In our personal lives, many understand that urbanization is one of the largest macro trends in the world. Jobs, universities, shopping, healthcare and so on are often centered in and around large cities, which drives more and more people to move to these spots.

This is true in the United States, but also around the world — urbanization is a global MegaTrend. This MegaTrend also brings significant opportunities for investment because creating modern infrastructure not only requires Old Economy companies, but also New Economy technologies to create successful densely populated cities that provide quality of life, as well as productivity advantages.

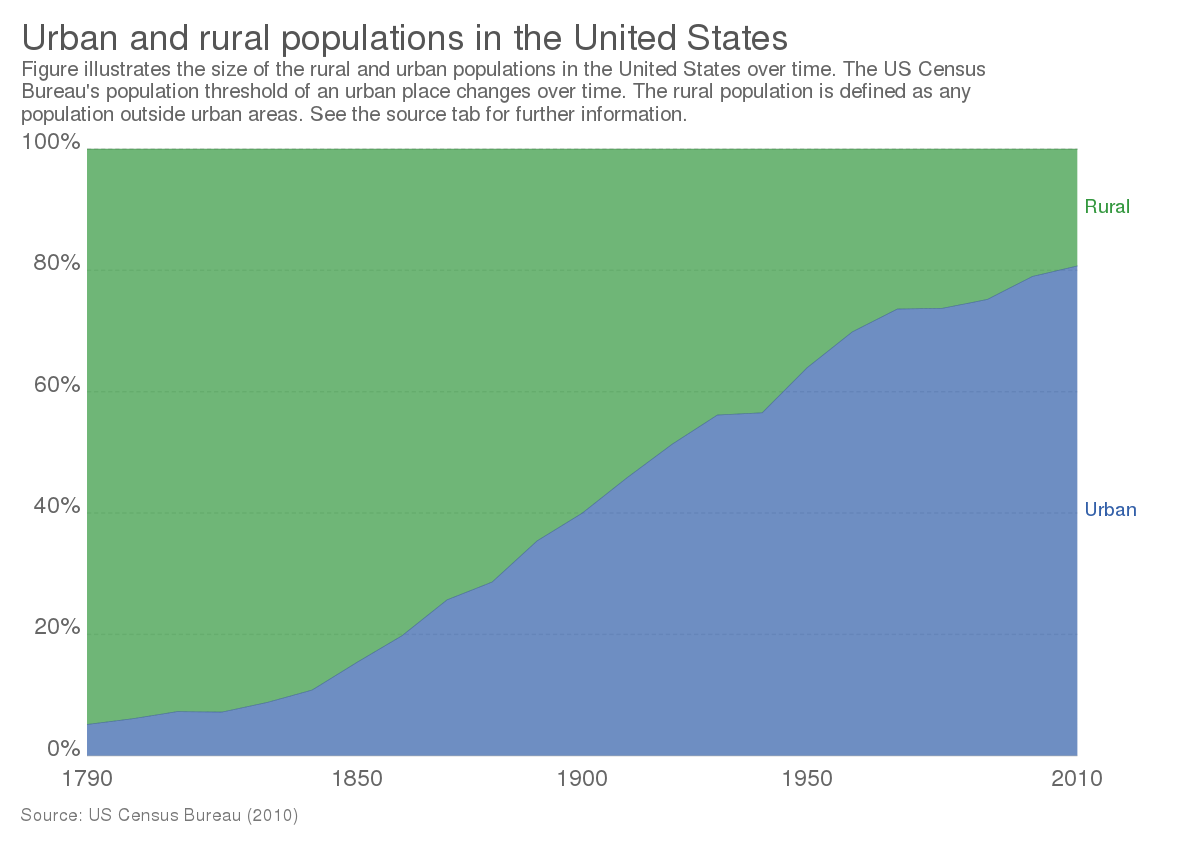

The following graph shows the trend of urbanization in the United States, which really began around 1850 due to industrialization:

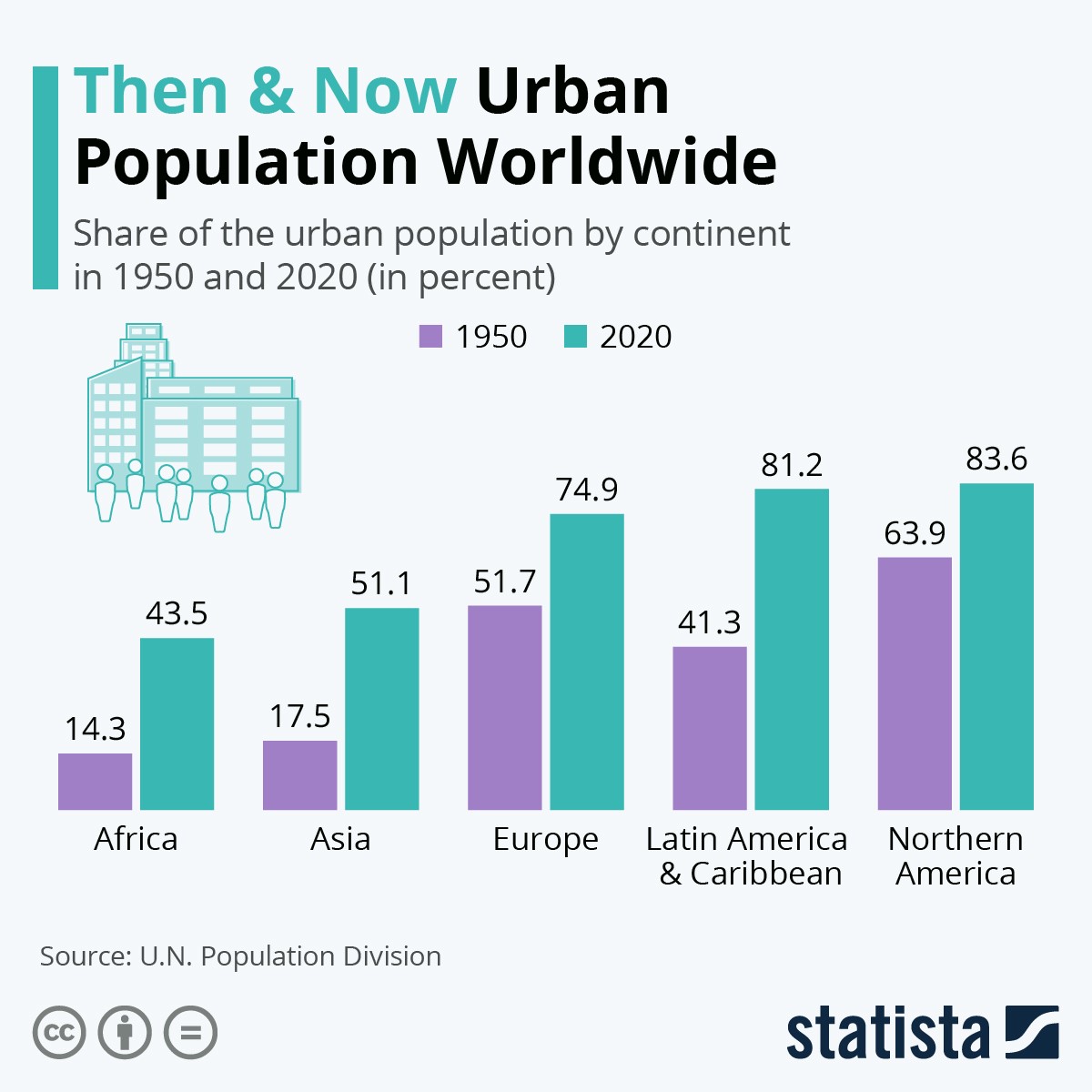

Since then, the ratio of people living in urban settings has risen continuously, hitting more than 80%. In other countries and on other continents, similar trends are in place:

While not every continent is as urbanized as North America yet, the trend is pretty clear across the whole world: People are moving into urban settings, especially toward large cities and megacities. It seems likely that the ratio of people living in urban settings will continue to climb rapidly in Africa and Asia, where the ratio is still significantly below the levels seen in Europe and the Americas.

Of course, more and more people living in ever-growing cities means that population density in these areas will likely continue to rise. Additional infrastructure is required, as all of these people will require water, electricity, and heating/cooling, while demand for roads, retail space, working space, and so on will climb as well.

Cities will have to become more sustainable and “smarter” in order to allow them to house an ever-growing number of people who also all want a rising living standard, especially in fast-growing developing and emerging countries.

How To Benefit from The Urbanization MegaTrend

Real estate in growing cities will likely remain in high demand, and investors may be able to benefit from that via investments in select real estate investment trusts. However, there are also other ways to play the urbanization MegaTrend. Growing cities will require additional government spending on highways, roads, airports, and so on, and “picks and shovels” stocks could benefit from that.

Caterpillar (NYSE: CAT) is a leading manufacturer of construction equipment. When urban centers around the world keep growing and infrastructure is being built in and around these cities, then demand for construction equipment could rise drastically in the future.

Caterpillar also manufactures and sells mining equipment: Since construction of new infrastructure, as well as (high rise) housing in urban settings, requires steel, copper, and so on, demand from the mining industry for Caterpillar’s products could climb as well.

In short, Caterpillar could be a “double winner” from the urbanization MegaTrend that goes hand in hand with rising infrastructure spending.

In urban settings, public transportation makes a lot more sense than in the countryside where population density is low. Manufacturers of train systems, metro systems, and so on could also see their business prospects soar thanks to urbanization. Bombardier (OTC: BDRAF) and Siemens (OTC: SIEGY) are two leading manufacturers of such transport systems.

Air travel between large urban settlements will also continue to grow, which results in nice business growth prospects for companies such as Boeing (NYSE:BA).