To make all these technologies perform, they require data, and that data then needs to be processed.

Source: PR NewswireSource: statista.com)

Think about what you’re doing as you drive your car, for example. You want to know weather conditions, the status of your vehicle, the best route to take to your destination given the time of day, then manage your speed, mind traffic, and stay on the road.

Do it all IRL (in real time). This is what many are training computers to do, but to train them, you need as much data as possible and then be able to process it at lightning speed.

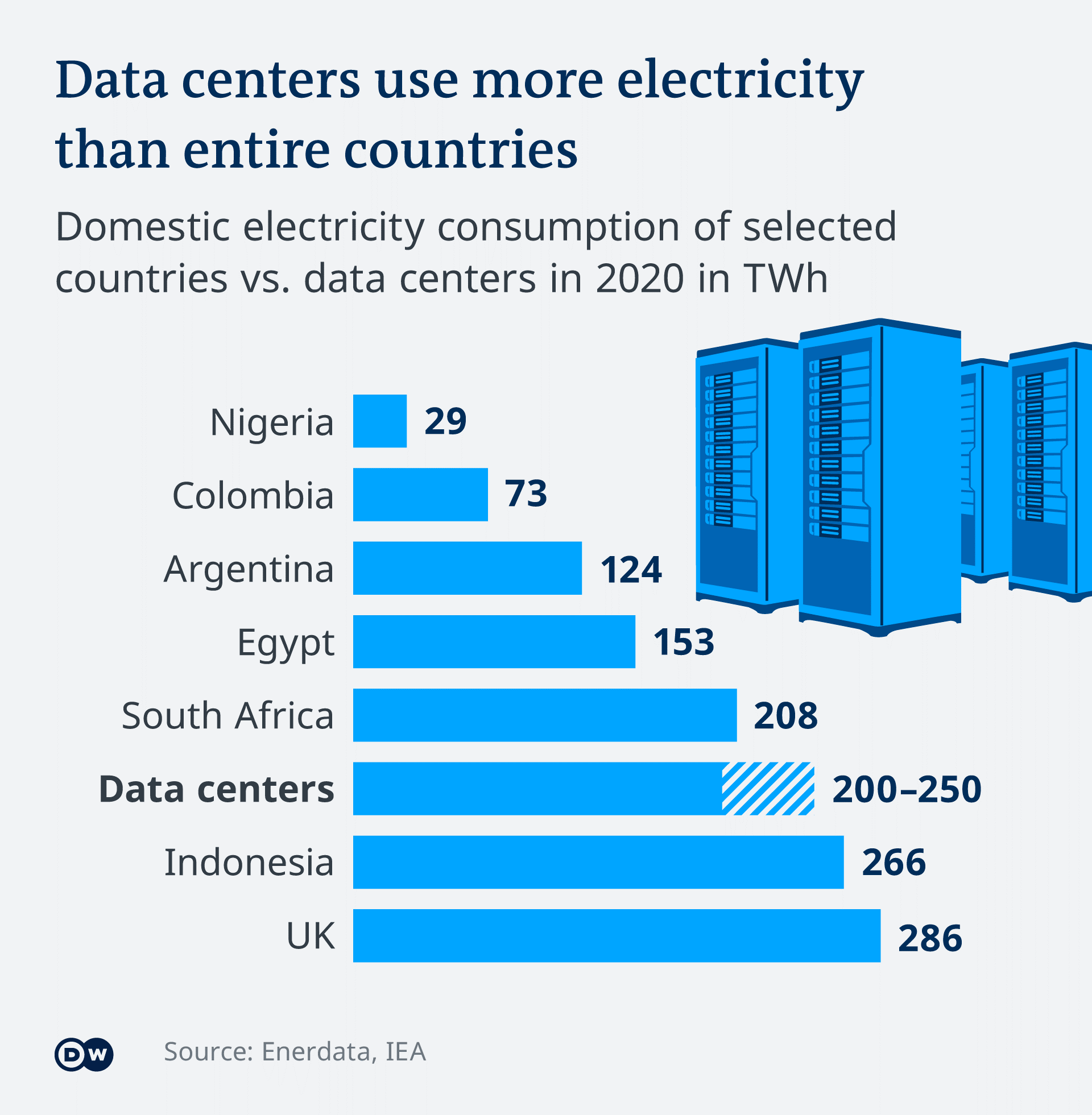

To get there, we need faster chips and more data. That’s why this stat is a hint at things to come:

If you notice, this stat is from four years ago! Data center power has certainly surpassed many more countries by now.

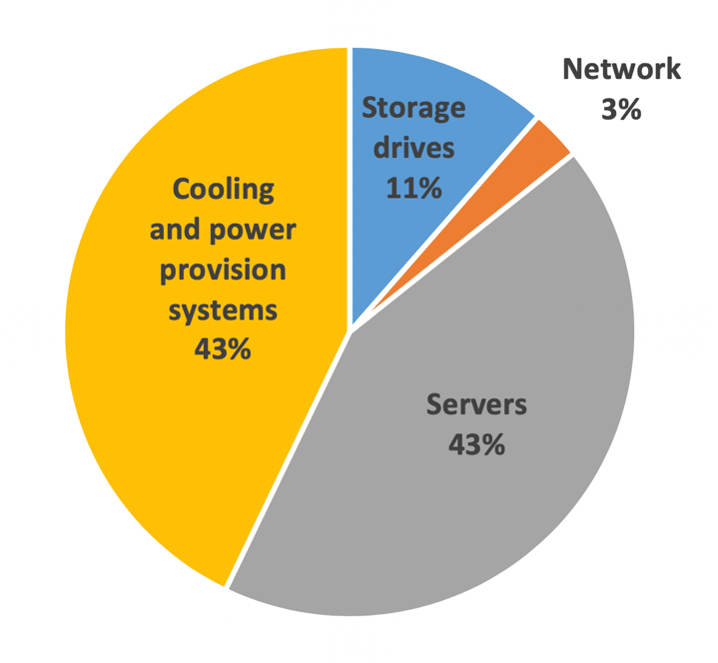

Also, not all the electricity is simply to power the servers.

What does this mean for investors?

It means regardless of short-term fluctuations in the world’s top chip stocks – NVIDIA (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), Taiwan Semiconductor (NYSE: TSM), Micron Technologies (NASDAQ: MU) – this sector has decades of growth ahead of it.

So instead of timing the market’s fluctuations, buy quality and buy it now.