Editor’s Note: It seems the world keeps moving faster and investing can be a serious time suck to do it right. But we’ve found a way to keep it simple, very profitable…and cheap!

Our newest, most innovative product: Proffe’s Options Trader (POT) was built for profits and simplicity.

It’s designed to capitalize on the volatility in today’s market, with up to 6 trades per month, contracts held for up to 12 months, and 10%-20% target gains per trade (but we’re averaging 24% per contract with an average holding time of about 44 days!). The best part is, there’s no long-term commitment—cancel anytime. And it’s only $99/month. Click here to learn more.

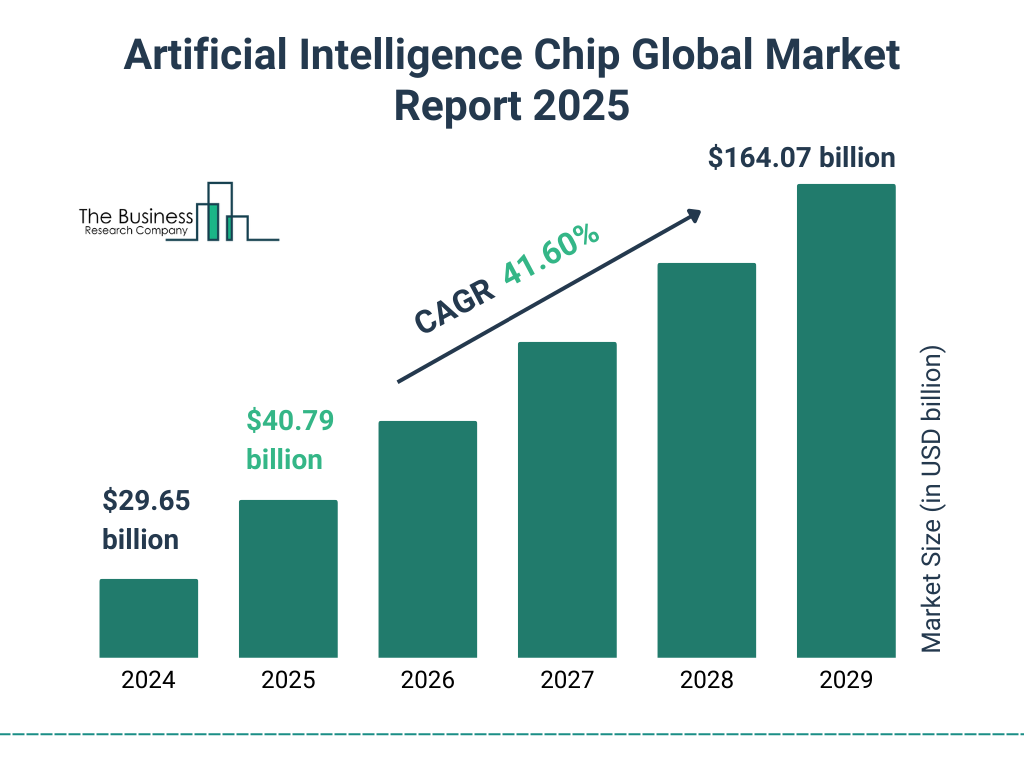

If you have any doubts about the potential profits locked into artificial intelligence (AI) in the next five years, all you have to do is look at the chart below.

The thing is, this is only the chip market and not the entire sector – software, hardware, etc.

The simple reality is, the longer you wait to get in, the less upside you’re going to experience. That is, if you pick the right stocks.

AI Is So Powerful, It’s Changing the Global Economy

We all know by now that the US is renegotiation virtually all its trade agreements around the world, and since it’s the most powerful economy in the world, it carries a lot of influence when it negotiates.

The best way to judge what sectors are the more economically important globally is to see where the biggest negotiations hinge.

The one standout: AI chips.

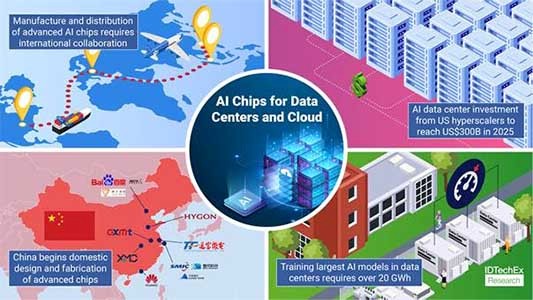

As you can see above, most AI chips – as well as equipment, logistics, etc. – is in China. The chips are engineered in the US, but the large majority are built in Asia.

China is very interested in using the newest AI chips as it builds its own native AI chips. That has been a push and pull in trade for years now.

Just this week, the US gave the green light for the AI chip kingpin NVIDIA (NASDAQ:NVDA), as well as Advanced Micro Devices (NASDAQ:AMD), to again sell its most advanced chips to China.

This is a big move, not just for the MegaTrend leaders like NVDA and AMD, but the entire sector.

In this kind of market, the important thing to do is buy quality for the long term. Trying to outsmart the short-term moves in this dynamic sector is where individual investors get off track.

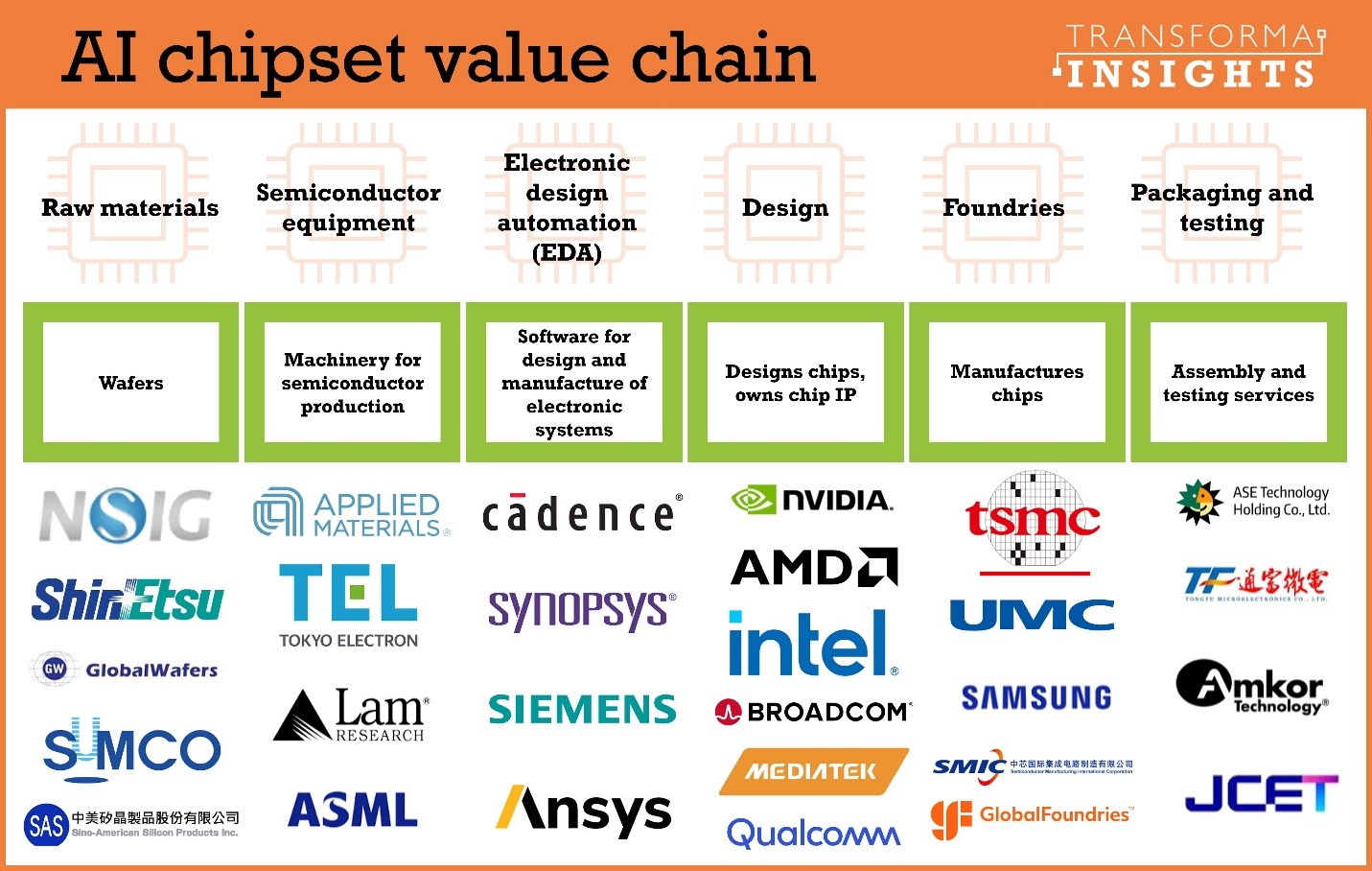

Buying quality MegaTrend stocks like AMD, NVDA, ASML (NASDAQ: ASML), Broadcom (NASDAQ: AVGO) and others are the way to lock in long-term growth in a significant MegaTrend.

Certainly, there will be others involved as well, especially tech-focused players that are focused on building out their own AI chips and integrating it into their diversified digital businesses. I’m talking about companies like Alphabet (NASDAQ: GOOGL), Apple (NASDAQ: AAPL), and Meta (NASDAQ: META).

Our unique approach to grabbing shorter term gains isn’t to find the potential up and coming stocks. That’s more risk than we’re willing to take.

What we do is use long-term options to leverage the best stocks’ growth opportunities. We have services like POT (see editor’s note above) that are options-only products, and we have others that are hybrid stock and options services.

See our site for all the details, including a service specifically focused on AI stocks!