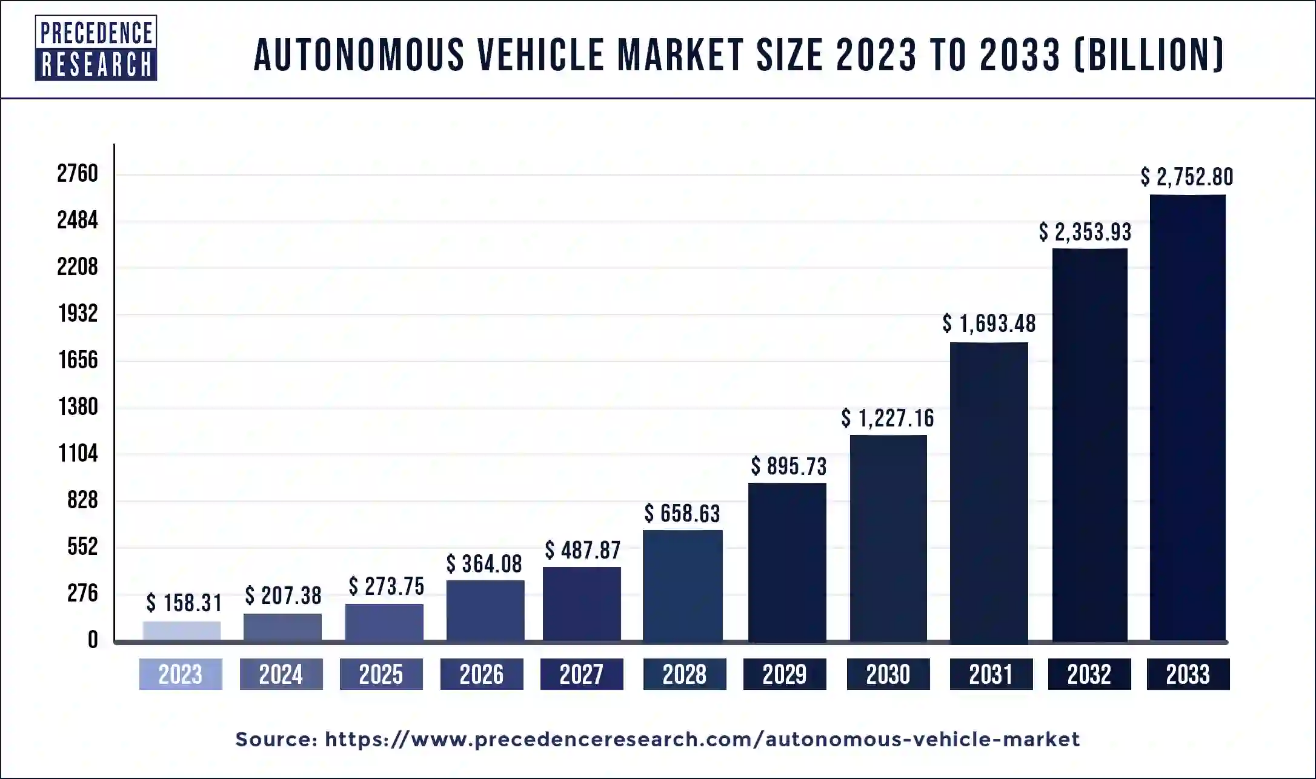

This graph lays out a $3 trillion-plus AV market in the next decade, and if you add the projections from the first graphic – 20 million EVs sold by 2030, you have a market getting near $4 trillion (and likely more).

Source: Precedent Research

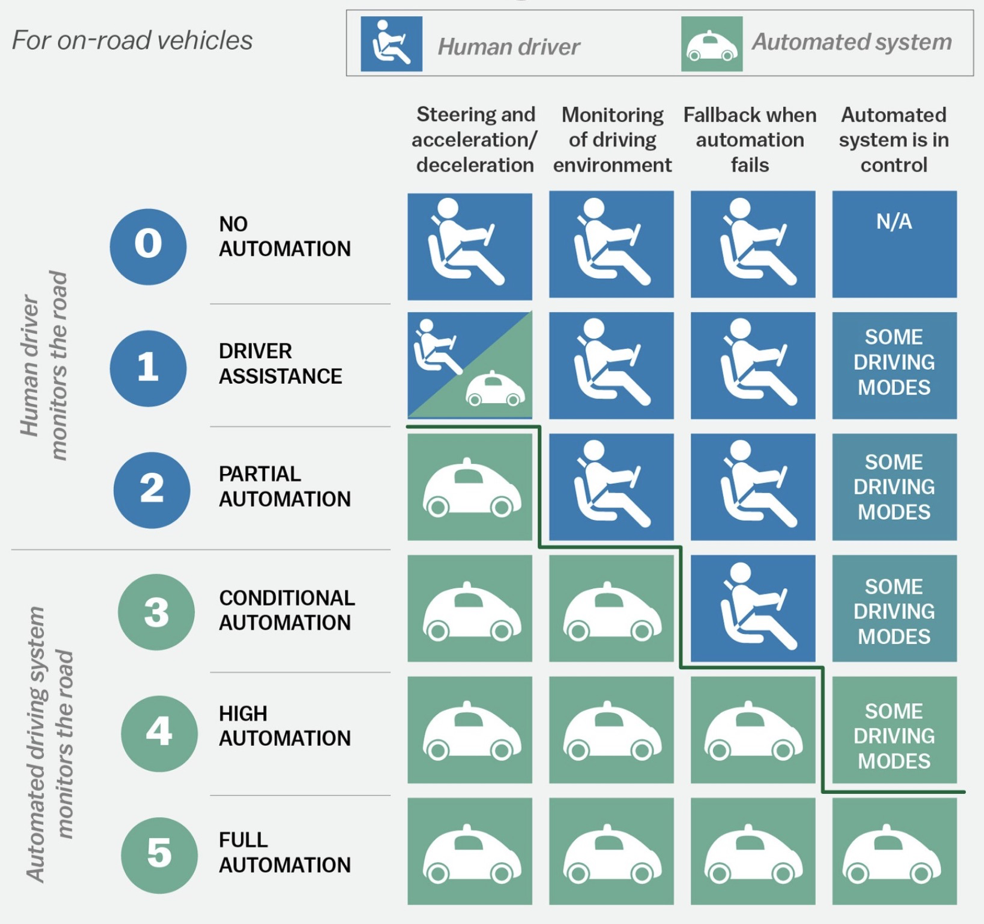

While TSLA has been promising “FSD” (full self-driving) for years now, the real winners are likely to be Alphabet (NASDAQ: GOOG), with its Waymo division that is already expanding AV taxis in Phoenix, Los Angeles, and San Francisco.

With Waymo’s new partnership with Uber (NASDAQ: UBER), they’ll be launching in Atlanta and Austin in 2025.

Deploying this technology in a more controlled way than allowing some of tens of millions of drivers to flip a switch may be the way to get AVs on the road in greater numbers safely and successfully.

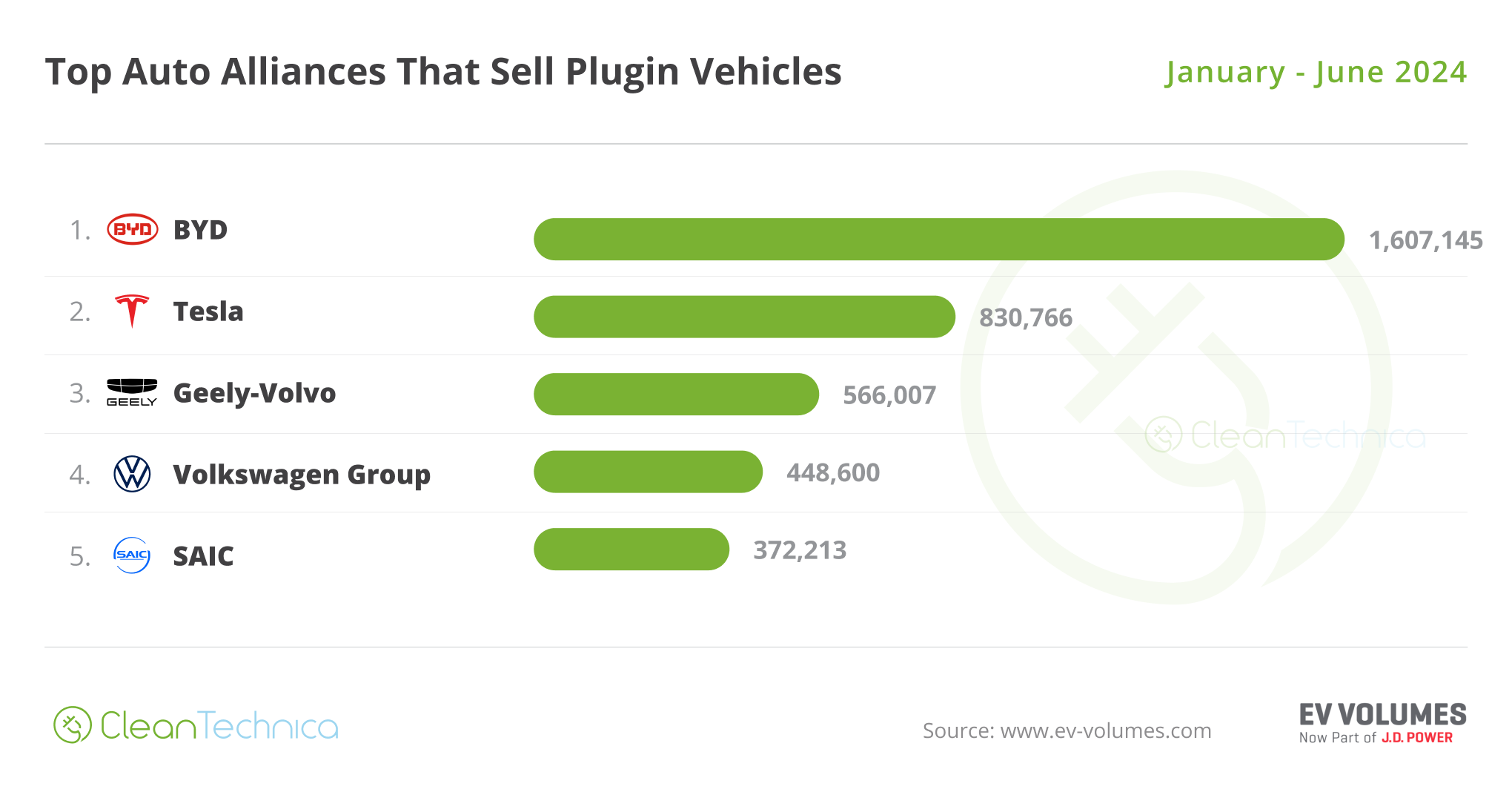

On the EV side, we’re also seeing that being first into the EV sector doesn’t necessarily mean that those companies will dominate.

The big car companies took their time and haven’t gambled their fortunes on EVs right out of the gate. Hyundai is now a big player in the US, and Ford (NYSE: F) is making moves in the truck sector.

With EVs and AVs growing, the better their onboard computing power, the better AVs will be.

That means chipmakers like NVIDIA (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), and Advanced Materials (NASDAQ: AMAT), as well as companies like ASML (NASDAQ: ASML), will also be major beneficiaries of this MegaTrend.