Funding for the Space Gold Rush

Going to space may very well be one of the most expensive endeavors known to mankind. Just to give you an idea, NASA’s budget for this year, 2023, is over $25 billion. Here’s another data point; Blue Origin is funded directly by Amazon founder Jeff Bezos to the tune of $1 billion per year.

Be sure that It’s going to cost a lot more than this to realize the full vision described above with Moon colonies and orbiting space station hotels.

A general budgetary number used by space industry experts is that it costs about $10,000 per pound to launch cargo into low Earth orbit. The structures necessary to build dwellings for colonies and modules for orbiting space hotels will be hundreds of tons. This should give you at least some idea of the costs involved in colonizing space.

So where is all this money going to come from? Of course, some will come from governments, some will come from Wall Street, and some will come from venture capital, but this still may not be enough.

So, it has been proposed that colonizing space could be partially funded using tokenization of assets, such as landers, rocket boosters, moon dormitories, launch towers, etc. There could be entirely new crypto coins introduced in a way that a large number of people can effectively crowdfund space endeavors.

These new space crypto coins would have associated blockchain ledgers with full transparency that would allow all parties involved to know how much money would be raised and how the funds would be distributed.

What Can a Blockchain Be Used for in Colonizing Space?

Having an established blockchain specifically for colonizing space can be useful for many things besides keeping track of financial transactions and resources.

For example, when spaceships are launched into Earth’s orbit, or when they land on the Moon, for example, copious amounts of data are collected from various sensors used to guide the spacecraft. Some examples include temperature, spacecraft attitude, engine power, acceleration, and much more.

This data may seem mundane, but it’s actually quite valuable. In fact, private, public, and government space exploration companies and agencies would pay handsomely because it helps them better prepare for their own future space flights. Keeping track of who bought what and for how much and when is an excellent job for blockchain technology.

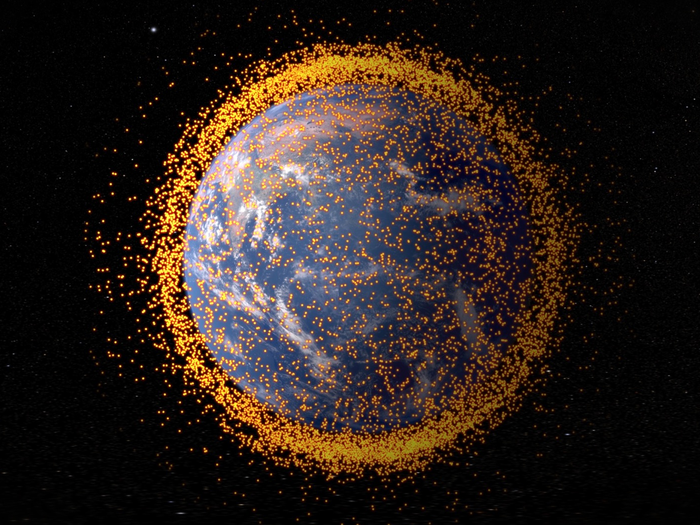

Safety may be another application for blockchain technology in outer space. There are tens of thousands of active and inactive satellites orbiting the Earth right now. Elon Musk and SpaceX have alone added about 4,000 of these through the Starlink project. Some satellites are micro-sized, some are meters across, but they all have one thing in common – if they fly into another satellite or a spacecraft, there’s going to be a lot of damage.

Keeping track of each of their locations is a monumental task, and the problem is only going to get worse as more and more satellites are placed in orbit. For example, Starlink is looking to add an additional 42,000 small satellites in the next few years. Blockchain technology has been proposed as a means to better track and understand the dangers of all these satellites and their individual trajectories. Each additional satellite could be represented by a new block on the chain and the software already exists to handle blockchains of nearly infinite length.

Outer Space Blockchains

Given all the potential uses for blockchain technology in space, many companies and organizations are working to build specialized chains right now. Both NASA and the European Space Agency are both exploring space blockchains. They see opportunities in regard to more efficient decentralized decision making and easier data management as well as maintaining the highest levels of cybersecurity.

They’re also both looking to fund small companies to develop applications for space blockchain technology.

SpaceChain is a private company with headquarters in Singapore founded in 2017 by Zheng Zuo and Jeff Garzik with funding from Tim Draper. They are mainly exploring the use of blockchain technology to fund expensive space exploration projects.

As always, with many of these growth opportunities, the direct plays aren’t always where the real opportunities are. Primarily, there’s no way to invest at this point, and these focused newbies may not turn out to be powerful players as much as visionary companies. That’s why current MegaTrend stocks, like Nvidia (NASDAQ: NVDA) and Mastercard (NYSE: MA), as well as others, like Block (NYSE: SQ) and IBM (NYSE: IBM), are very attractive now.

We’ve seen NVDA move on the growth of AI and the demand for faster chips. MA is already in the blockchain business and manages massive amounts of data securely. SQ has shown its ability to bridge old school financial thinking with the new digital world, and IBM is always on the cutting edge, even if its pipeline from lab to fab isn’t exactly serving it well.

The point is, it’s often best to find the winners that are already dominating the present to see who is going to influence the future.

Get Ahead of the Next MegaTrend and Join Our Premium Portfolios!

Unleash the Power of Proffe’s Growth Stocks

Gain exclusive access to our monthly entry-level publication featuring 20 handpicked MegaTrend stocks, carefully selected using Michael Proffe’s Trendsetter strategy. For only $149.99 a year, you can unlock a world of investment opportunities!

Supercharge Your Portfolio with MegaTrend Stocks and Options

If you’re serious about building generational wealth, incorporating options alongside your stock picks is essential for long-term growth. Introducing Proffe’s Trend Portfolio, a fusion of top-notch MegaTrend stocks and carefully selected, long-term, in-the-money call options based on Michael Proffe’s proprietary 3-step TrendSetter analysis.

Gain access to our exclusive, time-tested stock portfolio accompanied by our distinctive and successful options strategy, all for just $399 per quarter.