Microchip Technology (NASDAQ: MCHP) is about as nondescript a name as you can get in this furiously competitive and high-flying sector. It’s not a massive player, or a maker of superfast CPUs or GPUs, and its chips aren’t the go-to choice for server farms or mining Bitcoin. Still, MCHP has a $38 billion market cap and has been around since 1987. That’s around the beginning of the second wave of computer technology. Personal computers were just getting started.

The Macintosh had been released a few years earlier. Sold as a portable computer, it was like carrying a heavy box around, but hey, it was one piece and technically portable. PCs had been around for most of the decade, but had more value in workplaces than homes.

Source: Apple Insider

By this time, many people were realizing that computers were significant productivity boosters in the workplace, and there was a lot more potential than just crunching numbers and doing research. The digital ecosystem was growing, and MCHP began to see opportunities.

Made In America

One of the unique qualities that MCHP has maintained is that it makes most of its own chips and microprocessors. It has fabrication facilities (a.k.a. fabs) near its headquarters in Arizona, Oregon, and Colorado, as well as US-friendly Thailand and the Philippines.

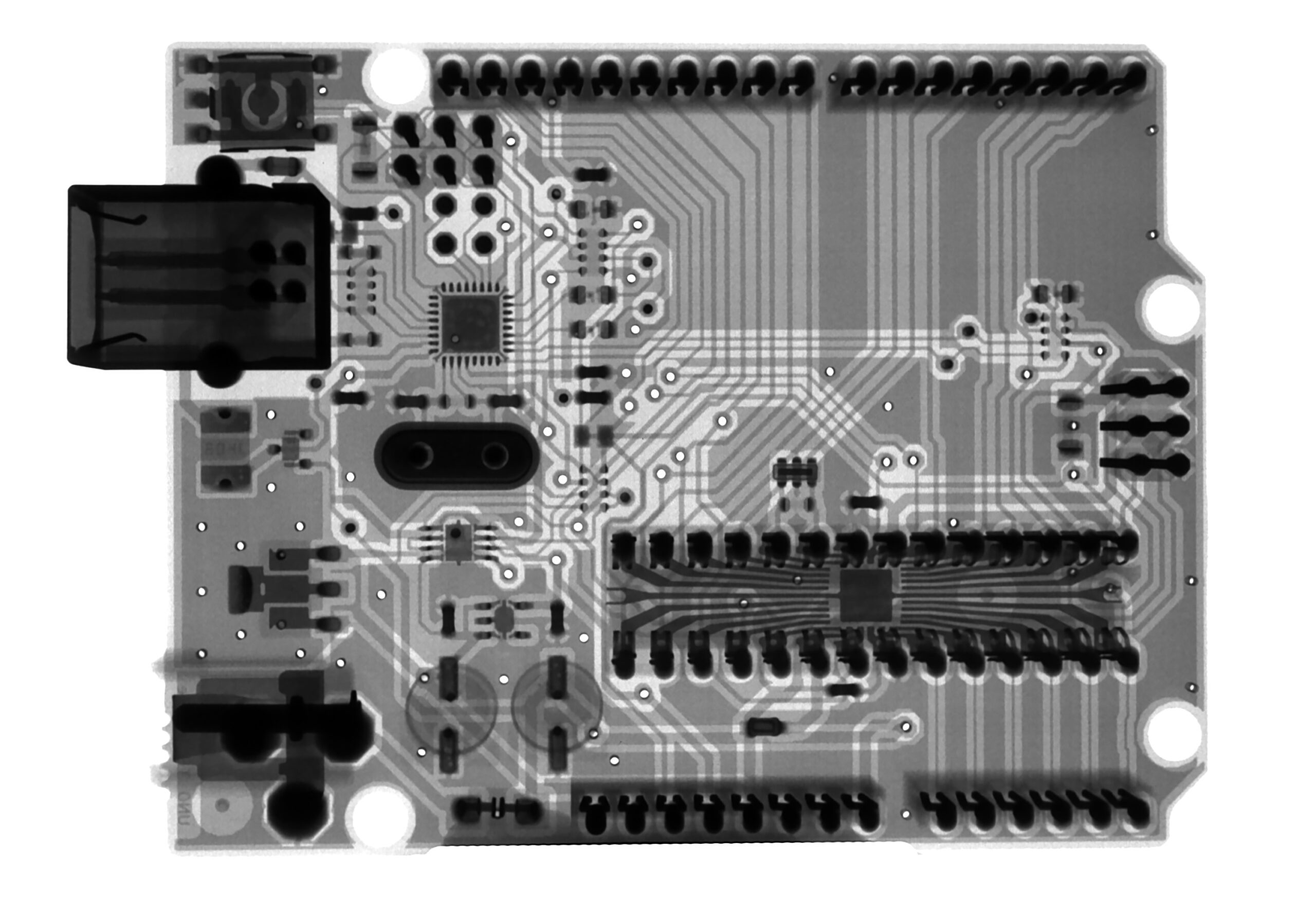

This has served MCHP well, since it has developed into a niche chipmaker that specializes in embedded computing products. Embedded computing is basically where a computer or chip is embedded into another larger product with a range of purposes. For example, a camera uses computer chips for many different functions today, but its ultimate value is capturing images, not computing. The same goes with cars, military equipment, and frankly, almost everything these days.

That’s the point. MCHP continues to develop and sell technologies that are continually in demand as the digital and mobile ages move forward.

Source: ARC Advisory Group

Bear in mind that having that “Made In America” label is becoming a big deal again. With supply chains under strain and global geopolitics heating up, controlling the means of production is a massive asset. It’s also why Tim Cook of Apple (NASDAQ: AAPL) paid China $275 billion to keep APPL safe from politics and China shutting down local distribution or exports to the US.

Safety isn’t the only facet, however. With the massive infrastructure stimulus bill starting to get deployed, US companies will be top priority beneficiaries of the money for new systems, many of which will include embedded systems – heavy machinery to HVAC systems to smart roads.

The Party Is Just Getting Started

What’s more, the world is becoming more digitized, not less. That means demand continues to expand. One of MCHP’s newest products is TanvasTouch, a touchscreen solution that you can run your fingers across and feel realistic textures. You can also feel the resistance of switches and buttons.

Source: Microchip Technology

This is a dream for gamers, but it will also have significant implications for new phones and the expanding meta universe that is already under construction.

Source: commons.wikimedia.org

MCHP stock has sold off with all the other tech high-flyers, but that’s to be expected since a sector selloff first means the big stocks in the sector are all sold together, then big investors move back into individual shares that have the most promise in the new environment.

You can be sure that MCHP will be back quicker than its smaller brethren and some fabless chipmakers that will offer more risk because they’re now at the mercy of changing times; when means of production becomes a significant asset again.

Don’t miss your chance to benefit from this economic shift and market recovery with the right stocks!

The right stocks are the MegaTrend stocks and you can benefit from them by subscribing too…

Proffe’s Global Growth Portfolio is a bi-monthly stock portfolio helping individuals become better global investors. For just $49.95 a year, you receive a bi-monthly portfolio update with pertinent MegaTrend information and stats. That’s 24 issues at $2.08 per issue of an all-stock portfolio that you can easily and profitably follow. CLICK HERE to find global diversification without ever leaving the US market by subscribing to Proffe’s Global Growth Portfolio NOW!

Proffe’s Trend Portfolio is the profitable, premier stocks AND options portfolio from Proffe Invest Inc. It surpassed the one-million dollar mark during the summer of 2021. Right now, you can get a FREE, no obligation 30-day trial to learn about the best growth stocks in the world and the right options to accompany them. We won’t ask for your credit card until your free trial is up because we’re confident you’ll want to continue, like our many subscribers! CLICK HERE to start your free trial of Proffe’s Trend Portfolio NOW!