Last year, hydrogen was a $160 billion market. By 2037 – in just four years from now – it’s expected to be a $264 billion market. That’s a compounded annual growth rate (CAGR) of 10.5%. In markets this size, this type of growth is unusual.

What’s happening in hydrogen now has been going on for more than a century. You see, hydrogen is one of Earth’s most available elements. It’s in a huge number of things we use every day. Most importantly, it’s in water. It’s also in oil and natural gas.

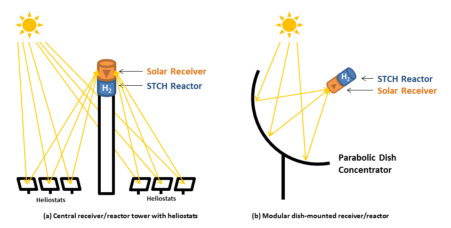

In recent decades, “cracking” the water to separate the hydrogen from oxygen has been progressing quietly but quickly. Today, there are several ways to use current energy sources – petroleum, solar in particular – to derive hydrogen.

That means hydrogen can complement already existing forms of energy and move some of the more polluting ones toward a profitable future as hydrogen demand grows. That’s always been the challenge with other alternative energy solutions where you completely replace one resource for another.

Remember, electric vehicles (EVs) have to get their electricity somewhere, and right now, they get it from utilities that have polluting fuels that run their power plants. The more demand for electricity, the more pollution.

Also, it takes 500,000 pounds of earth to refine one lithium battery pack. The places where we dig for lithium look like this. The first picture is the massive chemical ponds where the lithium is pulled from soil. The second picture is what a mine looks like.

Does this look sustainable?

Certainly, EVs will make up a share of the new low to zero emission vehicles of the future, but the fact is, EVs aren’t exactly as environmentally friendly as people imagine. That doesn’t mean they’re not a great step in the right direction, but there are better alternatives we have every ability to explore as well.

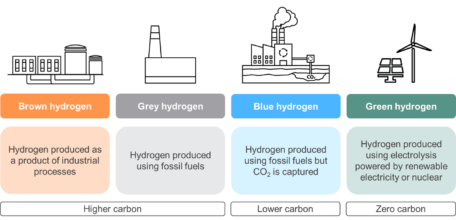

One of the big talking points right now with hydrogen is where it’s derived from. Some EV proponents complain that hydrogen can come from polluting industries, but as I mentioned, this gives these polluters a path to profits in hydrogen that may help them transition to cleaner alternatives. Electricity isn’t exactly a green solution yet either.

What’s more, there are a number of new ways to crack hydrogen from seawater, fresh water, and using newly discovered catalysts that will make hydrogen much cheaper and greener.

No, this isn’t a “fuel of the future”. It’s happening right now. Hydrogen is already a gas in demand with big companies like Air Products & Chemicals (NYSE: APD) and Air Liquide (OTC: AIQUY). There are also a number of newer players that have growing footholds in the industry.

Plug Power (NASDAQ: PLUG) signed a deal with Amazon (NASDAQ: AMZN) last summer to supply its growing hydrogen needs. Bloom Energy (NYSE: BE) is another smaller player that’s making big inroads into hydrogen, as well as carbon capture. Canada’s Ballard Power Systems (NASDAQ: BLDP) is another player in this space to watch as well.

Also, bear in mind that Europe and Japan are moving rapidly toward hydrogen vehicles, especially large commercial vehicles. Governments are subsidizing hydrogen filling stations, and internal combustion vehicles can also be retrofitted to burn hydrogen instead of gasoline.

What’s more, hydrogen-powered vehicles on the moon may be key to extraterrestrial colonies!

Hydrogen is certainly turning into a MegaTrend that’s offering some early-stage investment opportunities.

We’ll keep you posted!

Get Ahead of Market Volatility with Proffe’s Trend Portfolio 2.0

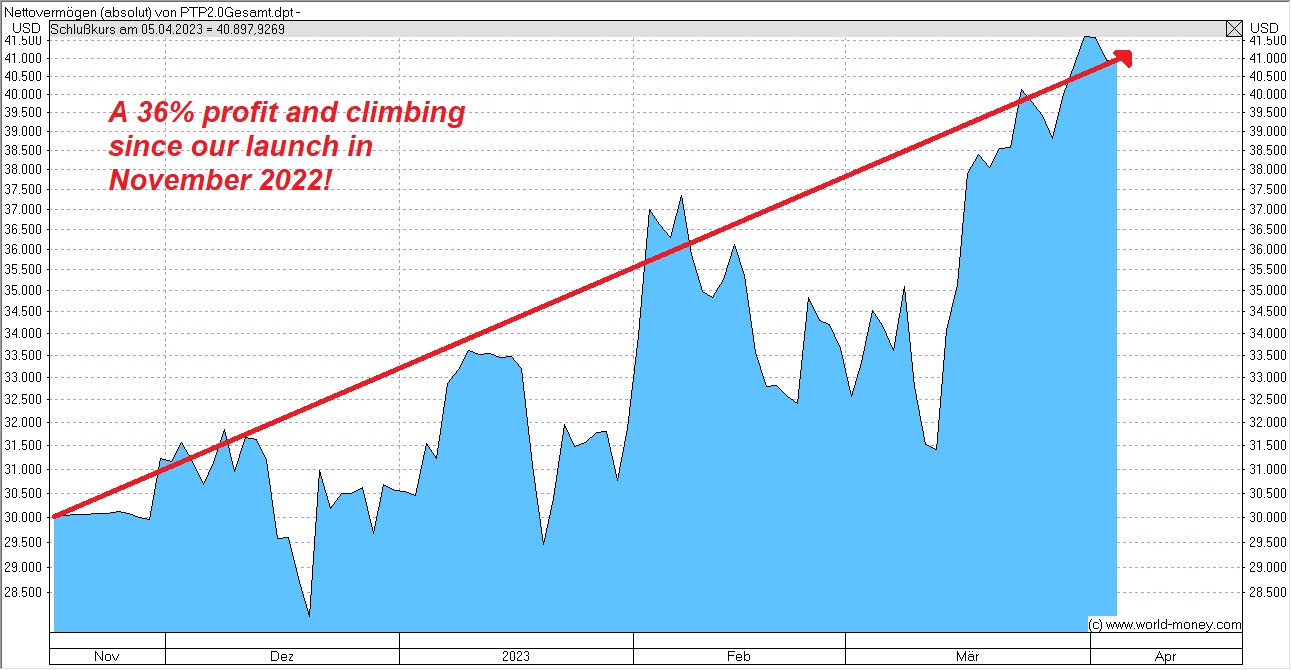

Market volatility keeping you up at night? Recent events may have caused some market unrest, but our high-quality stocks and long-term options positions are built to withstand short-term fluctuations.

Check out our performance below. We launched PTP 2.0 in November 2022 with $30,000 and have since grown it to $40,898, a 36% profit gain.

No matter how many market blips occur, our portfolios continue to perform well, rain or shine. This is how you build real wealth and secure your financial future.

Plus, with our consistent and growing profits, you can enjoy the peace of mind that comes with successful long-term investing.

Get started today with a 14-day trial for just $1 and see our hand-picked Megatrend stocks and options portfolio!