Painting the Sector with a Broad Brush

As I said earlier, the whole global supply chain fiasco, combined with central banks letting go of the reins of most major economies, has meant inflation and significant sector rotation. The losses that have been making headlines in recent weeks are what happen when there’s a fundamental shift in the way the economy is functioning. Institutional investors – pension funds, hedge funds, private equity, banks, financial institutions, etc – start to move out of the sectors that operate well in a low growth, low interest rate environment, and they start to rotate into sectors that perform well in a rising interest rate, faster growth economy.

Source: Visual Capitalist

The initial phase of this rotation is traders usually start to dump all the stocks in a sector, then they buy all the stocks in the new hot sectors. Afterwards, they nuance those big sector trades and start looking more at particular companies across all the sectors that are posting strong numbers.

You see, when the bull was all about growth, investors and traders weren’t too interested in silly things like earnings and revenues. It was about growth that made sense and growth that made no sense at all. That can be a great help for young industries, like electric vehicles and next-gen energy storage or electric air taxi business, but sometimes investors lose sight of the value of long-term growth.

MegaTrends vs Fads

That’s why I focus on MegaTrend stocks that I unearth with my Trendsetter Strategy. These are trends that are going to last for decades, regardless of market fads and short-term trends. These are generational trends, and the companies that can manage to see these trends, chart a course, and move toward that horizon are the stocks I want. They also have to be technically, fundamentally, and sentimentally strong.

Qualcomm (NASDAQ: QCOM) is a relative newcomer to my MegaTrend list. It made its debut in PGGP just a little over a year ago.

Source: BBC

Qualcomm started in San Diego, California in 1985 and was one of the pioneers in CDMA (code division multiple access) mobile telecom technology. Its CDMA work was foundational in establishing 2G standards as mobile devices began to grow. For your information, there are fundamentally two different phone bands, CDMA and GSM (global system for mobiles). Initially, the US and Japan primarily used CDMA for their mobile networks, while most of the rest of the world used GSM.

For example, in the US, Verizon (NYSE: VZ) uses CDMA technology. AT&T (NYSE:T) and T-Mobile (NASDAQ: TMUS) use GSM. Because the current 4G LTE standard also has 2G and 3G back-up, this distinction matters, and CDMA has limited functionality outside its carrier zones.

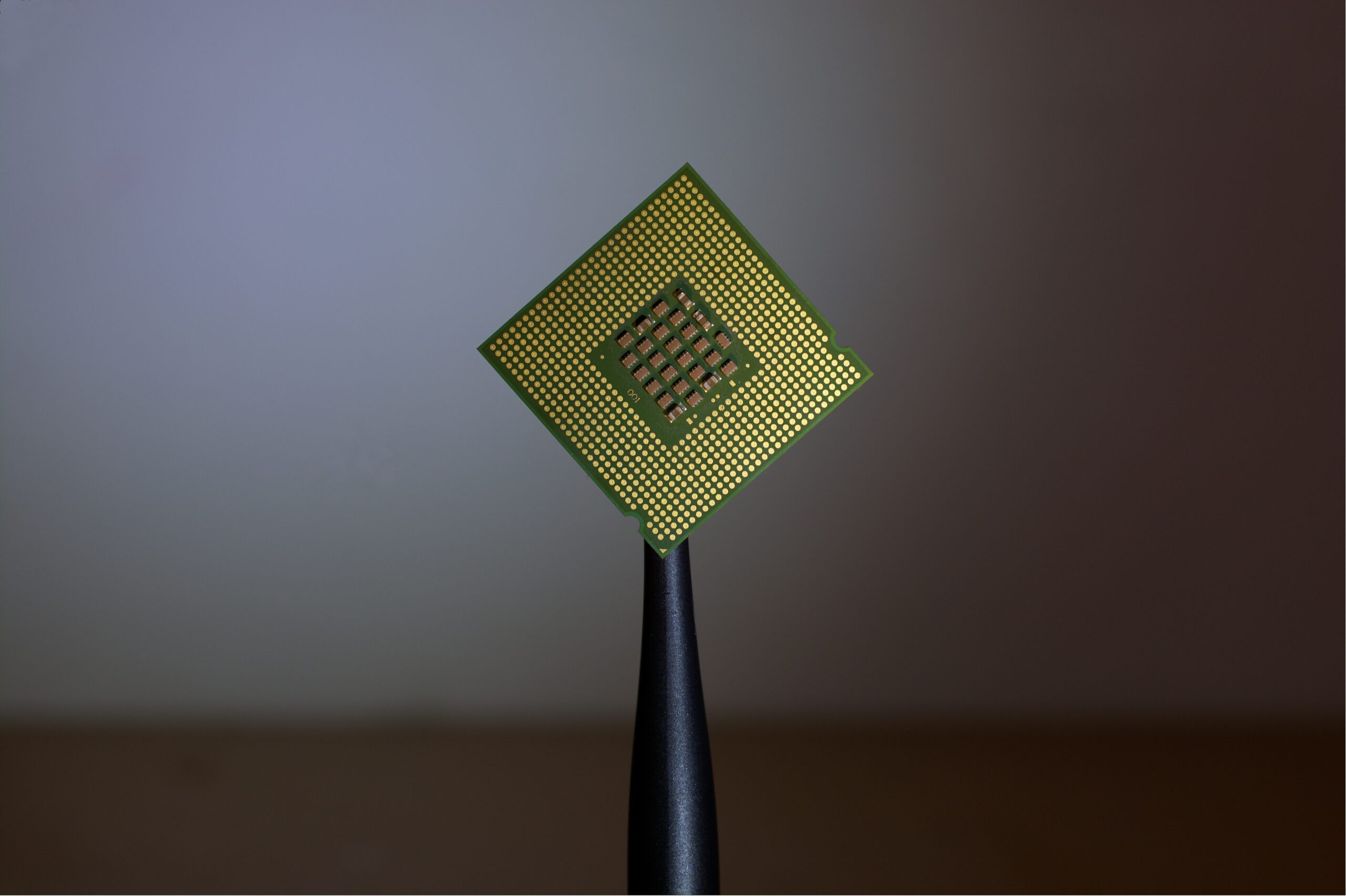

Now that we’re in a soon-to-be 5G world of mobile telecom, we can also thank QCOM for building chips that can send and receive both CDMA and GSM. No longer do carriers have to get stuck without service in some markets. This wasn’t an issue for QCOM since it was making chips for phones in both markets for decades.

Licensing and Chips

QCOM holds hundreds of patents on its technology going back to 3G mobile telecom. For quite a while, its chief revenue source was licensing its technologies to mobile phone makers. Its R&D department remains huge because its intellectual property is a significant source of revenue.

It has also built chips, but more for the telecom aspect of moving signals from towers to repeaters to towers, etc. It was only in 2014 that it built its now state-of-the-industry Snapdragon system on a chip. Today, Snapdragon chips are in all the top phones by most mobile phone companies.

DATA SOURCE: QUALCOMM. *NON-GAAP BASIS.

In the graph above, QCT is its chipmaking business. QTL represents its licensing business. Not only has it almost completely flipped its revenue stream in the last eight years, but it has also built one of the top chips for mobile telecom. What’s more, QCOM is perfectly set up to take off as institutional investors start to hand pick the stocks they want in their portfolios for the next few years. That’s why now is a great time to get on board.

QCOM stock is selling a decent forward PE, has very little short interest against it, and has provided very optimistic forward guidance out to 2023. It’s on sale and under the radar, at least for now.

Get More MegaTrend Stocks Like Qualcomm

Proffe’s Global Growth Portfolio is my monthly publication designed to give you global diversification without ever leaving the US market. Finding the right stocks starts with my MegaTrends and my Trendsetter Strategy screens. I then pick the best of those stocks. These are big US-traded stocks that are easy to enter and easy to exit, and it’s built for investors that are interested in buying the best stocks in the world…and letting the profits run. I don’t jump in and out of stocks. I buy the best stocks for now and years into the future with a minimum performance of 20% annual returns on each pick.

All my portfolios accomplish their specific goals with one four-word mantra in mind: More Time to Live. You see, you don’t have to make investing a full-time job if you have the right stocks in your portfolio, and investing in the right stocks is far more efficient and effective than trading. More Time to Live means you don’t have to make investing a new fulltime job or even a side gig.

If the market gets hit, I know my stocks will be the first to recover. If the markets rally, I know my stocks will outperform the others. When you’re building wealth, the foundation is peace of mind, and that’s what all my products deliver. That doesn’t mean I “set and forget” my stocks. I run them through my Trendsetter Strategy every week to make sure they’re still on track. If they’re not, I’ll swap them out for stronger stocks, and you’ll be the first to know when I do. Although, with the MegaTrend overlay, jumping in and out isn’t very common.

Proffe’s Global Growth Portfolio is only $49.95 for an annual subscription that delivers bi-monthly publications straight to your email inbox! That’s 24 issues at $2.08 per issue of an all-stock portfolio that you can easily and profitably follow. Click here to get started and subscribe today!