If you want to think about technology curves in the context of average people interacting with technology, we’re just past the AOL days and entering the MySpace version of AI’s potential.

We can see the future from here, but don’t have a clear idea about how much it will serve us or chain us.

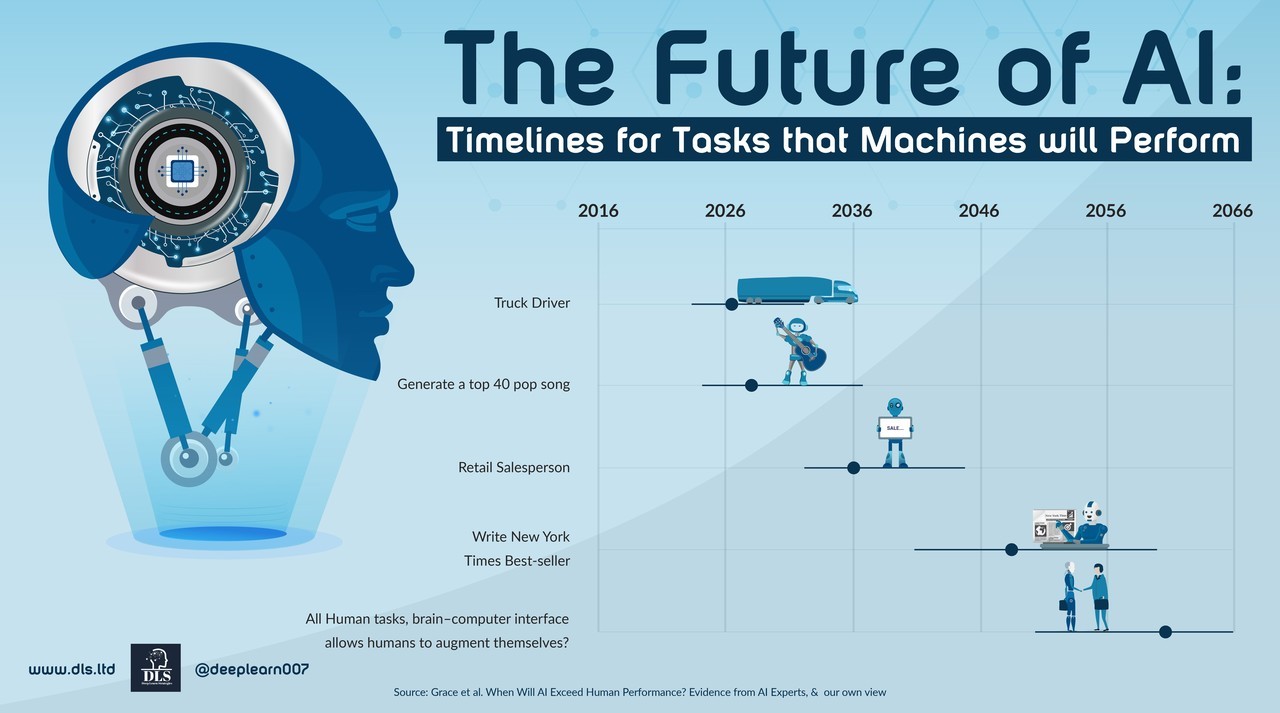

While the above projected timelines are interesting, the fact is, one AI-driven breakthrough in, say, quantum computing could shift these timelines rapidly forward and drive new breakthroughs we can’t even imagine yet.

The point is, regardless of the risks and opportunities, this is a MegaTrend that will unfold over decades and transform daily life for humanity, industry, and economies.

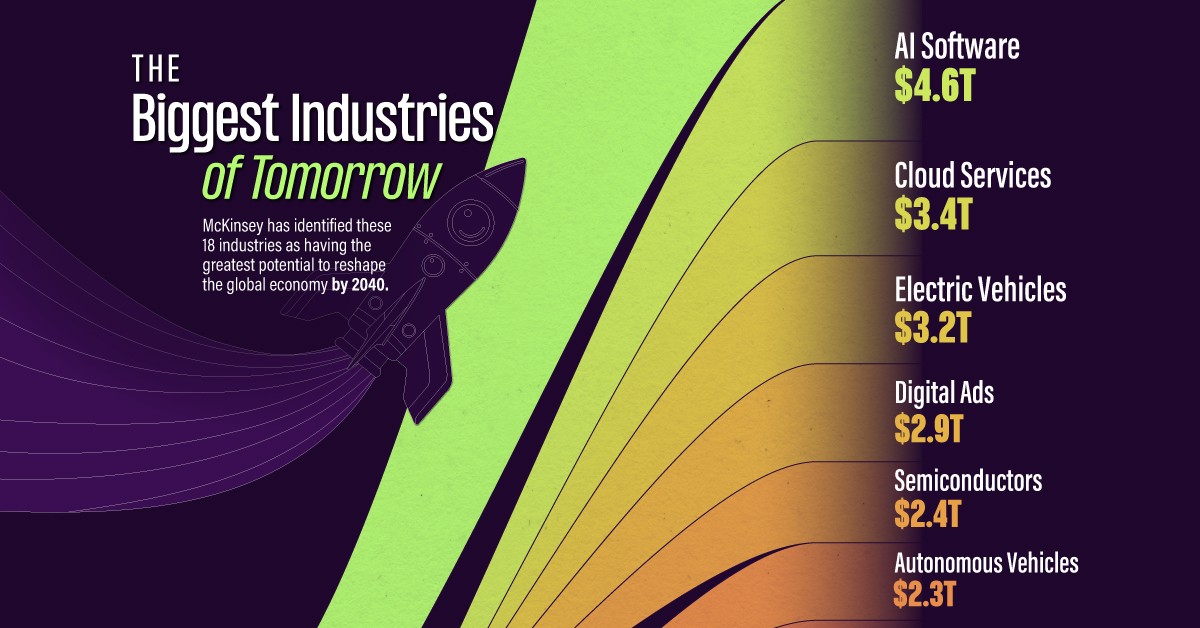

There will be surprises and new tangents along the way. For example, in the above projection, AI software is nearly double the size of the semiconductor industry.

Also, while autonomous vehicles sit at the foot of the list, electric vehicles are close to the top.

Tesla (NASDAQ: TSLA) may have a tougher time with its robotaxis than it expects, but its cars may do better than expected.

While chip stocks, like NVIDIA (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), Arm Holdings (NASDAQ: ARM) and others, may not stay the world’s most valuable companies by 2040, those MegaTrend stocks that are able to command a lion’s share of the market by remaining innovative and dominant will certainly have the keys to the kingdom.

As for AI software, expect Oracle (NASDAQ: ORCL) to be a player, along with Microsoft (NASDAQ: MSFT). On the cloud services side, Amazon (NASDAQ: AMZN), MSFT, IBM (NYSE: IBM), and ORCL will also be contenders with the latter two being very strong “middleware” players, helping different software work with one another.