There are certainly a lot of stocks to play this massive new energy trend, and as you can see with the tensions between the US and China over photovoltaic cells (A.K.A.

solar panels), the way renewables market access is playing out is becoming a very serious issue.

That means there’s big money and big industry at stake.

The winners here aren’t going to be the smaller companies. China has major players given significant government subsidies, so this isn’t the time to buy Chinese solar stocks.

US utilities, aside from NextEra Energy (NYSE: NEE), are looking more at wind generation and less on solar farms right now. Duke Energy (NYSE: DUK) is another option, although its portfolio isn’t focused on solar.

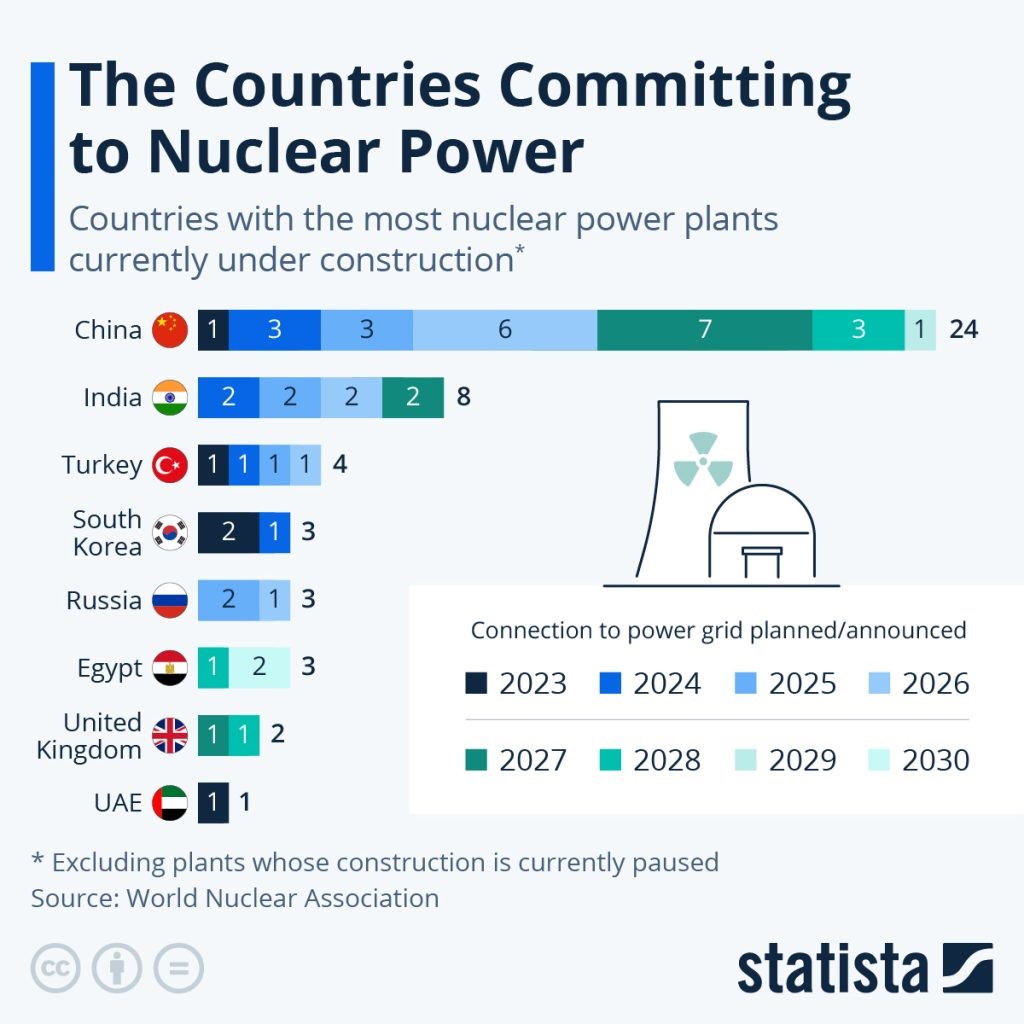

Nuclear energy is coming into its own again with new generations of reactors.

There are small modular reactors (SMRs) that are gaining interest around the world. Instead of a massive plant that can take a decade to build, these are small units that can be built quickly and can serve smaller, remote communities. Then, as demand grows, you add another SMR unit.

Even now, large nuclear plants are more standardized. That means easier siting and construction and safer, more predictable operations.

There are a number of interesting players here, including General Electric’s new energy spinoff GE Vernova (NYSE: GEV), NuScale Power (NYSE: SMR), and BWX Technologies (NASDAQ: BWXT).

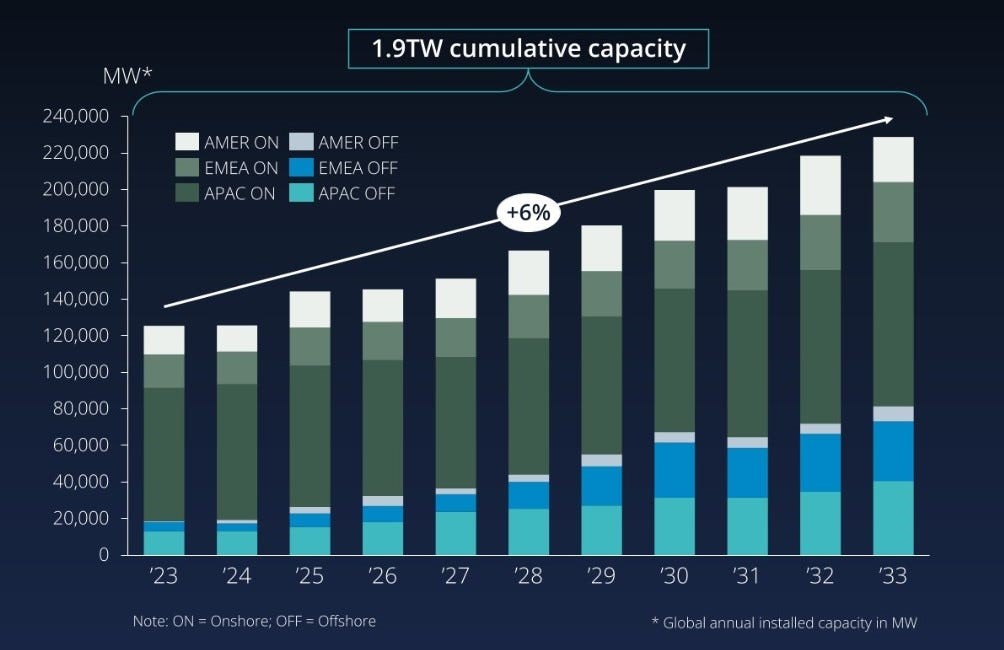

Finally, wind is another major player, and given the availability of wind around the planet, this option can be the most attractive.

Countries that border large bodies of water can take the most advantage, since there are few impediments to the winds and they are more consistent.

Steady, consistent winds are far more advantageous than strong, gusty winds because wind turbines are built to generate energy at optimal speeds over long periods of time and don’t operate efficiently with big variable winds.

As you can see, this growth is solid and steady for the next decade. It’s ideal for the big utility-scale players and many are involved directly or indirectly.

NEE, DUK, GEV, and Dominion Energy (NYSE: D) are some of the top players, but there are many others at different levels.