Nearly $1.7 Trillion in Student Debt Has a Real, Long-Term Effect on the Economy

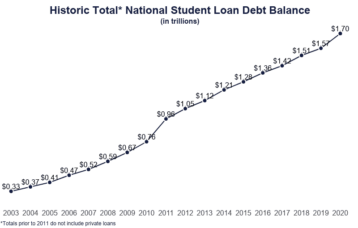

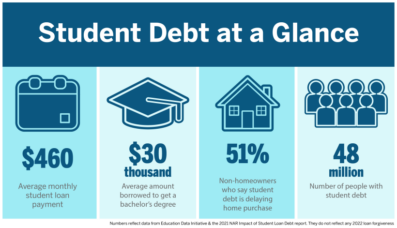

At this point, as you can see below, these 50 million college students have amassed $1.7 trillion in college debt. That number was just $330 billion in 2003.

The short-term reality is that many for-profit financial institutions weren’t primary lenders in decades past. That helped keep interest rates low for students, but as rates rose and college demand rose, so did student loan pricing.

Plus, much of this debt is just for undergraduate degrees. Today, the cost of graduate school is extraordinary for well-regarded institutions.

For example, Duke’s Fuqua School of Business, one of the top business schools in the country, cost around $145,000 for its two-year graduate program. Stanford is closer to $250,000. The top law schools cost about $200,000 for a three-year program.

That’s a lot of debt, and when you’ve sunk that money into your schooling, it means you have to earn big just to pay it down. If you don’t earn big, then you can forget about the nicer things in life for a decade or more.

Up to recently, this has had more of a knock-on effect to the broader economy since these graduates (grad or undergrad) don’t have the spending power of their successful peers or older workers who aren’t burdened with this kind of debt.

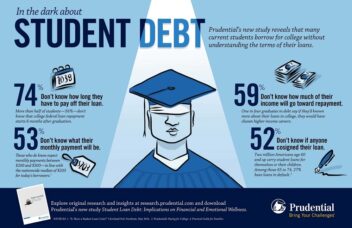

According to Bankrate, nearly 60% of US adults with student loans have put off important financial decisions due to student debt. That takes its economic toll.

Financial institutions have certainly benefited from this current paradigm.

What Are the Solutions?

As the Gen-Xers start to solve the problems of current and upcoming generations, what they’ve done is use financial technology (A.K.A. fintech) to help blunt some of the challenges.

For example, SoFi (NASDAQ: SOFI) started solely focused on helping college grads refinance their student loans at lower, more manageable interest rates.

Now SOFI has bought a bank charter and expanded its business to offer the same products as a traditional bank. It’s what is called a “neobank” or “challenger bank” that operates on a national level with few branches. It’s a digital bank and can compete with traditional banks since it has much lower overhead, plus it has a significantly bigger service area than most community banks and credit unions.

Digital banking has become a game-changer for digital native generations when it comes to managing their debts.

As we’ve seen post-pandemic, the federal government has mandated that student loan payments be frozen with no interest penalty to help keep the economy going.

The great thing about capitalism is that when challenges arise, the market will start to look for solutions. Some fail, and some rise to the top. In the case of student debt, we’re still in the early phases of the digital banking revolution, as well as a rethinking of student debt.

We’re always on the lookout for the Amazon.com (NASDAQ: AMZN) or Apple (NASDAQ: AAPL) of student debt.

A Stocks & Options Portfolio with Massive Gains

Have you planned out your financial goals for 2023? It’s not too late! This year can be the year that you give yourself and your family the gift of generational wealth.

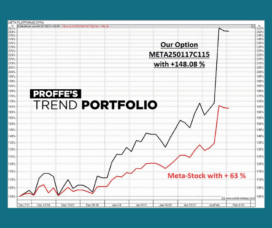

Our subscribers of Proffe’s Trend Portfolio 2.0 are experiencing massive gains. Thanks to Meta’s recent positive earnings, our options position has returned 148% in just a few weeks. That’s not all – since relaunching in November 2022, our options portfolio has delivered a whopping 28% return.

| Don’t miss out on these spectacular gains – start your 14-day trial today for just $1 and experience the excitement of successful investments! Start Your 14-Day Trial for $1 |