Last year, online education was a $250 billion industry. Studies project that it will be near or top $1 trillion by the time we hit 2027. By some measures, even these numbers are conservative.

That’s a compounded annual growth rate (CAGR) of more than 21% for the next 4 years. My goal for my MegaTrend stocks is about 20% annual growth.

Also, bear in mind that “Edtech” isn’t just a US phenomenon. While the US is the largest market now, the biggest growth is in Asia.

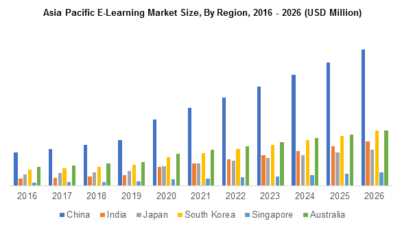

Below is what the projections are for the Asia Pacific region.

Even in the smaller markets beyond China, Edtech is becoming a growing business model.

Also, keep in mind that today, especially with tech-focused careers, earning certificates is just a crucial as earning a degree. Software changes and programming languages switch for new applications, and new tech, like artificial intelligence, calls for completely new integration tools and architectures.

As for the bigger picture, the infographic below spells it out for you. There’s enormous potential here, and it’s certainly a MegaTrend.

So how do we play it?

Well, I’m not much of a gambler. I’m a trained engineer. I fly airplanes. I work very hard to avoid risk while still finding activities that may seem risky…like investing.

So, I eliminate as much risk as possible by looking for the leaders – both tech and sector leaders – and those who will be able to stake and hold their claim in this sector.

I prefer to put my money on the store that sells the picks and shovels rather than the gold prospectors.

At this point in its development, I favor companies like Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), and NVIDIA (NASDAQ: NVDA), and maybe even Qualcomm (NASDAQ: QCOM).

They have the kind of global market penetration to create the platforms that make Edtech possible. Granted, they’re not pure play Edtech firms, but they don’t have to be the leaders in this sector. They are the “tech” in Edtech, and that’s what is important.

What’s more, they’re still bargains right now. That’s what makes them compelling, long-term growth stocks that will succeed as the digital economy expands.

Join Us for Profits with Proffe’s Trend Portfolio 2.0!

Have you planned out your financial goals for 2023? It’s not too late! This year can be the year that you give yourself and your family the gift of generational wealth.

With Proffe’s Trend Portfolio 2.0, you can get in on the start of the market’s next great bull run.

I know firsthand just how transformative this opportunity can be. In 2010, after the market crash in 2008, I started Proffe’s Trend Portfolio with just $30,000. By 2021, that portfolio had grown to over $1.5 million!

How did I do it? By using my proprietary market indicators to find the perfect time to invest. Now, it’s time to do it all again.

I’ve been a successful professional investor in Europe for decades, and I know what works. I don’t just publish theoretical portfolios, I actually make the trades myself and my subscribers follow along. I only recommend what I would buy myself, and so far, it’s been a delicious recipe for success.

Check out the portfolios, read my market insights and stock and options highlights, and learn about my unique investing strategy that has European roots and US wings. I have no interest in tricking you into a subscription. I want you with us because you see the potential and want to experience this incredible growth journey.

So, let 2023 be the year you invest in your future. Check out Proffe’s Trend Portfolio 2.0 and take the first step towards achieving financial success and building generational wealth.