As we’ve stated previously, we can all blame Amazon (NASDAQ: AMZN). When it started selling books online, there weren’t a lot of people thinking that this little digital bookseller would upend the way every consumer retail business does business, but that’s what happened, and now it’s changing the way we bank.

Many of the smaller fintech firms that were getting a toehold in the market got blown out of the water when rates started to rise and the VCs and PEs that were so generous just a few years earlier now wanted to get paid.

This is a great lesson in how MegaTrends work.

Those initial small cap disruptors evaporated pretty quickly, and it was the big players that were innovators that took up the slack and turned fintech from cool and funky into sleek and profitable.

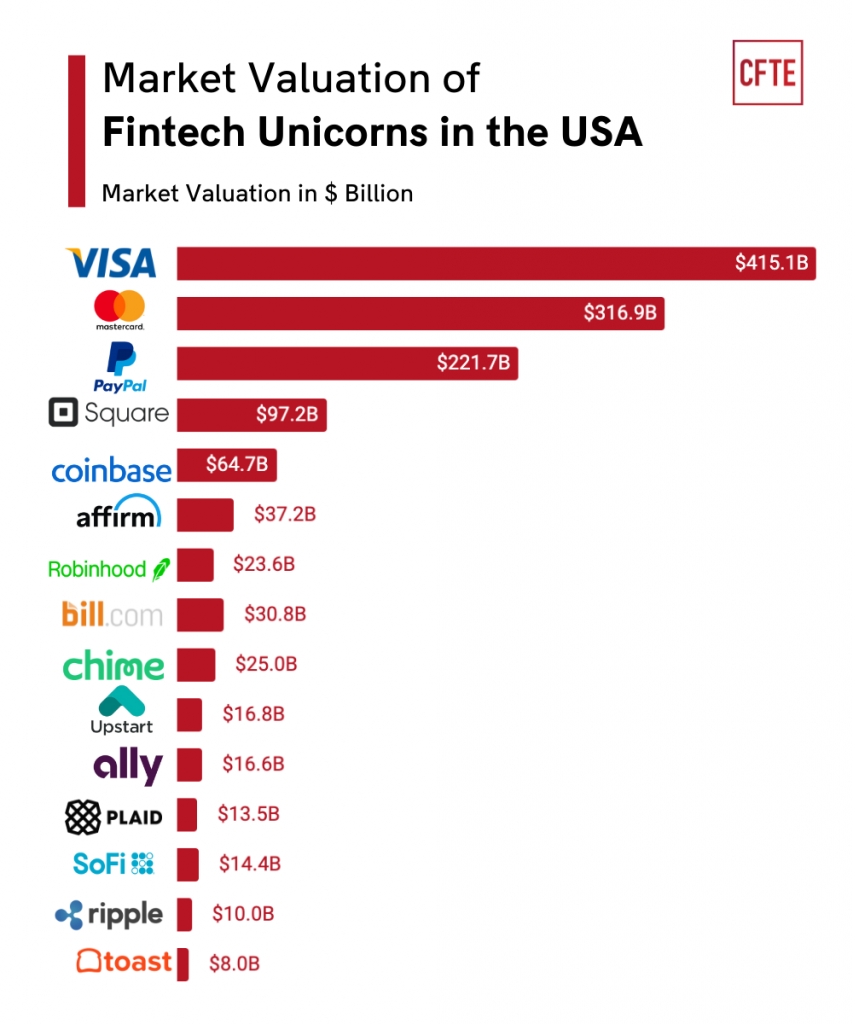

As you can see above, the biggest players in the fintech game right now are none other than Visa (NYSE: V), Mastercard (NYSE: MA), and PayPal (NASDAQ: PYPL). These same companies have been innovators and leaders for decades now, and all the talk that some of the smaller players were going to overrun the big players just hasn’t panned out.

It’s also the big banks, like JPMorgan Chase (NYSE: JPM) and Capital One (NYSE: COF) that have invested billions in turning their operations into fintech powerhouses.

One reason digital has caught on is the fact that younger generations are digital natives and they want access to their accounts 24/7, not just during bankers’ hours.

Also, they want banks to deliver the services every other digital platform allows them – flexibility and seamless user experiences.

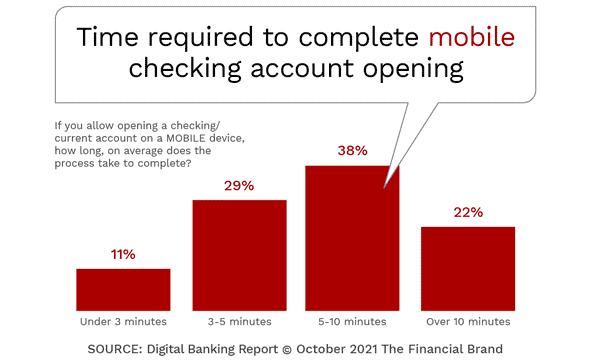

For example, whether it’s opening an account or applying for a loan, having to sit down with someone, talk everything over, send papers back and forth, wait for various approvals, etc., it is no longer the status quo.

Younger customers want to be able to do these things digitally when it’s convenient for them, not the bank, and they want it all sorted quickly, not over days.

This is becoming the new normal, and the big test is whether banks will be able to keep up with the expectations of their customers.

The biggest challenge comes to community banks and credit unions, since they’re much smaller and community focused, unlike megabanks and big regional banks.

It’s an exciting time for digital banking and the fintechs that are changing the way we spend, save, and borrow. You can be sure that we’re closely following the MegaTrend players that will dominate the sector for years to come.