Humans first visited the Moon in the 1960s, but no one was planning any long-term colonies on it back then. Space missions to our “companion” only lasted for a couple of days at a time, which is pretty amazing given the technology at the time.

The Apollo project eventually ended, and the US and other space-faring nations focused on other space missions, such as building and using the International Space Station as a first in sustainable living beyond Earth’s atmosphere.

There are, however, new Moon missions being planned in the foreseeable future, including manned ones. In late 2025, NASA plans to launch Artemis 2, which will see four astronauts fly around the moon for testing purposes of NASA’s newest equipment.

Under the Artemis program, NASA will eventually land astronauts on the Moon and will build a long-term base there. Habitation infrastructure will allow astronauts to remain on the lunar surface for extended periods of time, which will allow for improved exploration and increased scientific returns. The new automated landing vehicles, like Intuitive Machine’s (NASDAQ: LUNR) recent effort, will help map potential sites and build a communications mesh.

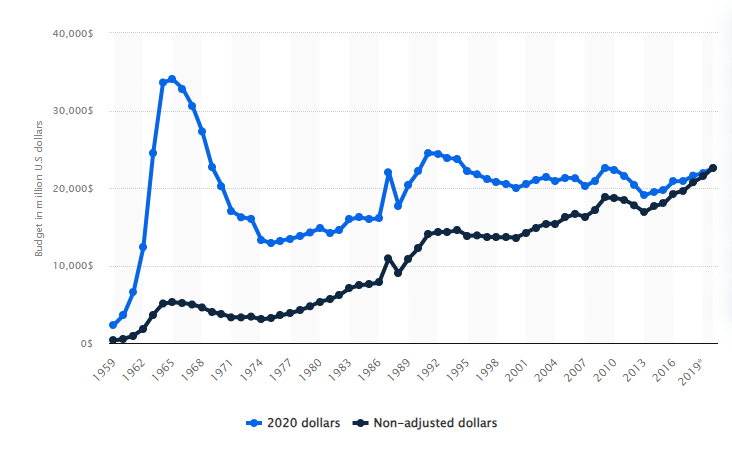

Space exploration is receiving increased attention, which can be seen in the following chart showing NASA’s budget:

We see that NASA’s budget has risen to new highs in recent years in non-adjusted dollars, although we are still below the peak seen during the Saturn program, once we account for inflation. Still, with continued increases, that record could eventually be broken as missions become larger and more complex.

It’s also worth noting that NASA’s budget is only one part of what humanity is spending on space exploration and missions. Other countries, such as Europe, China, and India are increasing their investments, and private organizations and companies are also spending billions.

SpaceX, founded by Tesla (NYSE: TSLA) head, Elon Musk, has launched its gigantic Starship for the third time just a couple of days ago.

While Starship is still being tested and will take a while until entire missions can be done with it, this example shows that private companies are also progressing quickly when it comes to moving forward with space tech.

Amazon (NASDAQ: AMZN) founder Jeff Bezos’ Blue Origin is also in talks to buy the United Launch Alliance, which is owned by Boeing (NYSE: BA) and Lockheed Martin (NYSE: LMT) currently.

Buying a Seat on the Future

We can’t invest in NASA, of course, and even when it comes to non-government companies that are active or working on moon missions and similar tech, there are few investment options.

SpaceX, the most famous space company, isn’t publicly traded, for example. The same holds true for Blue Origin. There are new companies getting into the business and there’s likely to be significant consolidation of boutique players. For example, advanced communication company L3Harris (NYSE: LHX) recently bought rocket maker AeroJet Rocketdyne to build its aerospace footprint. Airbus (OTC: EADSY) and Northrop Grumman (NYSE: NOC) are other aerospace and defense companies with exposure to space tech that could be of interest to investors.