What Is Big Data?

Big data describes a data trend that incorporates the “3 Vs” – data that comes with a lot of variety in high volume and with a high velocity.

More and more sensors across smart homes, smart cities, satellites, (semi-) autonomous vehicles, and so on means that we as humanity collect way more data today compared to the past.

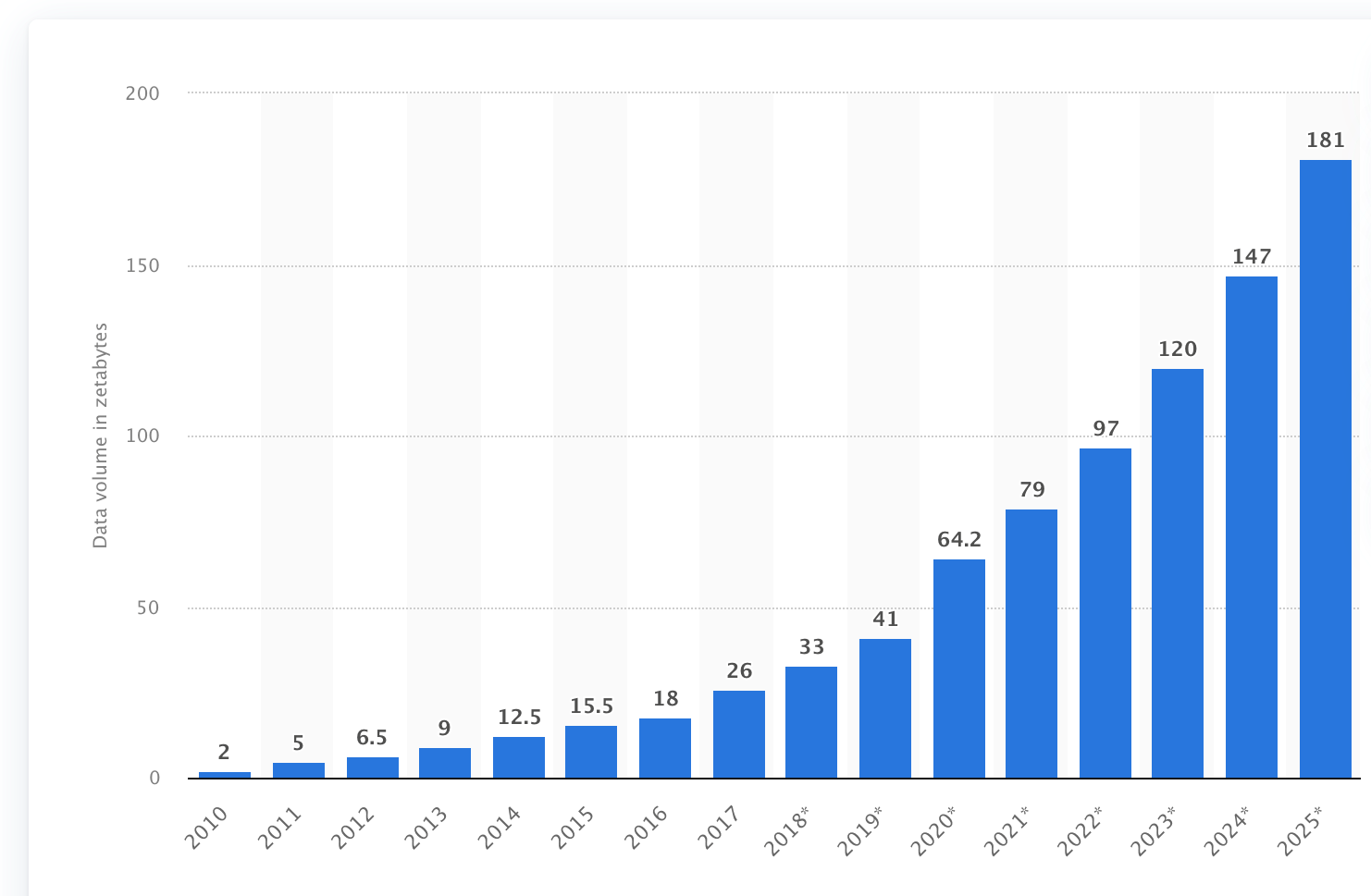

The following chart from Statista shows the volume of data that is being collected around the world. We see that growth has been explosive in recent years and will likely remain very pronounced going forward.

(source: statista.com)

Analyzing this data isn’t possible with the tools we had in the past, which is why machine learning, Autonomous Intelligence, and other big tech trends from the recent past are being used to utilize these large data volumes.

Chip Stocks Benefiting from The Big Data MegaTrend

When it comes to investing in companies that are benefiting from the Big Data MegaTrend, there are several ways to do so. Investors can opt for the data collectors and the companies that use them via their algorithms, which includes social media companies, like Meta Platforms (NASDAQ: META) or search engines like Alphabet (NASDAQ: GOOG).

According to the pick and shovel approach (that is, you make more money selling the picks and shovels to gold miners than mining yourself), investors can also opt to invest in the companies that make Big Data collection and utilization possible – the semiconductor companies that provide the necessary computing capacity.

There is some overlap here with our Artificial Intelligence picks, so feel free to check out our AI MegaTrend portfolio for more in-depth research and ideas.

NVIDIA (NASDAQ: NVDA) naturally is one of the top picks benefitting from the Big Data MegaTrend, as its very powerful chips are among the best for machine learning, AI, data analysis, and so on. Those that want to process a large volume of data, such as the aforementioned tech companies, but also pharma companies, universities, research labs, and so on, are oftentimes buying from Nvidia.

Advanced Micro Devices (NASDAQ: AMD) is, like Nvidia, a semiconductor company that produces GPUs and data center chips. While its overall growth has not been as strong as Nvidia over the last couple of quarters, AMD’s data center business is growing explosively thanks to the massive investments in data center computing power by many tech companies. It’s expected that AMD will be able to grow its revenues by around 30% next year alone, as its AI data center chip business continues to ramp up.

Broadcom (NASDAQ: AVGO) is another semiconductor company that benefits a lot from the ongoing Big Data, machine learning, and AI trend. Broadcom’s chips are used for large and high-powered data centers, which is why Broadcom has experienced a lot of business growth in recent quarters, with more growth being expected in the foreseeable future.

These are just a taste of the opportunities in the AI MegaTrends space, and we take a deeper dive with many more companies in our newest service, Proffe’s AI MegaTrends.