What’s important to understand about sustainability in the business sense is that this isn’t some tree-hugger movement. While ESG investing has turned into a political football in the past year, the fact is, this kind of corporate reframing should be encouraged.

We live in an amazing new world full of powerful technologies. Instead of trying to retrofit these technologies onto old products and processes, more often than not these days, it’s much smarter to build for the future and innovate to stay competitive and healthy.

When you buy a house, most people prefer one that’s modern, has new electrical, plumbing, HVAC, windows, etc. Buying an old house and bolting on those new innovations is more time consuming and more expensive than simply buying a new one.

This is the challenge of big and small corporations – either stick with the old status quo and dig their heels in or adapt to change.

Even as a species we evolve, and so does business.

As technologies have evolved in building materials, so have the opportunities for forward-thinking companies that know how to take advantage of these new opportunities.

As you can see above, these companies are some of the best in their respective industries. These aren’t fringe players. What’s more, governments around the world provide tax incentives for these corporations to change their views from short-term profit to long-term value.

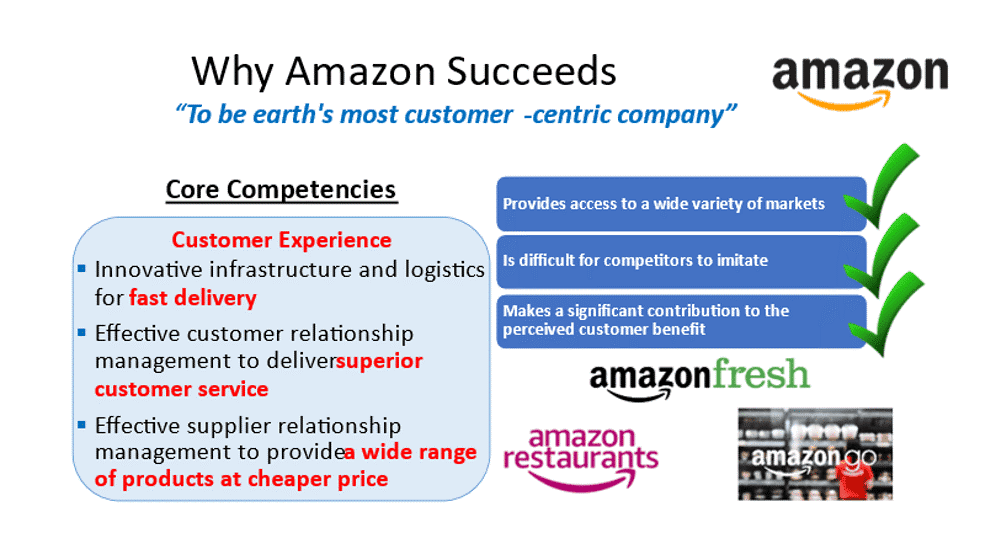

Amazon (NASDAQ: AMZN) is a clear example of how a company that innovates has a much easier time integrating sustainable solutions into its overall corporate strategy. Others, from Tesla (NASDAQ: TSLA) to Eli Lilly (NYSE: LLY) to Mastercard (NYSE: MC), are all in on the economic opportunities that the sustainability movement is providing.

What’s more, this long-term thinking is the engine room of successful, long-term growth stocks, which we love.

Get Ahead of the Next MegaTrend and Join Our Premium Portfolios!

Unleash the Power of Proffe’s Growth Stocks

Gain exclusive access to our monthly entry-level publication featuring 20 handpicked MegaTrend stocks, carefully selected using Michael Proffe’s Trendsetter strategy.

Supercharge Your Portfolio with MegaTrend Stocks and Options

If you’re serious about building generational wealth, incorporating options alongside your stock picks is essential for long-term growth. Introducing Proffe’s Trend Portfolio, a fusion of top-notch MegaTrend stocks and carefully selected, long-term, in-the-money call options based on Michael Proffe’s proprietary 3-step TrendSetter analysis. Gain access to our exclusive, time-tested stock portfolio accompanied by our distinctive and successful options strategy.