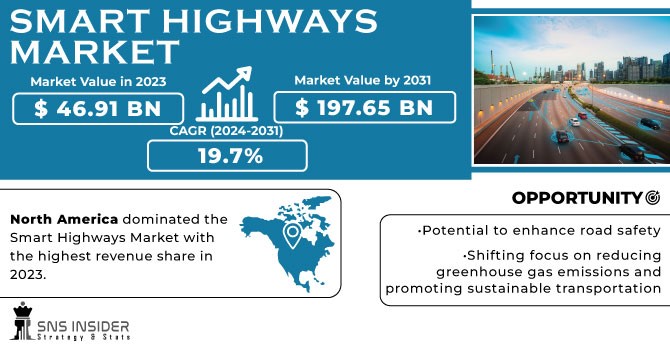

If you want to break it down a bit further, here’s what just the smart highways sector looks like in coming years.

Source: SNS Insider

Smart highways will make driving safer – self-repairing concrete to keep potholes at bay, smart materials that reduce frozen roadways or snow accumulation, traffic sensing, etc. – and it will help enhance productivity and travel times.

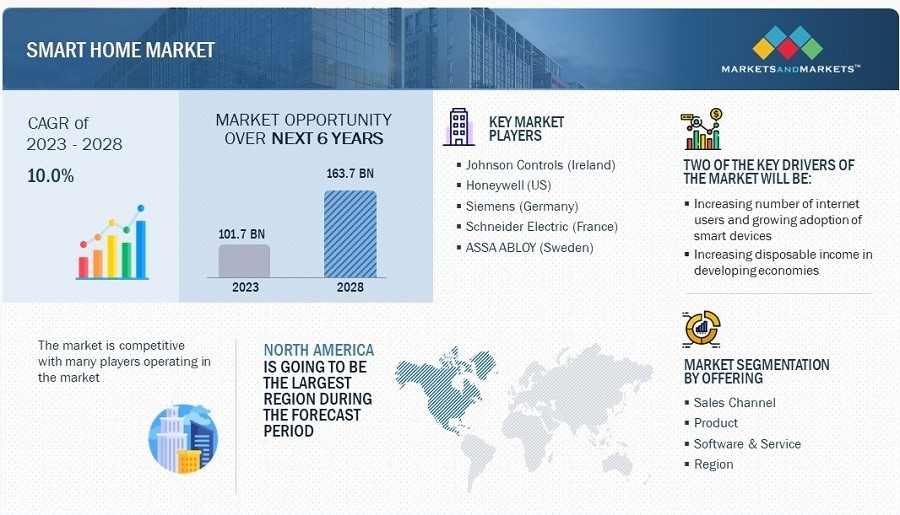

While there will be plenty of new companies jumping in, the smart move here is to go with Old Economy players, like Caterpillar (NYSE: CAT) or Deere & Co. (NYSE: DE), along with Honeywell (NYSE: HON) and Schneider Electric (OTC: SBGSY).

As for smart homes, Alphabet (NASDAQ: GOOG) and Amazon (NASDAQ: AMZN) have been involved in smart housing for almost a decade now. With their powerful server farms, as well as cutting edge consumer digital devices, it’s a perfect place to marry all of their various divisions.

You can be sure that Apple (NASDAQ: AAPL) won’t be far behind.

This is also going to bring along less holistic tech companies for specific components. This sector is best addressed as a “pick and shovel” play where the key to all of it working is smart systems driven by powerful server farms and powerful chips.

Those plays are NVIDIA (NASDAQ: NVDA), ASML (NASDAQ: ASML) and Applied Materials (NASDAQ: AMAT). Advanced Micro Devices (NASDAQ: AMD) will also have a hand in this smart MegaTrend as well.

Because of the magnitude of all these changes across a variety of industries, this will be a quiet revolution where things are moving incrementally short term, but long term will deliver us all to an entirely different place.

That’s why grabbing a toehold in these stocks now is a smart way to play these MegaTrends.