You don’t have to look far to find the top tier disruptive technology companies.

On the consumer side, you have companies like Apple (NASDAQ: AAPL) that changed the smartphone game, or Amazon (NASDAQ: AMZN) that went from an online bookseller to changing online retail to launching a cloud computing revolution, or Alphabet (NASDAQ: GOOG) that launched a free search engine and now pulls in more online advertising than any business in the world.

On the business side, you have companies like NVIDIA (NASDAQ: NVDA) that have designed and built the chips that power new trends like cloud computing, cryptocurrencies, blockchain, Internet of Things, and virtual reality. Its main competitor, Advanced Micro Devices (NASDAQ: AMD), is also in this group as well as ASML (NASDAQ: ASML).

This quote is from Clayton Christensen, one of the leaders in modern innovation thought, and this quote is precisely how to think of innovators.

In his book, Innovator’s Dilemma, he observes after studying innovators over decades that big companies are often the best innovators, yet they have a hard time bringing innovations to market. That’s where disruptors come in that can identify opportunities but also know how to scale those innovations.

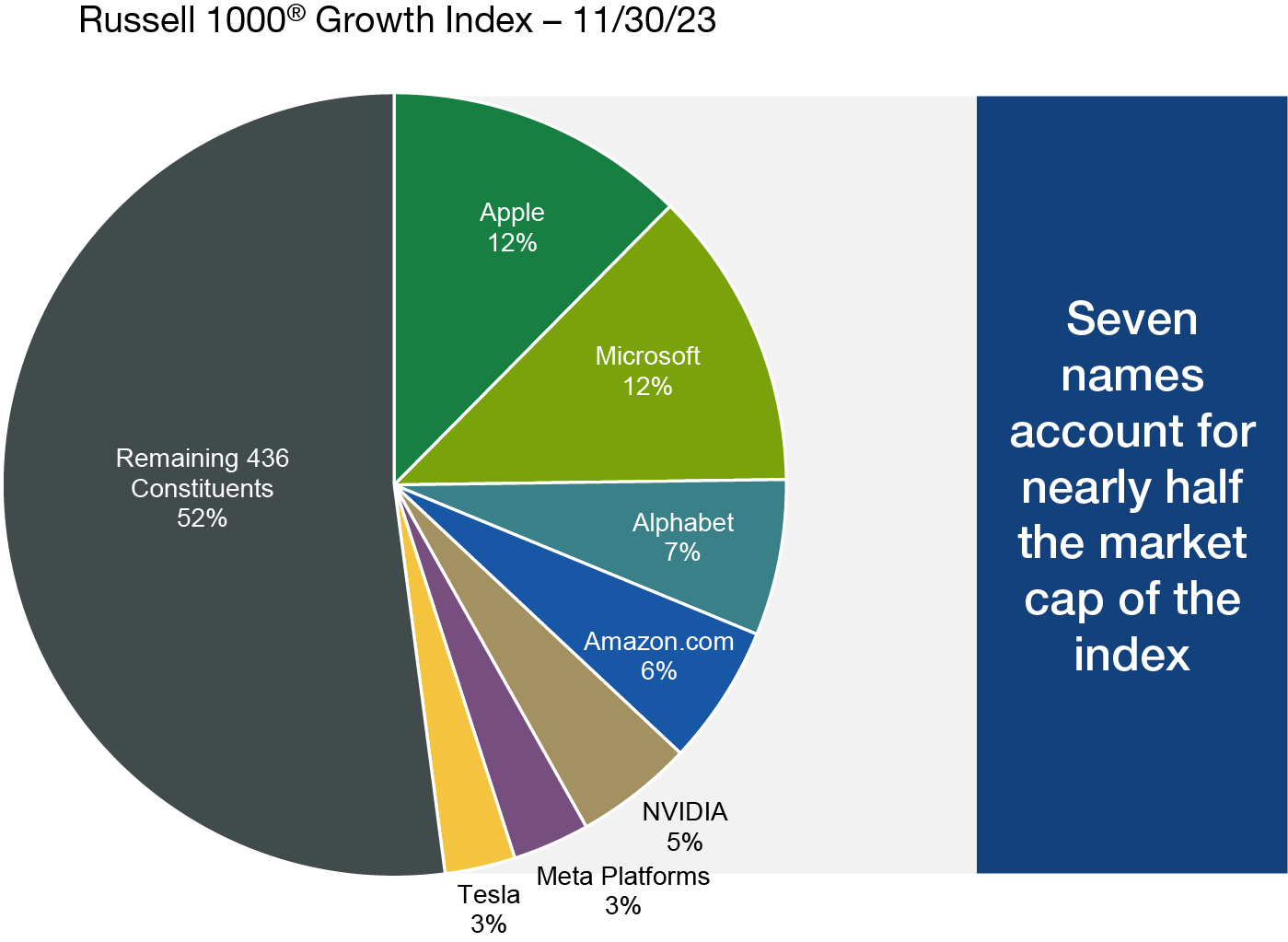

The companies we follow are the companies that have learned to do it so well that they now set the standard. So much so, that the Magnificent Seven (the newest generation of FAANG and MAMAA stocks) continue to drive the market forward.

When you can buy quality, liquid stocks that have this kind of vision and market power, then it’s silly to look for risky, one-trick ponies to drive long-term investing growth. That’s where we start our journey – find the most pragmatic and powerful innovators and leaders and invest for the long term.

In upcoming issues, we’ll explore individual disruptive MegaTrends and dive deeper into the stocks that make them such powerful market forces.