A Huge and Growing Market

We all see that more and more wind parks are being built and that more and more of our neighbors are putting up solar systems on their roofs, while we see more and more electric vehicles from Tesla (NASDAQ: TSLA) and others on the road.

But how large is the renewable energy market on a global scale?

Two or three decades ago, wind power generation and solar systems were available as well, but this was still a niche market.

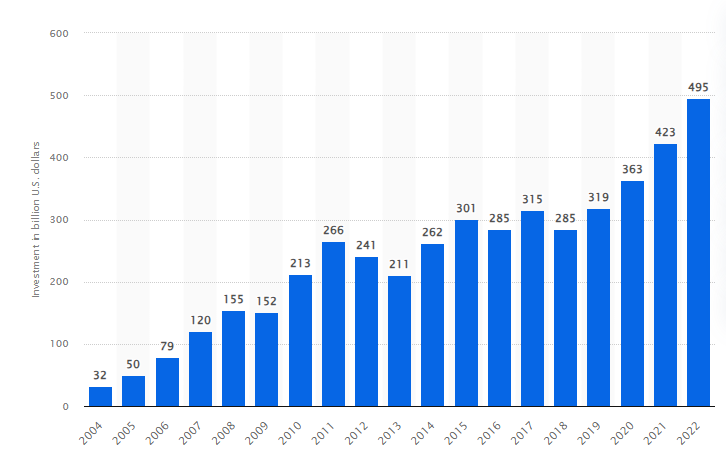

Over the years, efforts to reduce CO2 emissions have become larger and larger, and more and more money is being invested in renewable energy generation. The numbers started to look like this:

Between 2004 and 2022, renewable energy investments have grown by around 1,500% to almost half a trillion dollars. As we can see in the above chart, growth in recent years has remained very strong with 12%. 14%, 17%, and 17% in 2019, 2020, 2021, and 2022 respectively. Momentum is very strong and things aren’t slowing down at all.

The forecast over the next couple of years is highly encouraging as well, as the EU, for example, expects that global investments in clean energies will grow six-fold between 2022 and 2030. A couple of years from now, we could thus be looking at a multi-trillion dollar market.

Renewable energy investments are a global phenomenon, as many different countries are putting more and more money towards renewable energy for a variety of reasons. Some do so in order to decarbonize their industries, while others do it to stop smog and air pollution. Others do so because it’s cost-efficient to use renewable energy in areas with consistent wind and sunshine.

How To Benefit from The Renewable Energy MegaTrend

Investors that want exposure to this massive and fast-growing industry can get it in different ways. There are dedicated green energy and renewable energy ETFs, for example, such as Global X Renewable Energy Producers ETF (NYSE: RNRG).

Investors can also opt to invest in companies that produce windmills or solar panels directly, such as Vestas Wind Systems A/S (OTC: VWDRY) or First Solar, Inc. (NASDAQ: FSLR). Tesla also has solar systems in its portfolio and offers battery systems for at-home usage on top of that, which can be a good combination to a roof solar system.

Investors can also opt for companies that benefit from increased renewable energy indirectly, of course. Windmills and solar systems require all kinds of resources, including copper and steel, thus mining companies like BHP (NYSE: BHP) could be among the beneficiaries of steadily growing renewable energy investments.

When more renewable energy is available, more consumers might opt for EVs. Manufacturers such as Tesla or Rivian (NASDAQ: RIVN) could thus benefit from increased demand for their vehicles.

Last but not least, companies that operate huge data centers with massive power demand, such as Alphabet (NASDAQ: GOOG) or Meta Platforms (NASDAQ: META), could benefit from more electricity being available at attractive rates.

Subscribe to Proffe’s AI MegaTrends

This new portfolio is dedicated solely to artificial intelligence, and the timing couldn’t be more perfect. AI is now beginning to make a tangible impact across various industries, and we are on the cusp of a major AI revolution, offering immense potential for everyone involved.

Proffe’s AI MegaTrends will distinguish itself with two unique features, differentiating it from our other publications:

- An AI-focused stock portfolio, featuring up to 10 of the leading AI companies globally. Given the fast-paced nature of AI, this portfolio will involve active trading rather than a long-term buy-and-hold strategy.

- An AI-focused options portfolio, comprising up to 10 short to medium-term contracts that align with the AI stocks in our portfolio. But there is a catch, these options contracts will be available as a separate purchase, exclusive to Proffe’s AI MegaTrends subscribers.

I am confident in our ability to achieve massive gains consistently and urge you to get involved to seize this opportunity!