Hydrogen has been around a long time. The only trouble for commercializing it three decades ago was it was too expensive to do on smaller scales, and creating a distribution network that was safe and efficient was also extremely costly.

That’s no longer the case. Newer technologies and rising interest in the sector have lowered costs, boosted safety, and opened massive opportunities.

Here’s an example of just one country’s commitment to the noble gas, Australia:

Today, the debate is more about what hydrogen industry, business, and consumers should actually use.

The more people that see the potential, the more momentum it’s gaining. While EVs are certainly a significant move to new propulsion, lithium and many rare earth metals have to be mined and separated with toxic chemicals to make the batteries.

Hydrogen doesn’t have those issues and can be generated out of thin air – literally. What’s more, as we explore space, hydrogen could be universal fuel for exploring the solar system.

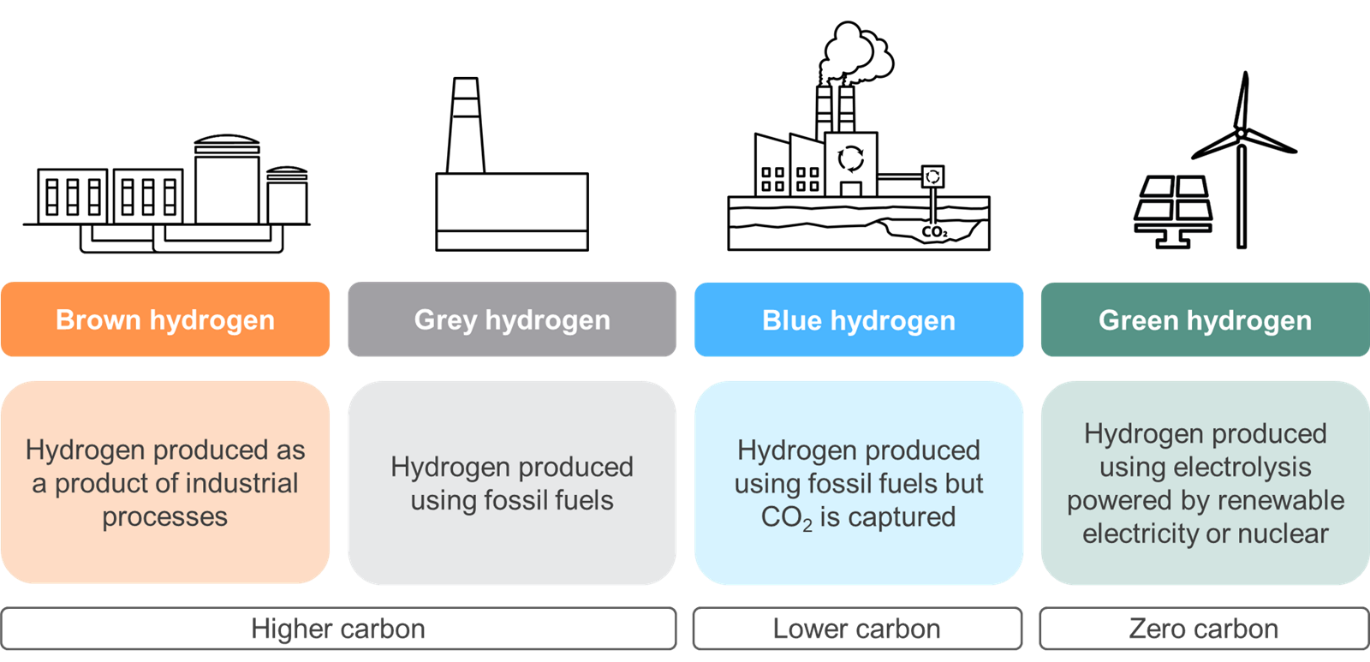

There are more complex breakdowns of this spectrum, but this gives you the best idea.

The big push now is to focus all consumption on Green and Blue Hydrogen for the rapidly expanding hydrogen powered cars, trucks, busses, industrial equipment, even airplanes.

That makes sense that the fuel – which only emits water as exhaust – should be as “net zero” as possible, but given the volume of Brown and Grey Hydrogen that already exists, it may be the ideal fuel for big oil companies to use as a way to transition from fossil fuels to their greener alternative.

Right now, many European and Asian nations are making significant commitments to hydrogen infrastructure (fueling stations).

Some interesting early players in this space include Bloom Energy (NYSE: BE), Plug Power (NASDAQ: PLUG) and Ballard Power Systems (NASDAQ: BLDP).

There are also big players that have been in the industrial market for decades, like Air Liquide (OTC: AIQUY), Linde (NYSE: LIN) and Air Products (NYSE: APD).

Then there are indirect players, like engine maker Cummins (NYSE: CMI), green energy utility NextEra Energy (NYSE: NEE), and a number of German, Japanese, and Korean car and bus makers.

Subscribe to Proffe’s AI MegaTrends

This new portfolio is dedicated solely to artificial intelligence, and the timing couldn’t be more perfect. AI is now beginning to make a tangible impact across various industries, and we are on the cusp of a major AI revolution, offering immense potential for everyone involved.

Proffe’s AI MegaTrends will distinguish itself with two unique features, differentiating it from our other publications:

- An AI-focused stock portfolio, featuring up to 10 of the leading AI companies globally. Given the fast-paced nature of AI, this portfolio will involve active trading rather than a long-term buy-and-hold strategy.

- An AI-focused options portfolio, comprising up to 10 short to medium-term contracts that align with the AI stocks in our portfolio. But there is a catch, these options contracts will be available as a separate purchase, exclusive to Proffe’s AI MegaTrends subscribers.

I am confident in our ability to achieve massive gains consistently and urge you to get involved to seize this opportunity!