Editor’s Note: Before we get to the exciting story on military robots this week, I wanted to let you know before we send this out to the general public. I’m launching a new options-only service in coming weeks.

It’s called Proffe’s Options Trader and it will be taking advantage of this incredible market for my unique style of options trading (which is as safe and simple as trading stocks). In PTP 2.0 my Options Portfolio has delivered more than 620% in just 20 months!

POT will be limited to only 150 subscribers, first come, first served. If you want to learn more, get your name on the waitlist now and we’ll send you more about the service closer to launch!

Big Data is one of the important MegaTrends we have been covering here. While we recently looked at how this could impact our chip stock investments, we will be taking a look at software stocks today – more precisely, software stocks that benefit from the Big Data MegaTrend.

(source: LinkedIn)

Big Data Needs Big Software

Big Data describes a data trend that incorporates the “3 Vs” – data that comes with a lot of variety, in high volumes, and with a high velocity. But while all of this data needs to be processed, which means a lot of demand for chips due to the required computing power, there is also a need for specialized software.

After all, running data analysis is most efficient with specialized tools that are built for determining trends in data, clustering data, and so on.

This is a fast-growing market, as more and more companies, research labs, and even governments want to better utilize the data they have, making them spend more on the software and solutions from specialized Big Data software vendors and developers.

Imarcgroup argues that the Big Data software market, valued at $192 billion in 2023, will grow to more than $410 billion by 2032, which would make for an increase of well above 100% in one decade.

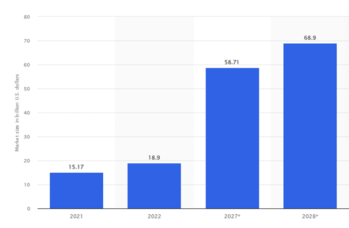

Likewise, Statista expects massive market growth in one important area of the broader Big Data software market, the analytics as a service (AaaS) market:

(source: statista.com)

Growth between 2022 and 2027 is forecasted at more than 200%, or more than 25% annualized (CAGR). Market growth this strong naturally means that there will be potential to earn a lot of money for the leading players that capitalize on this trend.

The Big Deal Stocks in Big Data

There’s not one single way to benefit from the Big Data trend. Instead, investors can opt for different ways. Going for the chip stocks is one option, while investors can also opt for the large players collecting a lot of data, such as search engine giant Alphabet (NASDAQ:GOOG) or social media giant Meta Platforms (NASDAQ:META).

But according to the picks and shovels approach, investors can also opt to invest in the companies that make Big Data utilization possible – the software companies that provide the necessary tools or that provide AaaS.

There’s some overlap here with our Artificial Intelligence picks, so feel free to check out our AI MegaTrend portfolio for more in-depth research and ideas.

International Business Machines (NYSE:IBM) has been around for many years, but the company constantly invests in new areas and grows inorganically via M&A. IBM offers AI cloud computing services and data-driven solutions to all kinds of businesses around the globe, making them a beneficiary from increased Big Data spending in the B2B space.

MongoDB (NASDAQ:MDB) is a provider of databases and database services to clients around the world. As a specialized player in this space, MongoDB has delivered highly attractive business growth in the recent past, with revenue growth coming in between 20% and 55% since 2022.

Snowflake (NASDAQ:SNOW) is a provider of cloud-based data platforms. Its offerings allow customers to consolidate data in a single place to drive efficiency and to allow for better AI usage to drive insights and gain an edge versus competitors. Like MongoDB, Snowflake is a rather specialized player that has been experiencing massive business growth in the recent past. Over the last two years, revenue growth has come in at 30% to 60% on a year-over-year basis, and I believe that it’s likely that the company will continue to grow at a rapid pace.