We all know from our personal experience that modern vehicles, be it taxis, our own cars, or those of friends and family, have gotten a lot smarter. Many things are automated or automatable, meaning drivers can decide whether they want to control things themselves or have a computer control things for them.

This is only possible due to more and more sensors being built into modern vehicles, with expanding computing power being used to fully utilize all the data modern vehicles collect via these sensors.

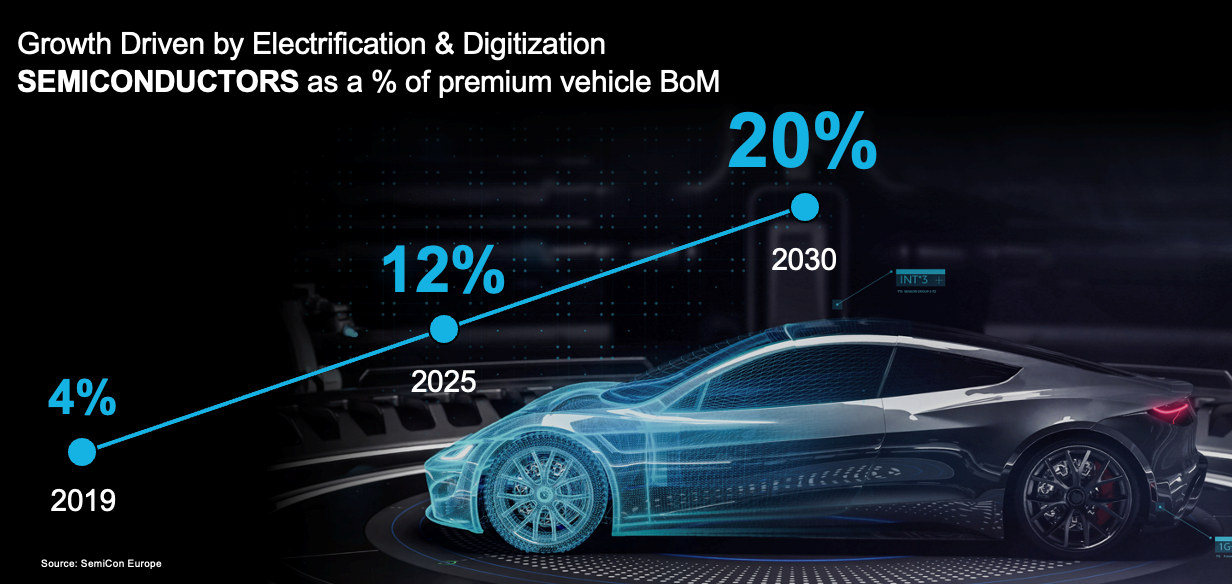

As a result of more semiconductors, the revenue share of semiconductor companies that’s generated in the automobile industry keeps growing. The following chart shows the semiconductor percentage of premium vehicles’ bill of materials.

(source: LinkedIn)

That number is forecasted to climb 12% next year, up threefold from 4% five years ago. By the end of the decade, a full 20% of vehicle costs will be attributable to semiconductors. If a new vehicle cost $60,000 in 2030, around $12,000 would go towards the pockets of semiconductor companies that produce the sensors and chips that are used in this vehicle.

How To Benefit from the “Chips in the Automobile Industry” MegaTrend

Investors can choose among some of our Artificial Intelligence picks to benefit from growing chip usage in the automobile industry, as there is a link between automation, machine learning, smart vehicles, increased algorithm usage, and chip revenue in the automobile sector.

NVIDIA (NASDAQ: NVDA) is the king in the AI space, and it could benefit from growth in the automobile industry. Companies working on solving self-driving vehicles use NVIDIA’s chips in their data centers, for example.

NVIDIA also sells its chips to automobile companies directly, such as NIO (NYSE: NIO), a Chinese premium electric vehicle company that uses NVIDIA’s platform in some of its vehicles. Volvo is another premium automobile manufacturer that utilizes NVIDIA’s technology, with the EX90 electric SUV using NVIDIA’s Orin SoC.

While not as well-known as NVIDIA, Qualcomm (NASDAQ: QCOM) is another attractive chip company for investors seeking to benefit from more and more chip usage in the automobile industry.

Qualcomm owns a wide patent portfolio of wireless tech, such as 3G, 4G, 5G, which should help the company benefit from increased interconnectivity in automobiles.

When smart vehicles communicate with each other in the future, Qualcomm’s patents are likely to be involved, resulting in royalty payments for the chip player. Qualcomm also develops its own chips for automobiles, including Wi-Fi and Bluetooth chips, as well as CPUs and GPUs under the Snapdragon brand.

Last but not least, companies that offer cloud computing and AI software solutions could benefit from smarter vehicles that require more (cloud-sourced) computing power and software solutions as well. This includes some of the largest tech companies in the world, such as Alphabet (NASDAQ: GOOG) and Microsoft (NASDAQ: MSFT).