What Are EVs?

EVs are vehicles that aren’t powered by burning fossil fuels, but powered via electricity stored in on-board batteries.

Electric vehicles don’t cause any CO2 emissions while driving, but the required electricity generation may cause CO2 emissions elsewhere – e.g. at the location of a coal or natural gas power plant. Ideally, EVs are powered with electricity that’s generated via renewable energy sources, thus at very low (or zero) CO2 emissions.

This is, by far, the most important factor for a broad-based plan to electrify vehicles in many countries around the world; EVs will help bring down global CO2 emissions, which in turn will help combat climate change.

Apart from that, there are advantages and disadvantages of EVs. For example, while EVs are quiet and can be charged at home, as long as you have a wall charger or the proper plugs, EVs require rare and costly materials that have to be intensively mined. They’re also heavy and, in many cases, costly.

Their range is also, for now, likely more limited compared to internal combustion engine vehicles, and charging takes more time compared to fueling up a gas-powered vehicle. This explains why not everyone is ready to buy an EV yet and why EVs aren’t suitable for some tasks and use cases.

Green Torque: Head-snapping Growth Ahead for EVs

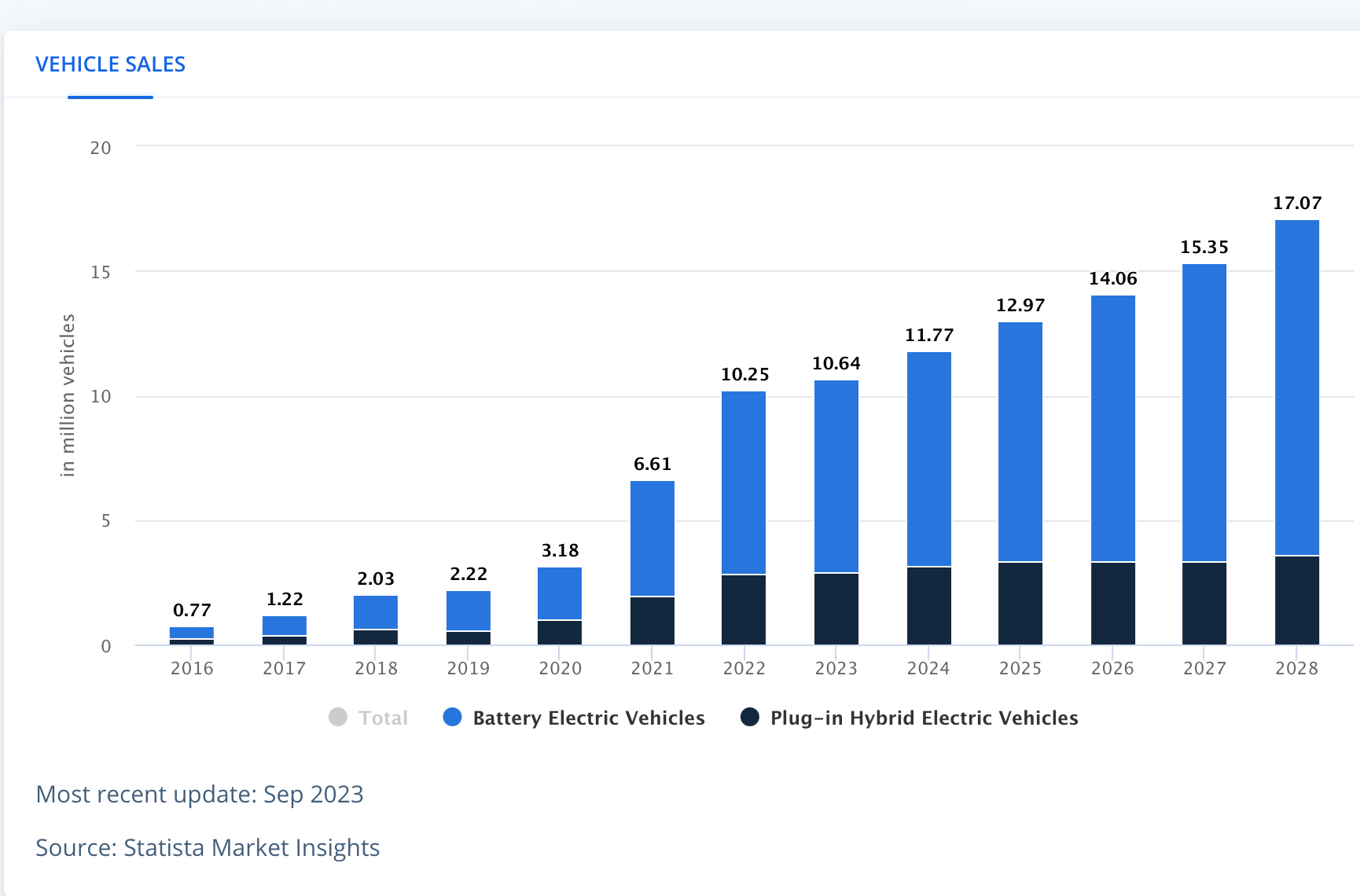

However, the demand for more EVs and lower CO2 emissions around the world has resulted in massive market growth in the recent past, as we can see in the following Statista graph:

Sales jumped upwards in 2021 and 2022, partially driven by pandemic-related stimulus spending. While 2023 didn’t see a lot of growth, EV sales still hit a new record high, and analysts are forecasting that we’ll see new record sales numbers in 2024 and for many years to come.

Relative to 2023, sales numbers are expected to grow by more than 60% through 2028. This growth will largely be fueled by pure battery vehicle sales growth, while sales of plug-in hybrids aren’t forecasted to grow as much.

Right now, China is the most important EV market by far, but the US and Europe are major markets as well. Other countries, such as Brazil and Mexico, are experiencing substantial sales growth rates as well, although from a lower level.

How To Benefit from The Electric Vehicle MegaTrend

There are many EV companies investors can choose from, with TSLA being the most prominent one. While Tesla has been a forerunner and has the highest market capitalization among all automobile companies by far, BYD (NYSE: BYDDY) has overtaken Tesla when it comes to units sold.

BYD’s vehicles are being sold at lower average prices, however, which is why TSLA still is generating higher revenues compared to China-based BYD. The new proposed tariffs for Chinese built EVs announced by President Biden have also chilled enthusiasm for Chinese EV growth in the US.

Apart from these two giants, there are many other potential EV investments. Rivian (NASDAQ: RIVN) has a truck and SUV focus, while Lucid (NASDAQ: LCID) offers upscale sedans backed by Saudi Arabia. Chinese EV players include Li Auto (NYSE: LI), which offers vehicles with gasoline range extenders, and Xiaomi (OTC: XIACY) – originally a manufacturer of household tech items that has moved into the EV space with the well-received SU7 vehicle.

For those that want broad-based EV exposure, related ETFs could also be an option, such as the iShares Self-Driving EV and Tech ETF (NYSE: IDRV).