Neuralink

It’s no secret that we like Tesla (NASDAQ: TSLA) for its long-term investment potential. Although company founder Elon Musk’s recent activity has been controversial, we do like what he built at Tesla.

He has an amazing ability to turn what looks like science fiction today into reality tomorrow. This is why we’re watching his BCI technology company, Neuralink, very carefully. It’s not currently public, but we keep waiting patiently for its initial public offering.

Neuralink’s initial goal is to develop technology that will help people with paralysis regain their independence by implanting very fine wire electrodes in these people’s brains that will enable direct communication with computers.

In turn, these computers could operate robots or even robotic arms, legs, hands, etc. With Neuralink’s technology, the link between any implanted hardware and the main computer is completely wireless.

As part of this goal, the company is also developing surgical robots for implantation of the electrodes and associated electronic circuitry. The implants would be inserted through veins or arteries, rather than through major surgeries involving cutting and drilling.

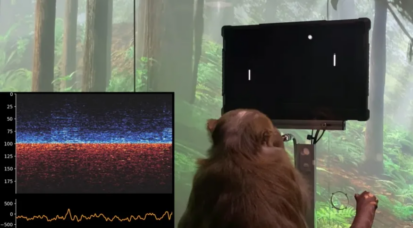

In April 2021, Neuralink demonstrated that a monkey implanted with the company’s technology was able to play the game “Pong” solely by thinking about it. The process went like this. First, the monkey, named Pager, played Pong using a joystick.

The brain wave signal associated with his hand movement was recorded in real time onto a smartphone. After a machine learning app on the smartphone decoded the signal, the company demonstrated that Pager could indeed play the Pong game by only thinking about it. The joystick was no longer needed.

The company was founded in stealth mode in 2016 and became known to the public in 2017. Musk funded the company with $100 million of his own money and then raised an additional $58 million through outside investors.

Neuralink has applied for FDA approval for human trials. If granted, it plans to begin implants in human subjects in 2023.

Blackrock Neurotech

Taking nothing away from the accomplishments of Neuralink, Blackrock Neurotech is even further along the path of addressing the needs of real human patients.

According to its website, there are 36 people in the world who have true operating brain to computer interfaces, and 32 of those were produced by Blackrock.

In fact, Blackrock has succeeded in implanting tiny wires in the brains of its patients. They’re located just below the outer layer of the brain, otherwise known as the cortex. The wires join just above the cortex into a tiny circuit packaged in a disc about the size of an M&M (non-peanut). A connection port is positioned in the patient’s skull. Wires are connected to the port which then go to computers or robotic prosthesis. Unlike the systems under development by Neuralink, these systems are not wireless.

Blackrock claims they have enabled patients with severe neurological injuries to move, see, talk, hear, and feel things they may never have otherwise.

One patient in particular lost complete control of his left arm following a severe stroke. This patient received a motorized exo-skeleton for his arm that is directly linked to a port and implanted brain circuitry developed by Blackrock. When he thinks about moving his arm, the motors are activated and he can move his arm quite naturally like before his stroke.

It’s unclear how much money the company has raised since its founding in 2008 by Professor Florian Soltzbacher and Marcus Gerhardt. However, it’s clear from internet sources that in May 2021, it raised $10 million, much of which came from PayPal co-founder Peter Theil.

The Neurotechnology Sub-Megatrend

Presented above are only two examples of companies that are creating a future where people with severe neurological injuries will effectively be cured using technology that will become as well understood and as common as pacemakers are today.

There are others making amazing contributions towards this goal. Some examples include Synchron (heavily funded by both Jeff Bezos and Bill Gates), Clearpoint Neuro, and BrainGate.

Indeed, Neurotechnology and BCI technology will take a long time to be profitable. However, the technology is clearly advancing very quickly, and it is worth the wait for one of the companies to go public. Stay posted with our newsletter, and we will keep you up to date on this evolving technology.

Introducing Proffe’s Trend Portfolio 2.0!

A new market deserves a fresh start…

In November 2021, Proffe’s Trend Portfolio officially crossed the $1,600,000 target. I reached this milestone with a portfolio of just a dozen stocks and a unique options strategy I perfected in Europe and brought to the US.

Having hit that benchmark, after starting with $30,000 about a decade before, I started to wonder how I could best help new subscribers that are coming on board now at this particular time.

Given the current economic conditions and the massive pullback across all three major indexes, I have decided to relaunch my flagship newsletter: Proffe’s Trend Portfolio.

Join Us!

Your nest egg – and grandchildren – will thank you!

Now and for a limited time, you can experience the market beating returns of Proffe’s Trend Portfolio for only $1 for a full 14 days! During your risk-free trial, you’ll get a firsthand look at how my strategy works and the MegaTrend stocks in the portfolio.

The new portfolio will follow the same criteria and investing philosophy that’s the bedrock of my (and my subscribers’) success, and that means a small portfolio of MegaTrend stocks that tick all the boxes in my Trendsetter Strategy and long-term, in-the-money call options that leverage the same MegaTrend themes as the stocks in the portfolio.

If you’re looking for a new way to invest that will provide great profits with far less work – and worry – than typical investment services, then sign up for a 14-day free trial to Proffe’s Trend Portfolio 2.0 for only $1 and join us for the next million dollar portfolio!

A new market deserves a fresh start…

In November 2021, Proffe’s Trend Portfolio officially crossed the $1,600,000 target. I reached this milestone with a portfolio of just a dozen stocks and a unique options strategy I