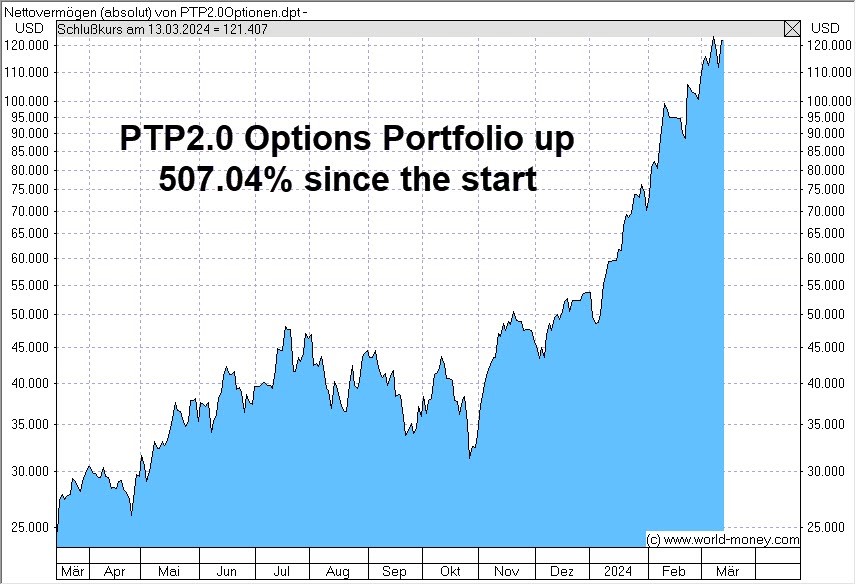

Below are the performance figures for the options portfolio in my Proffe’s Trend Portfolio 2.0. I launched it in late November 2022, when most of the pundits were predicting doom and gloom for stocks in 2023.

My Trendsetter Strategy said just the opposite. It was pointing to a major growth leg up, and the rising volatility would benefit my conservative, simple options picks.

Pick Great Stocks and Use Different Vehicles

What I’ve noticed in the US markets is many individual investors tend to follow the lead of professional options traders when using these derivatives, but there’s a different way to do it that makes using them less complex, less time-consuming, and less risky.

Over the decades I’ve continually improved how to do it.

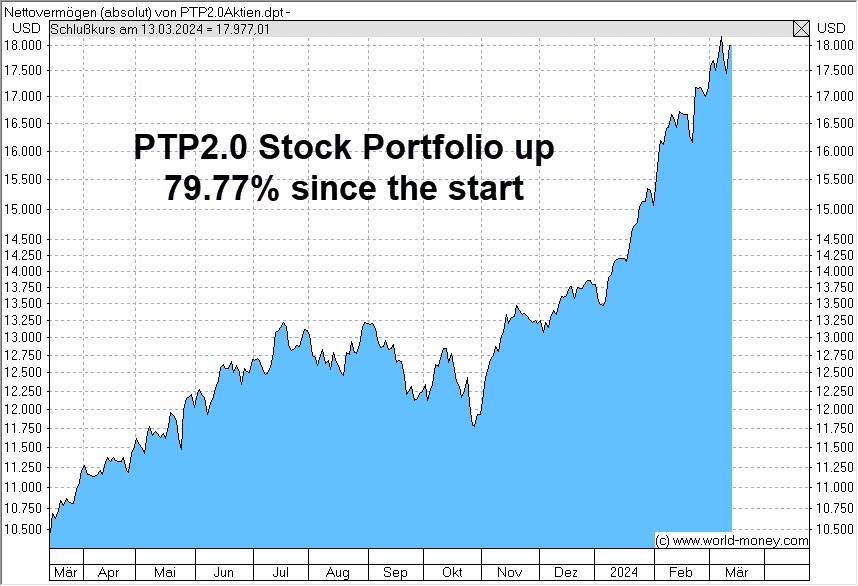

First, you may wonder why you would go to the trouble of using options when stocks are performing well. The answer: Compare the graph below to the graph from the previous page.

The options are performing nearly an order of magnitude better.

And one more thing: The MegaTrend stocks in the portfolio are largely the same companies I use for the options portfolio.

That may seem odd, but to me, what’s odd is how US investors tend to have a great portfolio of long-term growth stocks, but think they need to add smaller, riskier stocks for their higher performance portfolio.

What I do instead is simply switch the investment vehicle for my well vetted, supercharged MegaTrend stocks.

My logic is simple. I know these stocks work, so why look for lesser stocks when I can just change how I use them.

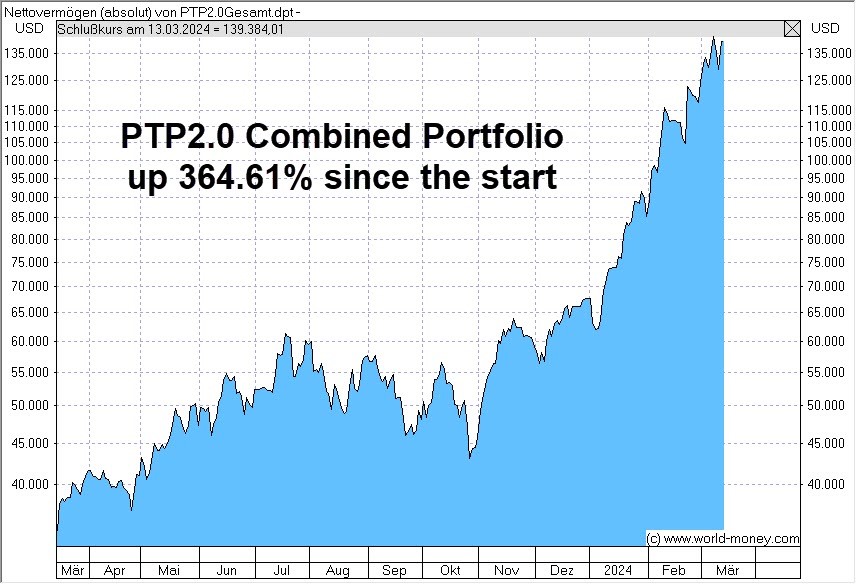

That way, I get the best of both worlds, as you can see from the chart below.

What kind of options do I use?

That’s the best part of this system. I use at the money or in the money long-term call options, usually with expirations 18-24 months out.

Why? Because it cuts down on price volatility and time erosion.

Since I know these companies are certainly going to grow in the next year or more, I’m pretty sure the options will be profitable, and those profits will be leveraged.

My combined product is Proffe’s Trend Portfolio 2.0. My new service, Proffe’s Options Trader, will only trade these easy, liquid accessible options. Use this link to join the waiting list and find out more details.