As you know, I’m a firm believer in sticking with the dominant companies in a sector, but in a MegaTrend that’s just beginning, spotting those companies can be challenging.

There are powerful, long-standing companies like Caterpillar (NYSE: CAT), Lockheed Martin (NYSE: LMT), and L3Harris (NYSE: LHX) that come to mind.

These have been driving forces in a variety of capacities and are deeply linked with the US space program through NASA, as well as private industry.

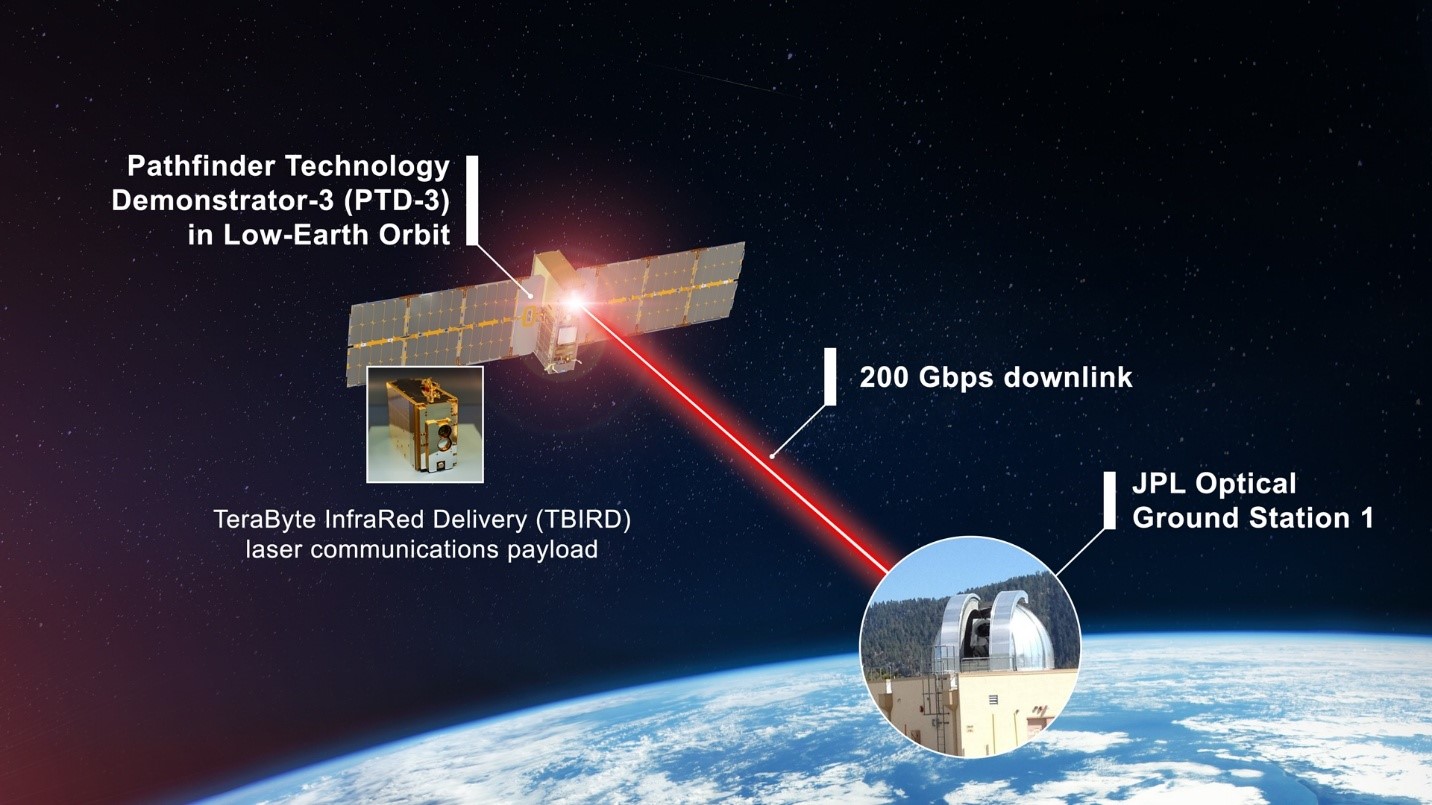

For example, the next iteration for communications – Starlink is the most visible example, but it’s not publicly traded yet – is using lasers to communicate from the ground to satellites to either other land-based receivers or to the Moon, or vehicles travelling in space.

The advantage? Lasers have significantly more bandwidth than typical radio frequency communications. They travel the same speed, but the amount of information you can deliver is orders of magnitude bigger. and that means you can operate heavy machinery remotely to start building a base on the Moon, for example.

The image above is from an article about how CAT, International Business Machines (NYSE: IBM), and NVIDIA (NASDAQ: NVDA) are already working with NASA to build the brains and the brawn to make this kind of pioneering possible.

CAT already builds the equipment that keeps launches and the rockets for those launches safe and functional.

This photo is a shot of the largest, self-powered vehicle in the world. It’s used for moving large rockets from their enclosed facilities to the launch pads. Because no matter what high tech you put on the machines and equipment that heads to space and to planets, it has to be Old Economy equipment that gets it there – from the transporters to the roads, to the launch pads.

As for the new names that are out there, a number have been gaining significant ground in the past year or two.

Intuitive Machines (NASDAQ: LUNR) is one to watch, as is New Zealand-based Rocket Lab (NASDAQ: RKLB).

An interesting German company that has significant investment from LHX is Mynaric (NASDAQ: MYNAY). It builds laser communications network equipment and software. It’s tiny, but it may be a strategic acquisition by a larger US company or a European competitor.

In Other News, Have You Heard About Our Latest Premium Publication?!

Editor’s Note: There’s a number I want to share: $16,290.

That’s the return I’ve delivered for subscribers using my unique options strategy since September with my new options-only service: Proffe’s Options Trader (POT). It’s designed to capitalize on today’s market (which is about to boom when rates start dropping), with 4-6 trades per month, contracts held for up to 12 months, and 10%-20% target gains per trade. We’re averaging 31% on 19 trades (assuming just one contract per trade) with an average holding time of just over 31 days!

Subscribers get email alerts with detailed PDFs and quarterly portfolio updates. No long-term commitment—cancel anytime. And the best part? It’s only $99/month. Click here to learn more.