My entire investing strategy is “More Time to Live”. That hardly puts me in the traders camp.

Granted, I have some services that move fairly quickly, but they’re the exception to the rule for me and usually have to do with options, which are unique to the investing world.

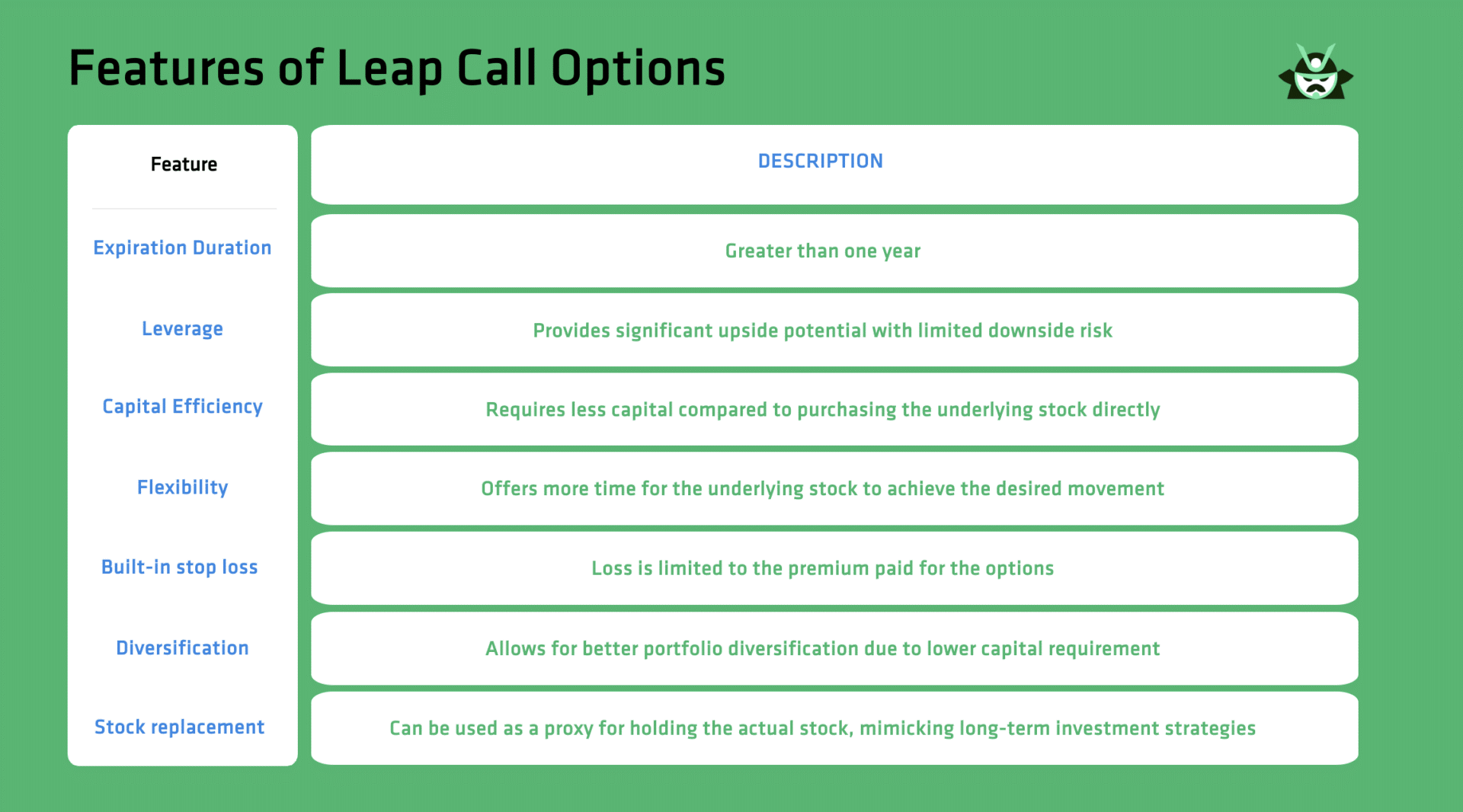

My broad options strategy is what is known in the US as LEAPS, as detailed below.

Long-term “in and at the money” call options give us a chance to control a lot of stock for a long period of time and spend a fraction of what a similar amount of stock would cost.

Plus, if the options do well, our returns are leveraged. If they struggle, we have plenty of time for them to get back to at least the price we entered at.

So, even though I use options, I’m not really even trading them as much as investing in them in most of my products.

Going Toe-to-Toe with Wall Street?

Having been in this industry a very long time, I understand how people can see trading as a smart way to play the markets. I mean, people in markets around the world go to work every day and make money for their clients trading, right?

Well, the reality is, professional traders are moving massive amounts of money and they don’t just buy a stock. They will hedge any position across the options market and potentially the futures market and currency markets as well.

Plus, they’re trading for hedge funds, corporations, financial institutions, or investment banks, so they have much more knowledge and experience than the average individual trader.

Going up against these pros is like a decent club tennis player going up against Roger Federer. Every day.

Pick a Game You Can Win

Long-term investing allows you to navigate the markets without having to chain yourself to your trading program and work the markets like a job every day.

Using my Trendsetter Strategy, I combine the best of the technical, fundamental, and sentimental indicators into a proprietary formula that helps me pick the top MegaTrend stocks available.

I want stocks that will provide outsized growth with companies that are going to do well in good times and are safe harbors when the markets get stormy. That means my stocks grow faster in good times and stay safer than their peers in hard times.

These aren’t swing for the fences stocks. They’re great companies that are leaders in one or more MegaTrends and will lead growth as those trends expand.

It might not be sexy, but it works, and best of all, it doesn’t take a fortune to start.

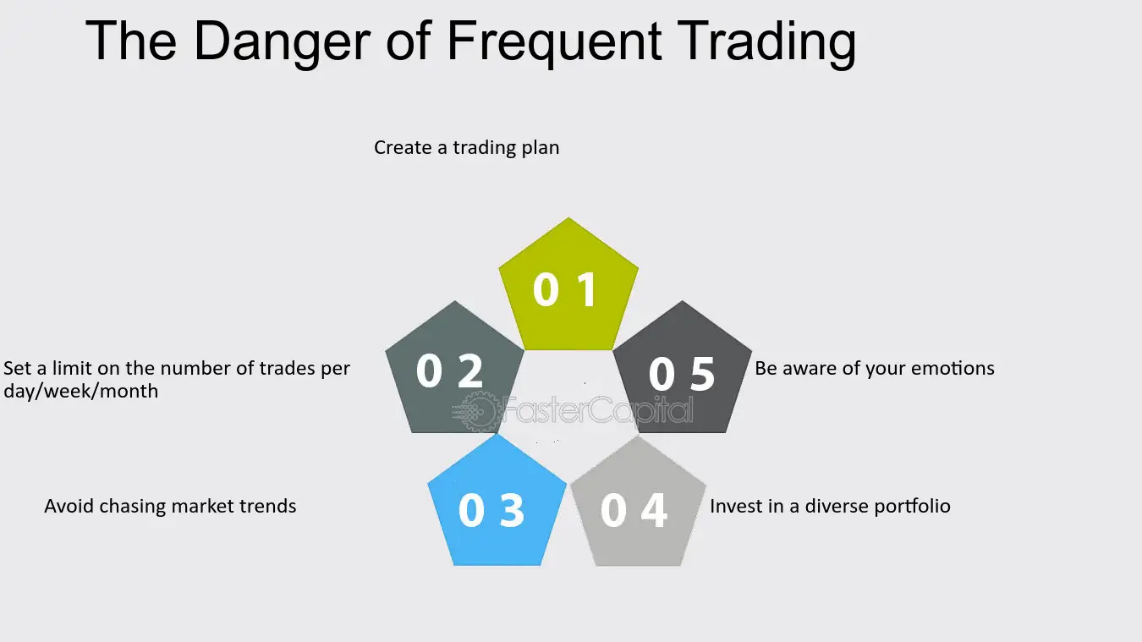

Again, some people think that if you’re undercapitalized, the best way to build your capital is to trade your way to “real” money. The fact is, that’s the most dangerous way to grow your limited capital because often it adds emotion (the fear of losing all your money or the added risk of investing on margin), which is the worst market move you can make.

It’s easier for long-term investors to stay disciplined and get out of the froth generated by investing channels and programs, quarterly earnings, and all the talking heads giving conflicting and constant “advice”.

Think base hits rather than home runs, and then, you can decide what to do with all the extra time on your hands, and do something you really enjoy!