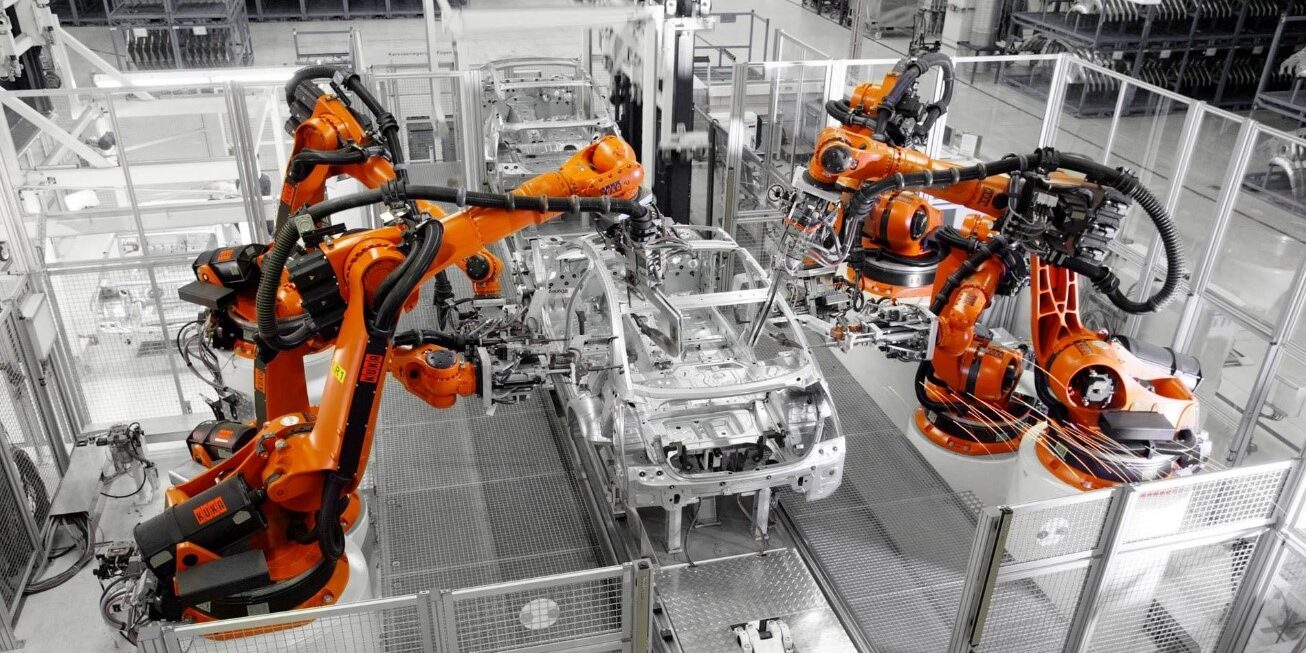

The next MegaTrend we are looking at is automation in technology. This word instantly results in associations for us when we hear it – many will see robots and partially automated assembly lines in their head when thinking about automation, something akin to this:

(source www.ptc.com)

However, factory automation is only one part of the broader automation MegaTrend, so let’s first find a definition for what automation means and includes.

The Automation MegaTrend Is Already Well Underway

IBM (NYSE:IBM), which offers a range of automation solutions, states on its website that it sees automation as “the use of technology to perform tasks with where human input is minimized.” This seems like a pretty suitable definition for the word automation, and it is pretty logical. Most will agree that automation means replacing human work in a “techy” way, which can take on many different forms.

Factory automation is one aspect, where robots can aid humans in tasks such as moving objects from place A to B, automatically filling bottles, cans, or boxes, aligning objects, coloring objects, and so on.

These technologies have become more refined over the years, but they have been around for some time and are not all that new, although it’s important to note that the capabilities of these industrial robots continue to grow, which means that more and more tasks can be automated and be done by robots.

Other tasks can be automated as well, though. The checkout process at stores can be automated, the ordering process at fast food restaurants can be automated, digital help desks can (partially) automate telephone hotlines, and so on.

Even in consumer settings, things can be automated: Homes can be automatically heated when the temperature drops to a set level, vehicles can automatically brake when the vehicle in front reduces its speed, and so on.

In some cases, automation helps businesses become more profitable by reducing expenses, oftentimes by making tasks less time-consuming. And automation can also help businesses when they can’t find enough employees to fulfill tasks in the “old way” due to labor shortages.

In other cases, automation isn’t done for the purpose of cost reduction, but rather to make products safer and/or easier to use for consumers, e.g. when it comes to driver assistance systems or operating in extreme environments.

The automation MegaTrend is already delivering substantial market growth for automation solutions, as we can see in the following chart, which shows one segment of the global automation industry – the industrial control and factory automation market:

The market is seen growing from $195 billion in 2020 to $340 billion in 2026, making for a double-digit annual growth rate and 74% cumulative growth.

How To Benefit from the Automation MegaTrend

When a market is growing fast, some companies will benefit from that growth. In the case of the Automation MegaTrend, there are many different beneficiaries.

This includes manufacturing companies that could benefit from cost reductions in their manufacturing process, e.g. when fewer workers are needed to build a new vehicle for Ford (NYSE: F). The packaging industry also benefits from automation via robots and barcode scanners that can automate filling, sorting, and moving packages and that do thereby cause cost-savings.

While self-driving autos are still in early stages, transportation will very likely become a huge market for automation. Self-driving taxis, trucks, and so on promise higher uptimes and lower operating expenses. Tesla (NYSE: TSLA) is one of the leading self-driving vehicle tech companies and plans to release full-self-driving autos to the public in the next couple of years.

Agriculture is another industry where automation should result in faster and cheaper processes. Cost-savings might be passed on to consumers, but major players in this industry could also expand their margins over time.

For newcomers to Proffe Invest, it’s recommended to check out our top-tier publications: Proffe’s Growth Stocks and Proffe’s Trend Portfolio, both boasting over 100% returns in the past year. These resources are ideal for those aiming to build long-term generational wealth.