To be clear, there is quite a variety of financial services companies that make up what we broadly describe as digital banking.

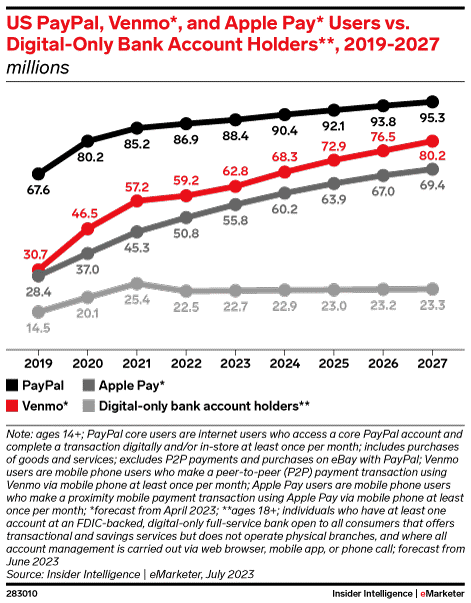

There are purely digital banks (neobanks). There are also non-banks that disburse loans (business, college, and personal). There are peer-to-peer services, like Venmo, that are simply new places to park money, or as they’ve come to be known, digital wallets. A digital wallet is really like a traditional checking account, except with no physical checks.

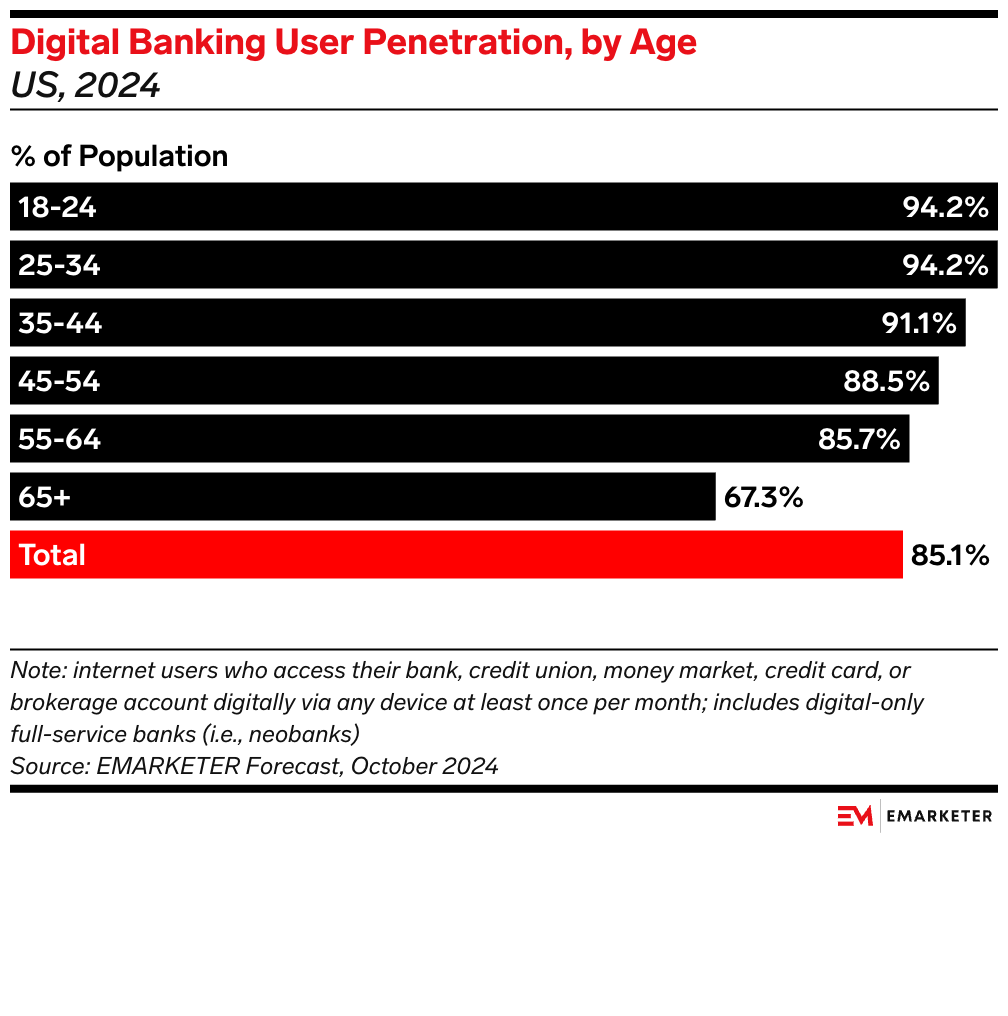

Even traditional banks have gone digital to keep up with the needs of growing generations of customers who want to bank on their time, not the hours that banks operate.

As you can tell by the numbers above, this isn’t just a fad, and there’s no going back. Even older demographics are using digital banking in significant numbers.

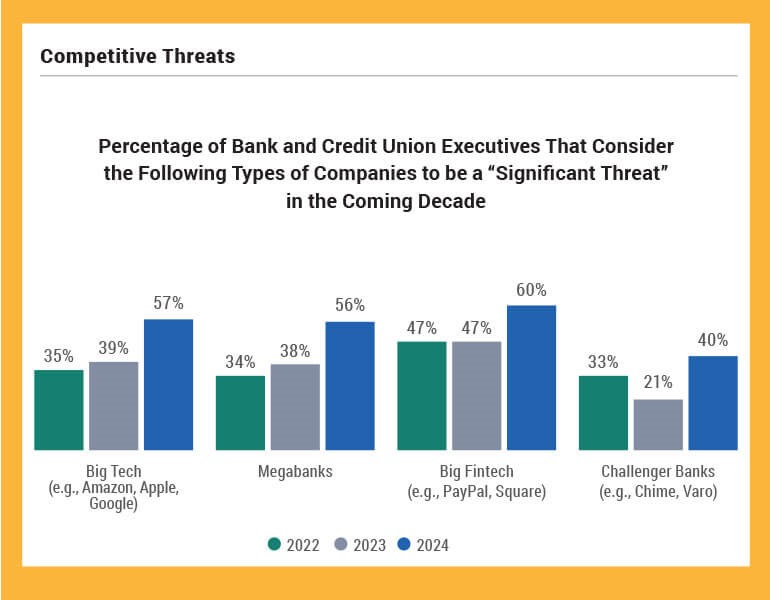

While the headline companies are fairly well known, the fact is, there are companies that help the banks integrate the payments, the accounts, and the account management (in banking slang, “the core”).

These are the infrastructure companies that are certain to be significant players moving forward – companies like Fiserv (NYSE: FI), Jack Henry (NASDAQ: JKHY), Corpay (NYSE: CPAY), Fidelity National Information Service (NYSE: FIS), Global Payments (NYSE: GPN), as well as majors like Visa (NYSE:V) and Mastercard (NYSE:MA).