When you look at a list of the top cybersecurity firms that work for the US government, it’s a bit surprising.

No. 1 on the list is Raytheon (NYSE: RTN), a leading defense contractor better known for making missiles (and the inventor of the microwave oven). RTN doesn’t just get its money from the defense sector. It works with Social Security, as well as Homeland Security, and it’s been a key partner for more than three decades.

There’s also General Dynamics (NYSE: GD), Lockheed Martin (NYSE: LMT) and Mantech (NASDAQ: MANT) that are generally known more for their military weapons and intelligence output, not their cybersecurity roles, but this makes sense since the military relies on the highest levels of security for much of its information. Certainly, any contractors that can pass muster for the military can secure sensitive civilian cybersecurity.

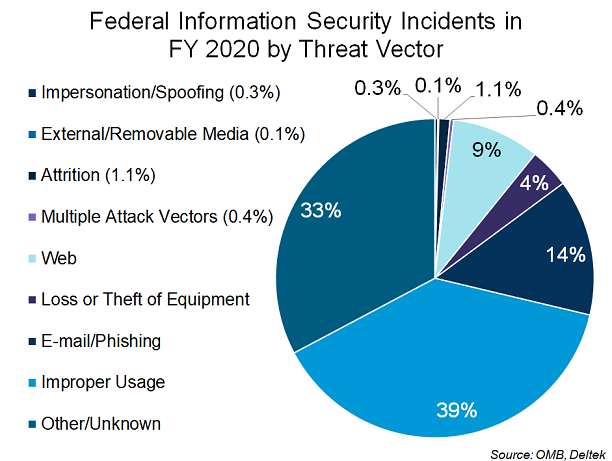

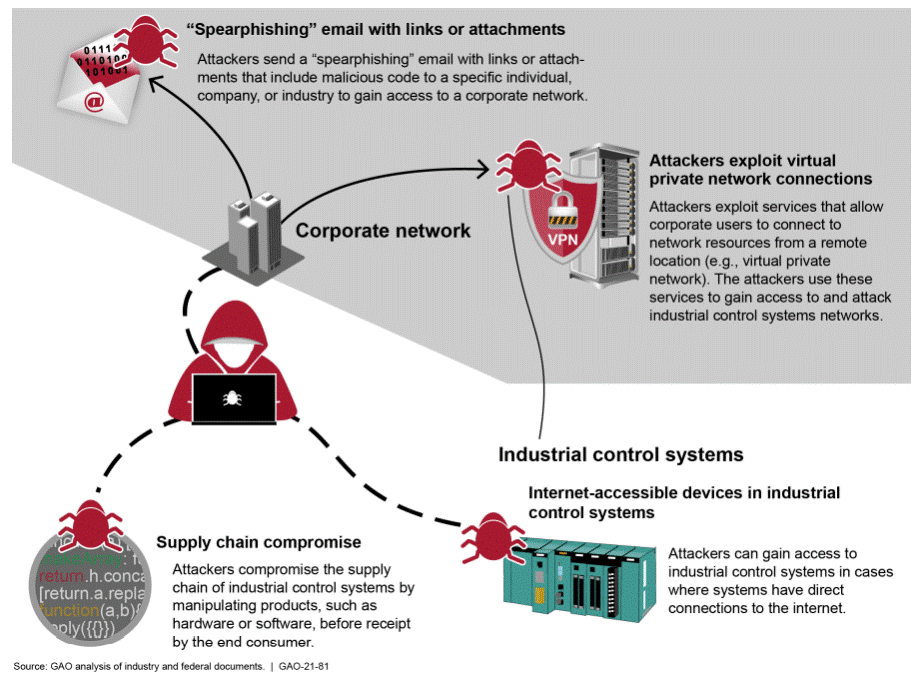

Here’s what the threat looks like these days:

Ironically, two of the biggest contenders for top military cybersecurity contracts now are Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT).

This reflects their ability to organize and manage all their customers on extremely reliable cloud business that are rarely breached. MSFT also is the lead contractor for its Windows software.

This may not be the future, but having significant long-term government contracts on the federal level are certainly very prized wins. It’s also great advertising for state governments, as well as the nation’s power grid.

Granted, there are much bigger sectors that cybersecurity firms can fight over, but few are as reliable. Being a prime contractor with the government has a lot of perks. Being able to jump through all the hoops and get through all the scrutiny makes you very popular inside and outside the beltway.

Most importantly, it means you are a key player in a significant growth market. This is the projected growth of US government’s cybersecurity market through 2027:

For the winning companies, this kind of growth has a significant effect on the bottom line, since the demand here doesn’t rely on economic conditions or the vagaries of corporate or consumer spending. Having this kind of business is an ace up the sleeves for the companies that can pull it off.

Get Ahead of the Next MegaTrend and Join Our Premium Portfolios!

Unleash the Power of Proffe’s Growth Stocks

Gain exclusive access to our monthly entry-level publication featuring 20 handpicked MegaTrend stocks, carefully selected using Michael Proffe’s Trendsetter strategy. For only $149.99 a year, you can unlock a world of investment opportunities!

Supercharge Your Portfolio with MegaTrend Stocks and Options

If you’re serious about building generational wealth, incorporating options alongside your stock picks is essential for long-term growth. Introducing Proffe’s Trend Portfolio, a fusion of top-notch MegaTrend stocks and carefully selected, long-term, in-the-money call options based on Michael Proffe’s proprietary 3-step TrendSetter analysis.

Gain access to our exclusive, time-tested stock portfolio accompanied by our distinctive and successful options strategy, all for just $399 per quarter.