Oxford Learning describes the term cybersecurity in the following way:

The state of being protected against the criminal or unauthorized use of electronic data, or the measures taken to achieve this.

Cybersecurity thus aims at securing data, such as one’s personal emails, but also a company’s product data or a government entity’s databases, from unwanted (illegal) access, use, and distribution.

A hacker or scammer looking to get access to the financial accounts of their victims is one potential threat, but other cybersecurity threats include industrial espionage by competitors, terrorist attacks on infrastructure, thus electricity nets, and so on. The potential threats cybersecurity companies have to guard against are myriad, and the threat landscape is continually evolving. Cybersecurity is never “solved”, but attackers and defenders are in a constant battle with each seeking to be in an advantaged position.

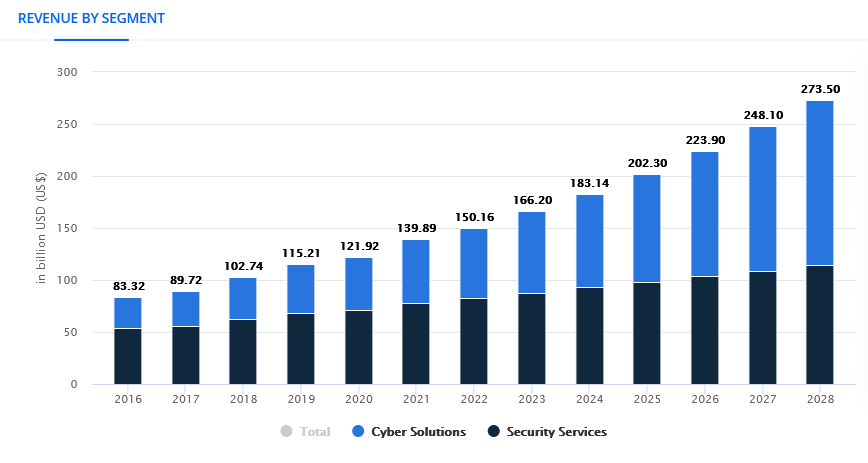

The increasing importance of cybersecurity and the growing acknowledgement of this fact by both consumers and large clients, such as corporations, has resulted in massive spending growth over the years:

We see that cybersecurity spending has risen from a little more than $80 billion in 2016 to more than $160 billion in 2023, doubling in just seven years. Statista’s forecasts see ongoing massive growth in 2024 and beyond, with revenues being forecasted to rise to $250 billion three years from now.

Here’s How to Benefit

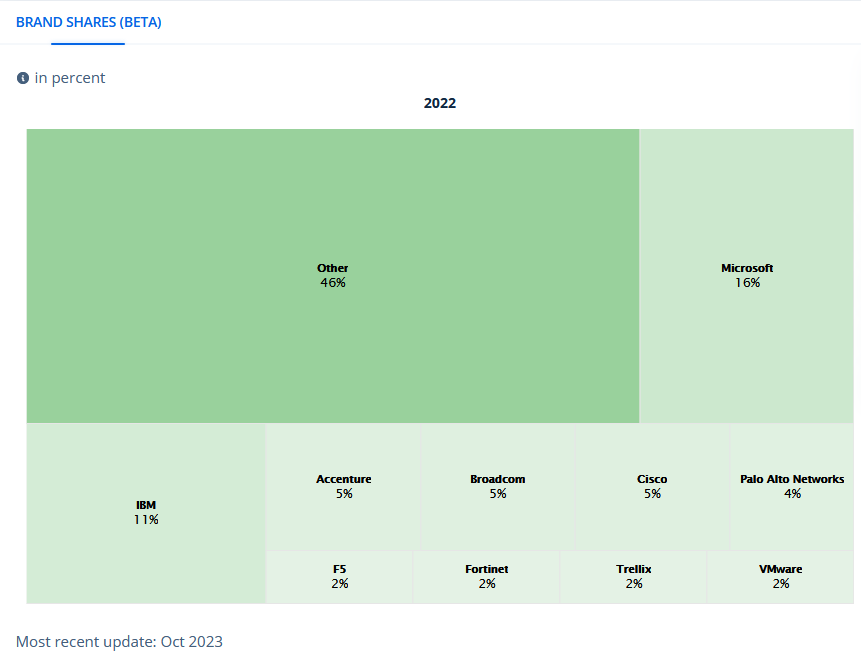

There are many different companies that are active in this space, as the industry is pretty fragmented. According to Statista, these are the largest players in the cybersecurity space:

MSFT is the largest single player, with a market share of around 16%. Yet MSFT isn’t a cybersecurity pure play. That’s why Microsoft is more suitable for those investors seeking for broad tech exposure, including AI via Microsoft’s stake in OpenAI.

IBM (NYSE: IBM) is another major player, with around one-ninth of the market, but IBM also isn’t a cybersecurity pure play. The same can be said about companies such as Accenture (NYSE: ACN), Broadcom (NASDAQ: AVGO), and Cisco Systems (NASDAQ: CSCO).

Palo Alto Networks (NASDAQ: PANW) is the largest cybersecurity pure-play that’s publicly traded, with a global market share of around 4%. PANW has grown its revenue by an impressive 1,200% over the last decade, meaning the company has grown much faster than the overall market so far. Its strong market position and focus in the cybersecurity sector could be a smart niche long term for the company.

There’s also the option to invest in cybersecurity ETFs, such as Amplify Cybersecurity ETF (NYSE: HACK) or Global X Cybersecurity ETF (NYSE: BUG), for investors interested in broad-based exposure to the cybersecurity MegaTrend that also want to avoid high allocations in any single stock.