Here are a few things to think about.

It’s predicted by the prestigious McKinsey Group that between now and 2040, we’ll spend $2 trillion on transport infrastructure.

Last year, smart transportation was a $110 billion industry. By 2030, the conservative estimate is around $300 billion. By that year, shared transportation and mobility could generate up to $1 trillion in consumer spending.

Today, industrial and transportation sectors are responsible for about 71% of energy consumption in the US. The more efficient businesses are in moving people or goods from point A to point B, the better margins they will have. For the consumer, that means lower prices. For investors, that means better earnings.

If you combine the Urbanization MegaTrend with the Big Data and Renewable Energy MegaTrends, you get quite a broad and significant opportunity. You also get a lot of stocks to choose from. There are Old Economy winners here, as well as New Economy winners.

For example, while Tesla (NASDAQ: TSLA) may build the batteries and cars, it will be Caterpillar (NYSE: CAT) equipment (autonomous or smart vehicles) that will be building the smart roads they run on.

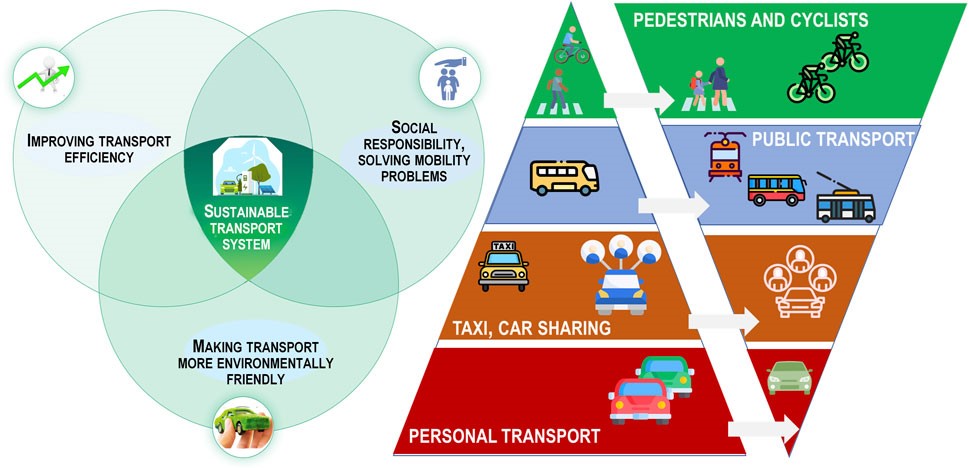

Also, sustainable transportation means flipping the pyramid on transportation choices in urban environments. For example, many modernizing cities are limiting car traffic through parts of town, encouraging walking, scooters, bikes, subways, trains, and buses.

Reprioritizing how our cities will function will also mean that they’ll have to get “smarter” in every way to accommodate these new developments.

That means companies like NVIDIA (NASDAQ: NVDA), Advance Micro Devices (NASDAQ: AMD), and Qualcomm (NASDAQ: QCOM) will have plenty of new customers as this MegaTrend matures.

Of course, companies like Amazon (NASDAQ: AMZN) and Walmart (NYSE: WMT) are already figuring out how to adopt this MegaTrend and use it to their advantage.

If you’re a long-term growth investor, then this is a space you need to get involved in. It’s not as hard as you think, since some of the biggest winners are already great companies that will simply maximize the benefits that this MegaTrend delivers.

Get Ahead of the Next MegaTrend and Join Our Premium Portfolios!

Unleash the Power of Proffe’s Growth Stocks

Gain exclusive access to our monthly entry-level publication featuring 20 handpicked MegaTrend stocks, carefully selected using Michael Proffe’s Trendsetter strategy.

Supercharge Your Portfolio with MegaTrend Stocks and Options

If you’re serious about building generational wealth, incorporating options alongside your stock picks is essential for long-term growth. Introducing Proffe’s Trend Portfolio, a fusion of top-notch MegaTrend stocks and carefully selected, long-term, in-the-money call options based on Michael Proffe’s proprietary 3-step TrendSetter analysis. Gain access to our exclusive, time-tested stock portfolio accompanied by our distinctive and successful options strategy.