In the next eight years, fintech is predicted to grow at a staggering 26% compounded annual growth rate (CAGR) from its current $116 billion size to nearly $1 trillion by 2030.

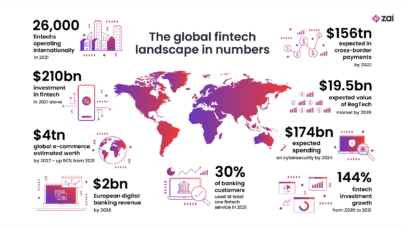

In the infographic below, you can see how profoundly the digital banking era is shaping the global economy.

While there are big opportunities for small companies to make it big, there are also even bigger opportunities for major MegaTrend players to take advantage of their size and vision to build out empires in the fintech space.

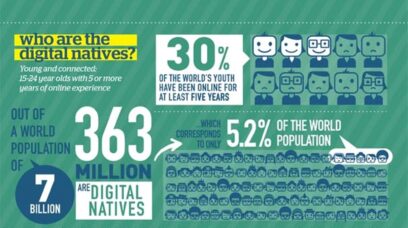

Just look at the numbers below. I would say that these are conservative. Some stats that I’ve seen show that around 200 million people in the US are Gen X, Millennials, or Gen Z.

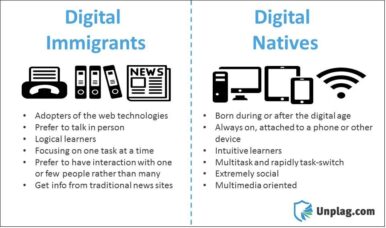

Granted, Gen X may be a transitional generation, or what they now call digital immigrants, but that still leaves around 137 million people that would be considered digital natives, which is about a third of the US population.

The point is, no matter how you define a digital native or a digital immigrant, they’re all digital, and that is changing every aspect of everyone’s financial life on the planet.

While it’s tempting to find the coolest, hippest fintechs out there that have the backing of the big-name private equity and venture capital firms, the real way to play this is to buy big and buy quality. Buy the MegaTrend and not the hype.

That’s why I’m locked into stocks like Accenture (NYSE: ACN) and Mastercard (NYSE: MA). If that’s not cool enough, then Amazon (NASDAQ: AMZN) or Apple (NASDAQ: AAPL) are also smart plays, as they have the financial power and market strength to enter the digital banking sector from the consumer retail end.

ACN and MA form the financial backbone of global payments and infrastructure. While there are certainly competitors, they have taken the early lead in expanding fintech accessibility and systems to financial institutions around the world.

AMZN and AAPL generate so much revenue that they can hold the kind of reserves that banks are required to hold without batting an eye. They’re also disruptors and see the opportunity in building out their brands to include financial services.

The next decade is going to be a very exciting time, and these MegaTrend stocks are going to lead the way. There’s little reason to put your hard-earned money at risk by buying companies that are swinging for the fences when you can buy rock-solid growers that will keep your blood pressure low and your portfolio rising.

Introducing Proffe’s Trend Portfolio 2.0!

A new market deserves a fresh start…

In November 2021, Proffe’s Trend Portfolio officially crossed the $1,600,000 target. I reached this milestone with a portfolio of just a dozen stocks and a unique options strategy I perfected in Europe and brought to the US.

Having hit that benchmark, after starting with $30,000 about a decade before, I started to wonder how I could best help new subscribers that are coming on board now at this particular time.

Given the current economic conditions and the massive pullback across all three major indexes, I have decided to relaunch my flagship newsletter: Proffe’s Trend Portfolio.

Join Us!

Your nest egg – and grandchildren – will thank you!

Now and for a limited time, you can experience the market beating returns of Proffe’s Trend Portfolio for only $1 for a full 14 days! During your risk-free trial, you’ll get a firsthand look at how my strategy works and the MegaTrend stocks in the portfolio.

The new portfolio will follow the same criteria and investing philosophy that’s the bedrock of my (and my subscribers’) success, and that means a small portfolio of MegaTrend stocks that tick all the boxes in my Trendsetter Strategy and long-term, in-the-money call options that leverage the same MegaTrend themes as the stocks in the portfolio.

If you’re looking for a new way to invest that will provide great profits with far less work – and worry – than typical investment services, then sign up for a 14-day free trial to Proffe’s Trend Portfolio 2.0 for only $1 and join us for the next million dollar portfolio!