Big data has only come about as computing has transitioned from last generation chipsets, especially GPUs (graphics processing units), to powerful new architectures. Combine that with the sheer scale of the new AI-focused server farms, and we’re seeing a complete rethinking of what’s possible with modern computing.

Remember, none of this technology is new. AI has been around since the 1950s – computers even longer.

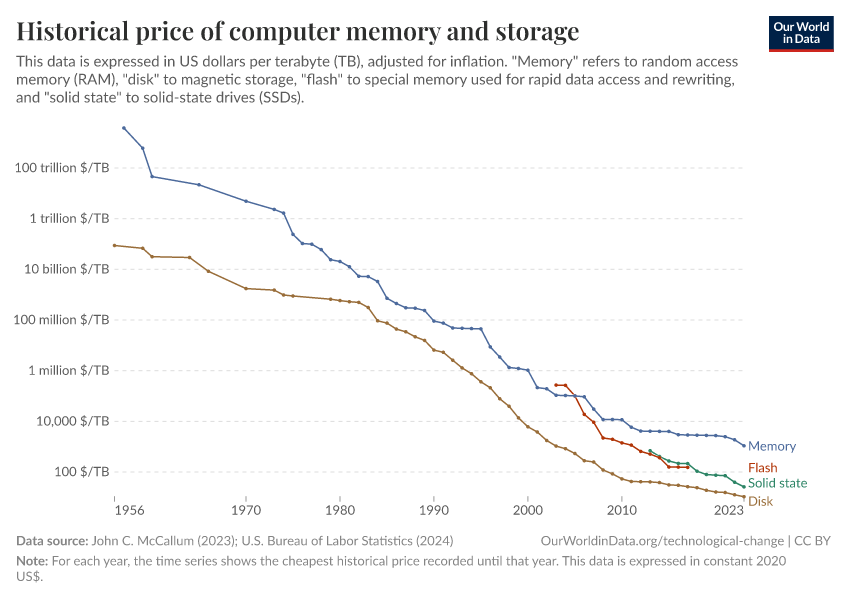

As you can see from the graph below, Moore’s Law – the number of transistors on a microchip doubles roughly every two years, with a minimal increase in cost – has stayed true to form for decades.

What this means is that chips are getting cheaper and more powerful, and it’s that processing power increase (the “speed” of processing) that has been the real gamechanger.

Bandwidth was the big story in the dotcom era, and mobility was another big paradigm shift. Watching movies or playing real-time games on your phone was a dream less than two decades ago.

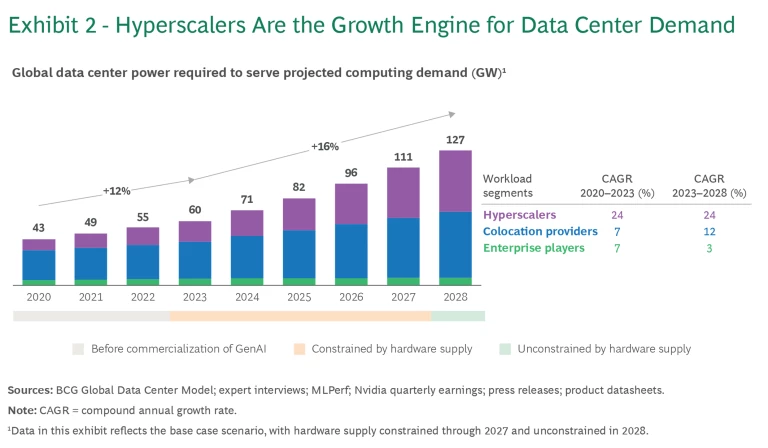

We’re now moving to the next step, which is scaling up massively fast processors and linking them together to create better models that can pore through vast amounts of data to allow unmanned vehicles – drones, cars, boats, etc. – more accurate weather forecasts, more efficient coding, and any number of other operations.

This is why the companies that lead the pack, like Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOG), and Meta (NASDAQ:META) are scaling up so massively right now.

Which brings us to the other beneficiaries of this hyperscaling – Utilities. These big firms are cutting deals with nuclear power plants and renewable energy utilities for their power needs. Constellation Energy (NYSE: CEG) and NextEra Energy (NYSE: NEE) are two top players.

Of course, the chipmakers will also be winners as demand will drive prices, as well as performance. The top players are NVIDIA (NADSAQ: NVDA), Arm (NASDAQ: ARM), Advanced Micro Devices (NASDAQ: AMD), Qualcomm (NASDAQ: QCOM), and Marvell (NASDAQ: MRVL).