Many companies that are huge and extremely profitable today, such as Meta Platforms (NASDAQ: META) and Alphabet (NASDAQ: GOOG), the parent entities of Facebook and Google, once were unicorns.

Beyond these relatively well-known names, there are many other unicorns that are relatively unknown – in total, there are more than 1,000 companies today that have “unicorn status”.

While a large number of unicorn companies are in the broad tech universe, including software, AI, gaming, social media, fintech, crypto, and so on, there are also non-tech unicorn companies. These come from industries such as consumer goods and retail (such as Fanatics, which sells sports merchandise) or healthcare (such as senior-focused health company Devoted Health).

Benefitting from the Growth of Unicorns

Unicorn companies are, by definition, not publicly traded. While it’s possible to have exposure to some of them via private equity or venture capital investment funds, this is an asset class that’s far less accessible compared to shares that are traded on public markets. There are generally significantly higher minimum investment values and also, in many cases, significant minimum holding periods. This isn’t a real option for most investors.

But investors can also benefit from the growth the unicorn universe is experiencing in a different way: By holding positions in publicly traded companies that do business with unicorn companies and indirectly benefit from their growth.

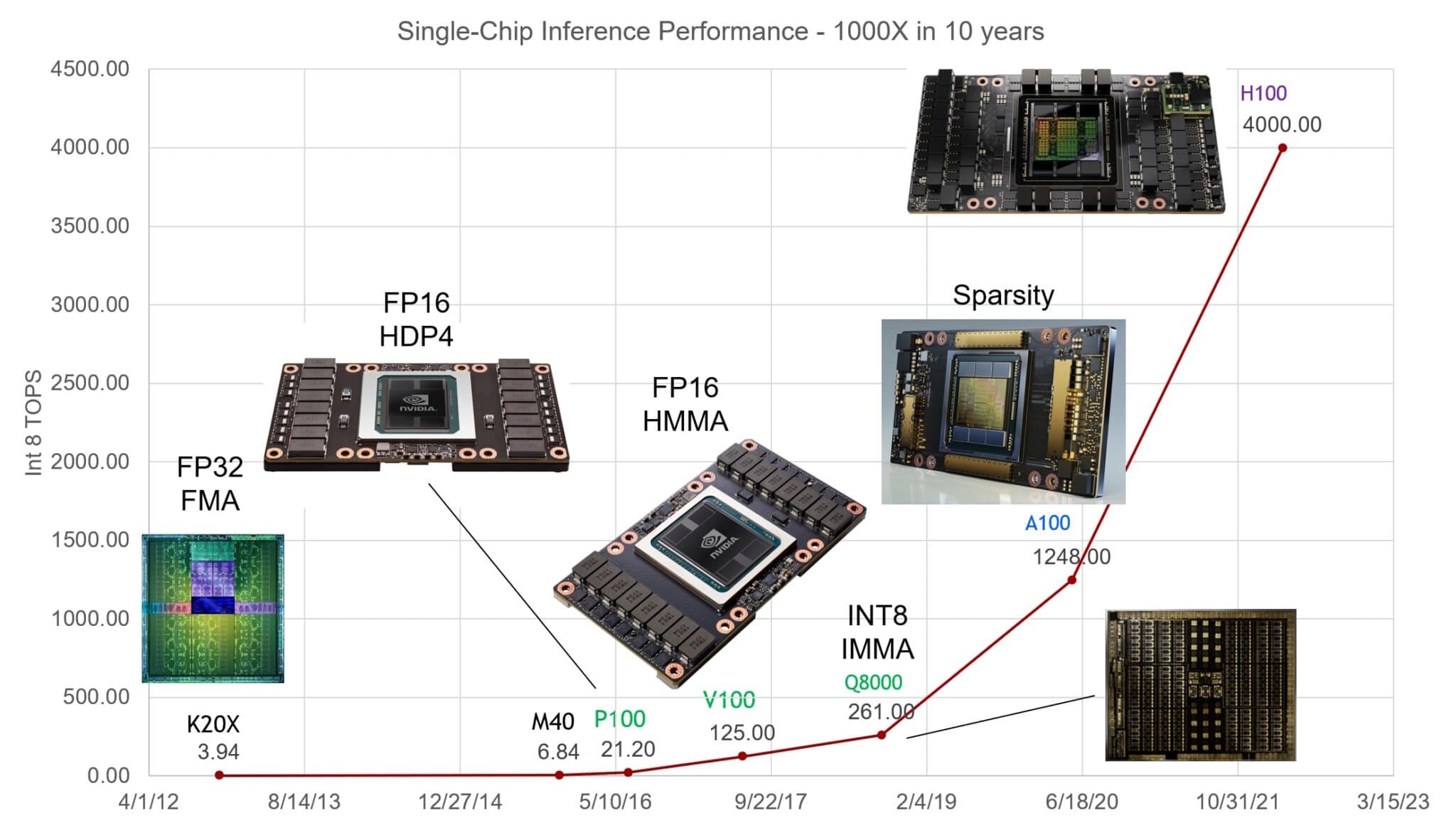

The best example is NVDA. NVDA does a lot of business with a range of unicorns, including OpenAI, one of the hottest unicorn companies in the world today. OpenAI, famous for its ChatGPT offering, needs to invest massively in computing power in order to train its AI algorithms, and NVDA is the supplier of choice for AI computing power. As OpenAI grows, so will its demand for chips, and NVDA will be a key beneficiary.

There are many other AI companies among the largest unicorn companies today, such as Elon Musk’s xAI, GOOG-partnered Anthropic, or Scale. NVDA will benefit not only from OpenAI’s growth, but also from the growth of these other AI-focused businesses.

Even unicorns without a clear AI focus oftentimes have some AI exposure, including ByteDance with its TikTok algorithms, or SpaceX, which utilizes AI to sort data for satellites, space debri, and so on.

NVDA isn’t the only company that will benefit from the data center and chip spending by these and many other unicorns, although it’s likely the biggest beneficiary. Other publicly traded companies that should benefit from the unicorn trend include Broadcom (NASDAQ: AVGO), QUALCOMM (NASDAQ: QCOM), and Arista Networks (NASDAQ: ANET), which will all benefit from growing data center capital expenditures in the future.

Our Artificial Intelligence picks are our favorites to benefit from the broad AI that is, among other factors, driven by many unicorn companies.