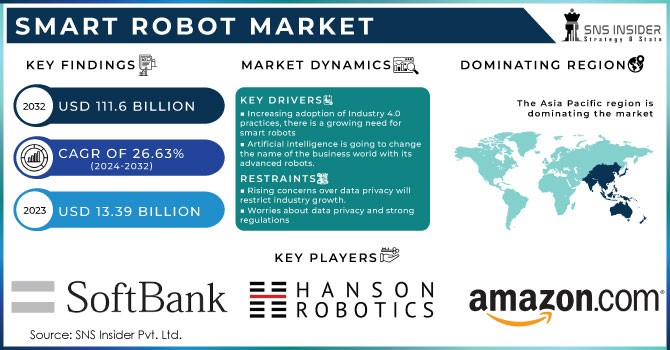

While Asia has been the biggest market for current generation robots, the field, thanks to advanced mobility and bandwidth that can deliver more feedback to and from robots, as well as new artificial intelligence (AI) applications, is transforming rapidly.

Large companies, like Amazon (NASDAQ:AMZN), have been embracing new generations of smart robots in their warehouses and other places.

The winners here are a variety of companies. There are Old Economy players, like Caterpillar (NYSE:CAT).

There are also new sectors where robotics are new but doing amazing precision work…on humans! The best example is Intuitive Surgical (NASDAQ:ISRG) and its DaVinci line of surgical robots.

Other Players in The Robotics MegaTrend

Of course, the “intelligence” of the robots is limited by their “brains,” and it’s the companies that are building those brains that will also see a growing revenue stream for their technologies. Chipmakers, like NVIDIA (NASDAQ: NVDA), Arm Holdings (NASDAQ: ARM), and Advanced Micro Devices (NASDAQ:AMD), will be there.

Also, chip equipment makers, like Lam Research (NASDAQ:LRCX) and ASML (NASDAQ:ASML), will also be winners.

Some robotics ETFs exist for investors that would prefer to take a broader approach to the sector initially, such as ARK Autonomous Technology and Robotics ETF (ARKQ).

Investing in companies that will benefit from increased robotics is another way to go, since it will likely increase efficiencies and boost margins. Automobile manufacturers, such as Ford (NYSE:F) or General Motors (NYSE:GM), are among the companies that could see the biggest benefits, but restaurant operators, such as McDonald’s (NYSE:MCD), and logistics companies, such as UPS (NYSE:UPS) and FedEx (NYSE:FDX), could use next-generation robots as well in order to expand their business and/or to bring down costs.