The reason I keep my discipline and focus on a set of MegaTrends is best illustrated in what’s happened to the AI sector with one announcement from a new Chinese AI competitor.

Of course, AI will continue to boom, and it’s certainly a MegaTrend as far as we’re concerned. I even have a service focused specifically on AI stocks.

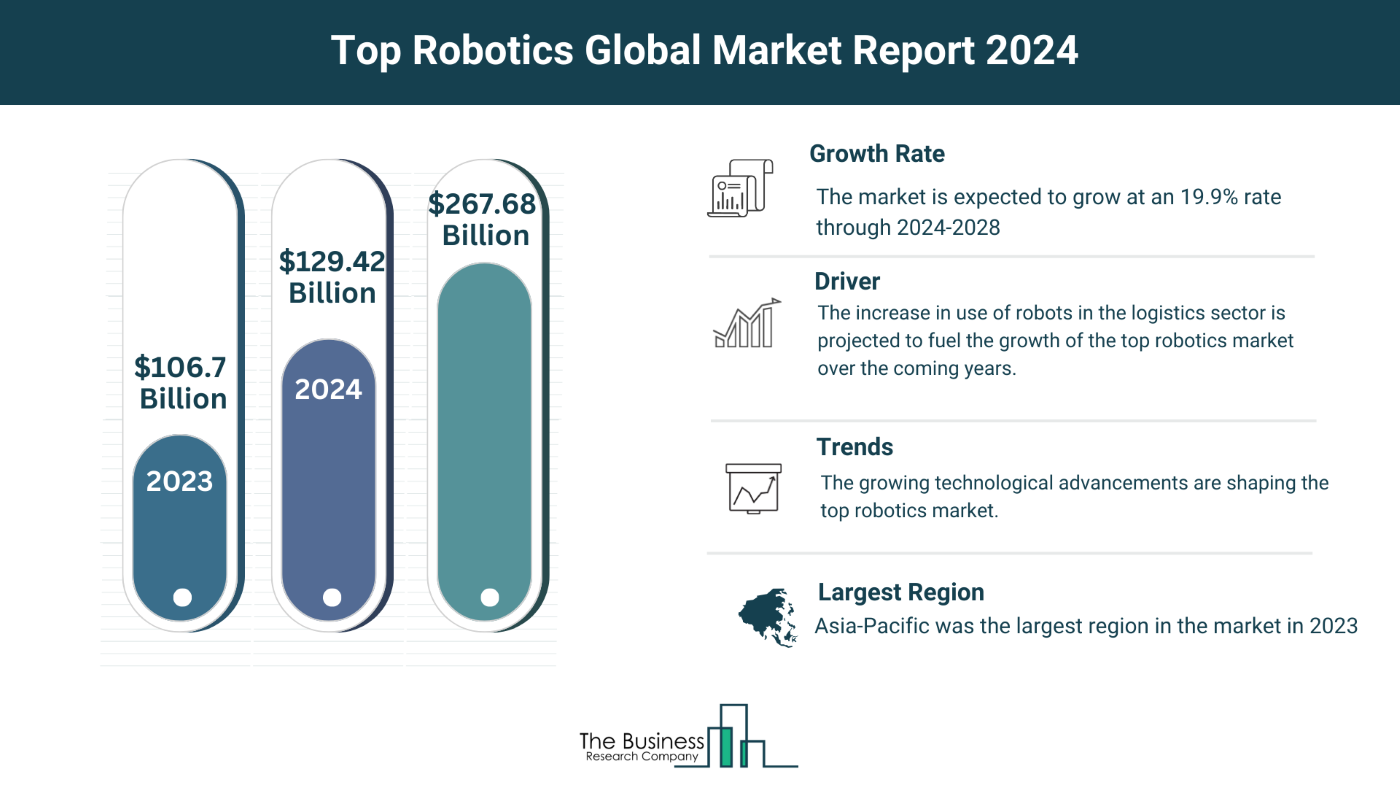

One of the prime beneficiaries of emerging AI will be its use with robots, or autonomous machines, which also includes drones, machinery, self-driving vehicles, etc.

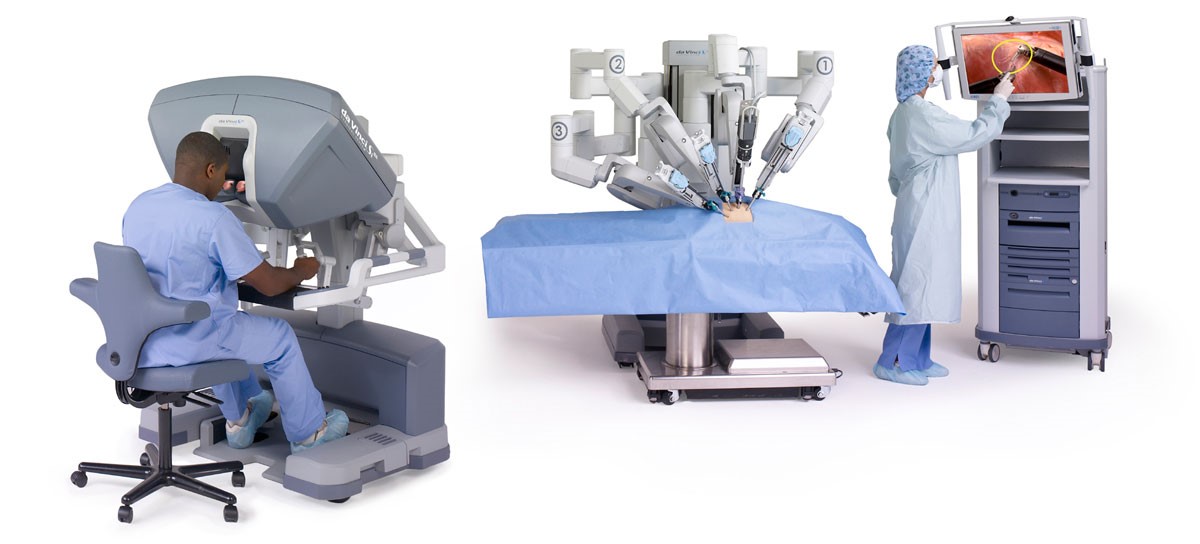

You have to remember that robots aren’t simply welding fenders any longer. They’re also sewing high-end clothes and assisting in operations.

The image above is the Da Vinci surgical robotics system by Intuitive Surgical (NASDAQ: ISRG). It’s one of the lead robotic surgery companies in the world, and it’s growing a very good clip.

The thing to remember as investors is, it’s not that hospitals simply buy the machines and are done with it. ISRG trains people working with Da Vinci and sells upgrades, equipment, and servicing. That means a consistent revenue stream off of every purchase.

On the other side of the equation are the companies that deliver the “brains” behind all these operations – chip companies and chip equipment manufacturers.

This is a state-of-the-art lithography chipmaker from ASML (NASDAQ: ASML). This is what it takes to keep Moore’s Law chugging away and companies like NVIDIA (NASDAQ: NVDA), ARM (NASDAQ: ARM) and Advanced Micro Devices (NASDAQ: AMD) going strong.

This is the thing about powerful MegaTrends. They intertwine to create sustainable growth far beyond just the combination of two MegaTrends. They create new industries and even new MegaTrends.