American Water Works: Keeping It Potable for 136 Years

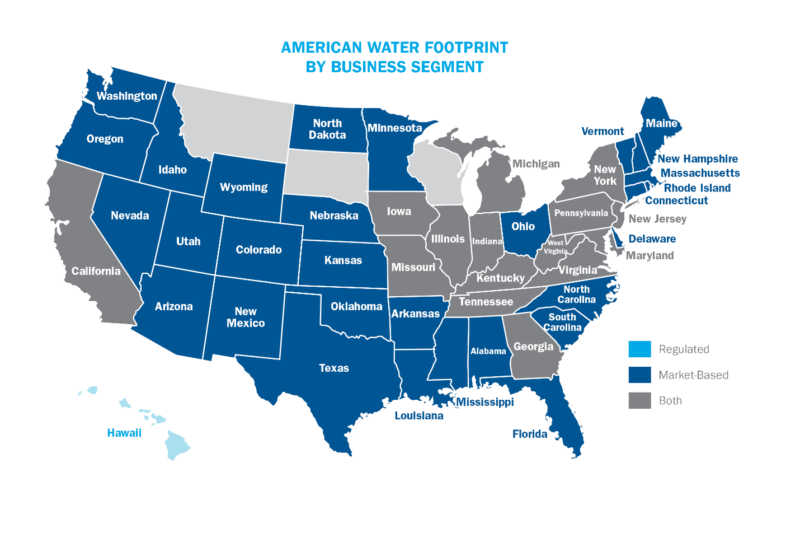

American Water Works (NYSE: AWK) started in Pennsylvania in 1886. Today, it operates in 14 states and has more than 3.4 million customers. It also started a separate division that operates water systems on military bases in the US as well. Overall, it provides water services of one kind or another in 24 states to 14 million people, and it’s the only water utility in the Dow Jones Utility Average.

Source: Amwatersolutions.com

Certainly, water isn’t the kind of business that causes heart rates to quicken, but the fact is, there are some fundamental industries that make money because they’re essential to everyone’s day to day functioning. Water is one of those.

Growing Demand for AWK

In the past couple decades, AWK has been growing that business because many smaller cities and towns just can’t afford to continually upgrade their equipment and provide water services at a decent price.

You may recall what happened in Flint, Michigan when the city chose a cheap, quick fix for its deteriorating infrastructure, rather than a more comprehensive solution. Flint isn’t alone.

Many states have cities and towns with degrading infrastructure, and there is no longer the tax base to support quality, reliable operations. AWK brings scale to these problems because it does this one thing and has been doing it for more than a century. It’s far more efficient at running a water system than a local government.

This is also becoming increasingly important as major cities in the West are now experiencing significant drought conditions.

Source: KGUN 9

These regions also tend to have significant amounts of farming as well, so the difficult choices are whether to supply diminishing water supplies to farmers to grow crops or to the citizens and businesses that pay taxes.

Source: The Guardian

When people talk about climate change, these are the massive, multi-year challenges that are really what will affect the economy over time. The climate isn’t going to just change from Monday to next Tuesday. It will happen slowly over years, but in that transition to the “next normal,” companies like AWK will be there to provide solutions to the challenges as they occur.

Granted, AWK won’t have all the solutions, but a shifting climate means every state has to reevaluate its water resources and how it uses and allocates them.

AWK Has Plenty of Upside Left

All this is very favorable for AWK. Rising uncertainty in weather patterns and broader issues with the climate only add to the fundamental need that everyone has for clean, potable water. Like electricity, water is absolutely essential to create a modern economy and society, and AWK continues to be a key company in helping states provide this essential service.

What’s more, since much of its work is under contract with local authorities, its operations aren’t regulated by the federal government, like other utilities. It has to operate to certain codes, but the prices it charges are more flexible than they are for regulated electric utilities.

As you can see from the chart above, AWK has returned 1,000% in the past 13 years. That’s about 77% a year for more than a decade. There aren’t many tech stocks that can boast that kind of strong, consistent performance.

I’m guessing AWK is looking sexier all the time, and the best part is, it doesn’t come with the risk that most high-flying tech stocks do. It comes with a 1.7% dividend. Best of all, the stock is down about 17% year-to-date, so it’s a bargain.